Our strategic issues, identified by members and the board of directors, includes two issues that have been of constant concern for us, recruiting and retaining the best people for the industry and changing the perception of our industry from a rust belt legacy industry that is dirty, dark, and dangerous; to one that is vital, modern and essential to national and economic security. Public policy in North America has burdened us with costs that are not borne by global competitors and limited our financial profitability. Culturally, manufacturing is seen as an unattractive career that is not a path to a fulfilling and rewarding life. We have an opportunity for the next few years to challenge these ideas and to touch the hearts of the young people we need to recruit if we are to become a leading industry for the high-performance complex systems of the future. This month’s Casteel Commentary is an appeal to you to participate and support the initiatives that SFSA has begun that will directly address these opportunities.

Table of Contents

Specification Committee Meeting

SFSA is actively involved in American Society for Testing and Materials (ASTM), International Organization for Standardization (ISO), Boiler and Pressure Vessel Code (BPVC), and American Welding Standard (AWS). The specification bodies foster collaborative development of commercial standards, which SFSA will work with to transition technologies into new or existing standards. These efforts are led by our Specification Committee, which will meet on November 12th in Orlando, FL. For more information, please contact Dave.

Technical & Operating Conference and Workshop

Supported by steel foundry members that make up the Society, the T&O conference is the premiere steel casting event in the world. The 78th conference will continue the legacy of technical and operating topics of today that will provide value to the industry for many years to come. This year’s workshop will feature Fimex’s IoT, riser sleeves, and Craftsmen with Character. The conference covers everything from melting to foundry engineering to molding to finishing to management to EHS to quality to technical & featured research. The program will be announced shortly; however, hotel reservations and registration are open now: https://sfsa.site-ym.com/event/to2024.

Next Gen Manufacturing Group Meeting

The Next Gen Mfg (NGM) group will meet in West Lafayette, IN on November 6-7. NGM group will join the Future Leaders for a tour of Harrison Steel Wednesday afternoon. NGM and Future Leaders will meet at Purdue University on Thursday 11/7 for SFSA’s Industry 4.0 research, roundtable discussion, and a tour of their Smart Foundry. Registration closes October 23rd.

Cast in Steel 2025 Competition

There are already seven teams signed up to make a replica of one of George Washington’s swords for the Cast in Steel Competition which will be held in Atlanta, Georgia, April 9-11, 2025.

Let Renee know if your foundry is interested in helping a team cast their sword for the 2025 competition at rmueller@sfsa.org.

For more detailed information about the competition, click HERE.

Teams that have already registered:

| UNIVERSITIES | FOUNDRY PARTNER |

|---|---|

| Cal Poly Pomona | Miller Casting Inc |

| Central Michigan University | Bay Cast Inc. |

| Instituto Tecnológico de Morelia | Fundidora Morelia |

| Instituto Tecnológico de Saltillo | TBD |

| Instituto Tecnológico de Saltillo | TBD |

| Pittsburg State University | Monett Metals |

| University of Dayton | Skuld LLC |

Casting Dreams Competition

The Casting Dreams program is a national program that provides local educational opportunities and industry connections that include casting design and production that qualify for local, regional and national competitions. The purpose of the program is to give school-age students an opportunity to create unique objects using metal casting to learn about the process and serve as a recruitment tool for both educational institutions and the industry. The castings they create are then judged on a local, regional, and finally a national scale to determine the winners based on several categories. The program works to bring students and the industry together to form lasting relationships and impressions of a metal casting career path.

SFSA has launched a new Casting Dreams Competition Website. If you’re interested in hosting or sponsoring (monetary donations or materials) an event or have questions on scheduled events, please contact Jerry Thiel – thiel@uni.edu.

