Cast in Steel has been a surprising success. While the hope was that a few of our university research partners would have teams and we could encourage some students to get into our industry, it has exploded in impact and enthusiasm. This year’s competition is supported by the DoD to reach young people to encourage them working in industry. The effort is being expanded to try to reach both the professionals and artisan workers we need. This month’s commentary is an announcement of our 2025 Cast in Steel Competition.

Table of Contents

Cast in Steel

We’re thrilled to announce that 14 teams and 12 foundry partners, double the participation we had at this time last year, are signed up to create a replica of one of George Washington’s swords for the 2025 Cast in Steel Competition! This exciting event will take place in Atlanta, Georgia, from April 9–11, 2025.

SFSA staff recently promoted the competition and showcased past winners at the FEF Industry Conference in Chicago. If you’re attending the T&O Conference, don’t miss the opportunity to view the past winners on display and learn more about the event.

If your foundry is interested in collaborating with a team to cast their sword for the 2025 competition, please reach out to Renee at rmueller@sfsa.org.

We can’t wait to see what this year’s teams will create!

| UNIVERSITY NAME: | FOUNDRY PARTNER |

|---|---|

| Cal Poly Pomona | Miller Casting Inc |

| California State Polytechnic University, Pomona | Aerotec Alloys, Inc. |

| Central Michigan University | Bay Cast Inc. |

| Colorado School of Mines | Western Foundries |

| Grand Valley State University (has 2 Teams) | Eagle Alloy Inc. |

| Instituto Tecnológico de Morelia | ACERLAN MATRIX METALS SA DE CV |

| Instituto Tecnológico de Morelia | Fundidora Morelia |

| Instituto Tecnológico de Saltillo (has 2 Teams) | Fundición De Aleaciones Especiales de México (FAE) |

| Pittsburg State University | Monett Metals |

| Tennessee Technological University | Magotteaux Inc |

| University of Dayton | Skuld LLC |

| Wentworth Institute of Technology | DWCLARK |

Casting Dreams

The Casting Dreams program is gaining incredible momentum! Over 200 students in Milwaukee and Michigan alone have participated, bringing their creative designs to life through casting.

Don’t forget to visit our Casting Dreams website for updates and details. We’re always looking for sponsors to help us inspire the next generation of casting enthusiasts.

If your foundry is interested in supporting the program through a monetary donation or by providing materials for an event, please reach out to Jerry Thiel at thiel@uni.edu

Thank you for helping us keep the dreams alive!

78th Technical & Operating Conference

The 2024 T&O is upon us. This is your last chance to register and attend to hear over 60 member papers presented – https://sfsa.site-ym.com/event/TO2024 (for help with registration, please contact Renee).

Feeding & Risering Webinar

SFSA’s original “red book” or “Risering Steel Castings” was published in 1973. The “red book” was revised in 2001 and became “Feeding and Risering Guidelines for Steel Castings” thanks to the work led by Christoph Beckermann at UI. On Wednesday, December 4th 10:00-11:30am US CST, Christoph will present background on development of the guidelines, feeding distance definitions, factors that influence feeding distance and calculations, and the physics of risers feeding solidification shrinkage. He will discuss “red book” rules on risering procedure, casting soundness, feeding distance and riser sizing provide guidance to insure castings are fed to achieve the quality required and maximize yield. These concepts can be applied in simulations or directly to rigging a pattern. For members that did not receive a link to the Teams meeting for this webinar, please email Dave. Note, if you are not able to attend, it will be recorded and posted to the SFSA wiki.

AFS Offers Free Safety Webinar to Industry

AFS will host a safety webinar on Tuesday, December 10th at 1pm central and invites all foundries to attend. Speaker Ted Schorn with Enkei America will present “Foundry Safety Data: Encouraging Progress”. The webinar will review newly released OSHA safety data for foundries and diecasters, examing the characteristics of metalcasting faciliting injuries, and discuss several key injury and illness trends. There will be a Q&A session at the end of the webinar. To register, please visit: https://hub.afsinc.org/nc__Event?id=a2AVP000000KOFt2AO

Market News