Check out the upcoming events below.

| Date | Location | Event Name |

|---|---|---|

| October 21-25 | Lenior, NC | Casting Dreams Workshop |

| October 26-Nov 15th | Milwaukee Wisconsin | Casting Dreams Workshops |

| October 29-30 | Georgia Southern | Cupola Refined |

| October 31 | Georgia Southern | Iron Pour |

| November 16 | Milwaukee Wisconsin | Iron Pour |

| November 18-22 | Anne Arundel Community College – Maryland | TBD |

| December 9th-13th | Cal Poly San Luis Obispo, CA | New Cupola Test |

| January 17, 2025 | Cal Poly San Luis Obispo, CA | Iron Pour |

| February 1-28 | Winston Salem, NC | Free Workshop Pattern & Mold Making |

| February 9-22 | Wentworth Institute of Technology – MA | TBD |

| March 1 | Greensboro, NC | Iron Pour |

Value of the Person Seminar – November 12-13, 2024

Value of the Person – Theory R was created to drive transformational change throughout the organization by creating a culture of Love, Dignity and Respect. The program teaches you with new ways to inspire, lead, develop, love and grow your people.

Nancy McDonnell, President and CEO, shared the story of how her father, Wayne Alderson, founded the Value of the Person and the impact it has had on many organizations including several foundries.

Nancy and her team are hosting a two-day business seminar on November 12-13 near Pittsburgh, PA. For more information and to register, please visit: https://www.valueoftheperson.com/theory-r-seminar/.

Market News

In August, YoY steel casting bookings dipped sharply, reversing the upward trend since April. Steel casting shipments continued its downward trend to 6% below year ago levels. Stainless bookings remained flat just over year ago levels and shipments showed moderate gains. Carbon and low alloy steel casting backlog continues to trend closer to year ago level at -8%. Stainless steel backlog is now higher than year ago levels at 1.65%.

ITR reported in their October Trends Report that most manufacturing sectors remain in the latter stages of the business cycle, but early signs of recovery are emerging in the metalworking, defense, aircraft, and food industries. In 2025, Phase B, Accelerating Growth, will dominate the manufacturing markets, with growth likely to gain momentum in the second half of the year. Interest rate cuts, lowering borrowing costs, will boost spending across most markets late next year and into 2026, although the timing will vary by market.

Overall, the upcoming business cycle will be more subdued compared to recent cycles, partly because any decline this year has been mild for most markets. Many sectors will be building on already high levels in 2025, rather than recovering from contraction. However, individual company data may be more volatile—companies that faced a recession during this cycle could see stronger growth in 2025 due to a lower year-over-year comparison. For additional insight on what may lie ahead for next year, the SFSA 2025 Market Forecast, presented last month at the SFSA Fall Leadership Meeting, is now available online here.

Casteel Commentary

The Fall Leadership meeting included an update on the state of our industry and a full slide deck from my state of the industry is available online here. This month’s commentary is a comparison of our industry with other capital-intensive producers including some of our customers, competitors and suppliers. In advocating changes in the public policy that makes capital intensive industries like steel producers lack adequate profitability to invest and modernize, an analysis has been done on publicly traded companies in various sectors.

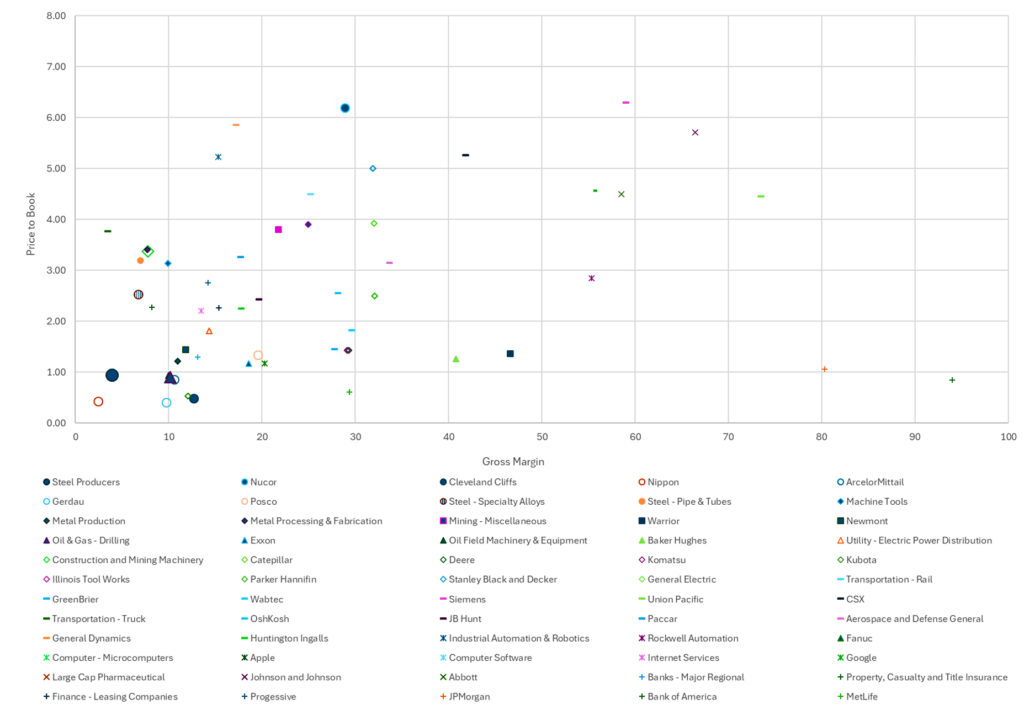

The price of the companies is the market capitalization, and the gross margin is the value of sales beyond the cost of production shown in Figure 1. Financial institutions have low price to book because their deposits are the book value, but they have little cost so their gross margins are close or at 100%. Global steel producers have low price to book and low margins and are clustered at the below 15% for gross margin and at a market value below their book value. NUCOR is the exception with a margin close to 30% and a market capitalization over 6 times their book value. Traditionally, the cost of public policy in North America, especially the U.S. was higher than other regions but was off set by investments in new technology and products. NUCOR’s development and use of continuous casting and EAF scrap melting has allowed them to be more profitable and growing encouraging a high market value for the company.

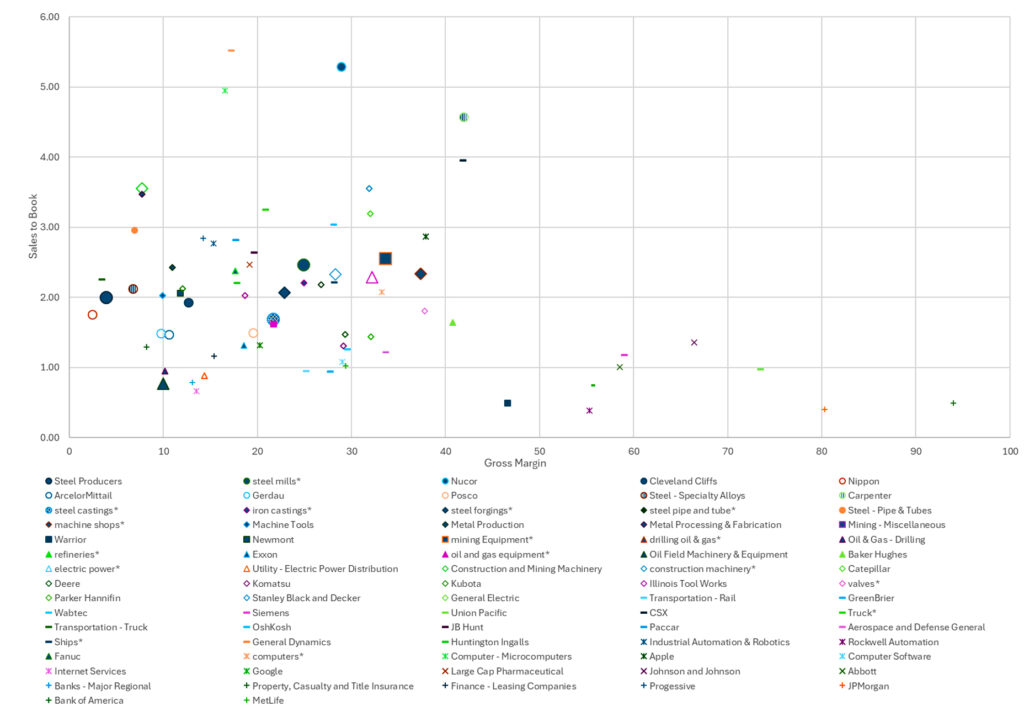

An alternative to price to book value for looking at a company’s value is to use sales to book. Since there is no available data for publicly traded steel foundries and other market segments of interest, this allows a similar comparison for our industry in Figure 2.

Here the steel producers shown in Figure 1 with a 5% gross margin and a price to book of 1 has a sales to book of 2. This is typical if we look at Figure 1 compared to 2 for most industries like ours. Steel foundries are slightly over 20% gross margin with a sales to book below 2. Slightly above 2 with a higher gross margin is the steel forging industry. The aggregated values for steel mills is at 2.5 sales to book and 25% gross margin.

Construction and mining equipment companies have a higher sales to book over 3.5 but a low gross margin of around 7%. Mining equipment from the bank data with a sales to book of 2.5 and a was higher gross margin of over 30%. Oil field equipment and machinery has a gross margin of 10% and a sales to book below 1.

For our industry, we need to gain value and profitability. There are two factors likely to be determinative for us. One is fast approaching, the liquidation of capacity over the last 40 years will result soon, less than 5 years, in a capacity crunch that will allow us to get market value instead of production cost in our industry. This is the fuel that normally allows for modernization and innovation. The second factor that depends on our insight and creativity is investing in game changing innovation.

Steel castings will be recognized as a preferable product form to achieve the highest performance at the lowest cost. In looking at the enthusiastic embrace and funding of additive processes and products, steel castings provide the advantages with lower costs, more flexibility in alloys and a wider and bigger size capability. Giga-castings for aluminum die castings developed by Tesla shows how innovation and aggressive product design can be a game changer. Innovative companies like them are likely to build their own production facilities to fully capture the value and to have the inhouse expertise to maximize their competitive advantage.

We will need to think through the best way to participate in partnership with the most innovative companies or product teams in existing companies to create value that requires steel castings.

Raymond

| STEEL FOUNDERS' SOCIETY OF AMERICA BUSINESS REPORT | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| SFSA Trend Cards (%-12 mos. Ago) | 12 Mo Avg | 3 Mo Avg | August | July | June | |||||

| Carbon & Low Alloy | ||||||||||

| Shipments | -3.6 | -6.1 | -3.1 | -5 | -10.3 | |||||

| Bookings | -6.7 | -10.8 | -15 | -10.4 | -7 | |||||

| Backlog (wks) | 9.9 | 9.3 | 9 | 10 | 9 | |||||

| High Alloy | ||||||||||

| Shipments | -1.6 | 2.7 | 5 | 3 | 0 | |||||

| Bookings | -1.7 | 0.7 | 2 | 0 | 0 | |||||

| Backlog (wks) | 9.5 | 9.3 | 9 | 10 | 9 | |||||

| Department of Commerce Census Data | ||||||||||

| Iron & Steel Foundries (million $) | ||||||||||

| Shipments | 1,648.50 | 1,639.30 | 1,609 | 1,650 | 1,659 | |||||

| New Orders | 1,680.80 | 1,616.70 | 1,606 | 1,637 | 1,607 | |||||

| Inventories | 3,213.00 | 3,231.70 | 3,263 | 3,223 | 3,209 | |||||

| Nondefense Capital Goods (billion $) | ||||||||||

| Shipments | 83.2 | 87.8 | 88.1 | 89.7 | 85.6 | |||||

| New Orders | 88.5 | 82.7 | 91 | 92.1 | 64.9 | |||||

| Inventories | 230.2 | 232.5 | 232.9 | 232.4 | 232.2 | |||||

| Nondefense Capital Goods less Aircraft (billion $) | ||||||||||

| Shipments | 74.1 | 73.7 | 73.6 | 73.7 | 73.9 | |||||

| New Orders | 73.7 | 73.6 | 73.7 | 73.5 | 73.7 | |||||

| Inventories | 163 | 163.2 | 163.4 | 163.1 | 163 | |||||

| Inventory/Orders | 2.2 | 2.2 | 2.22 | 2.22 | 2.21 | |||||

| Inventory/Shipments | 0 | 2.2 | 2.22 | 2.21 | 2.21 | |||||

| Orders/Shipments | 0 | 1 | 1 | 1 | 1 | |||||

| American Iron and Steel Institute | ||||||||||

| Raw Steel Shipments (million net tons) | 7.3 | 7.2 | 7.3 | 7.2 | 7.2 | |||||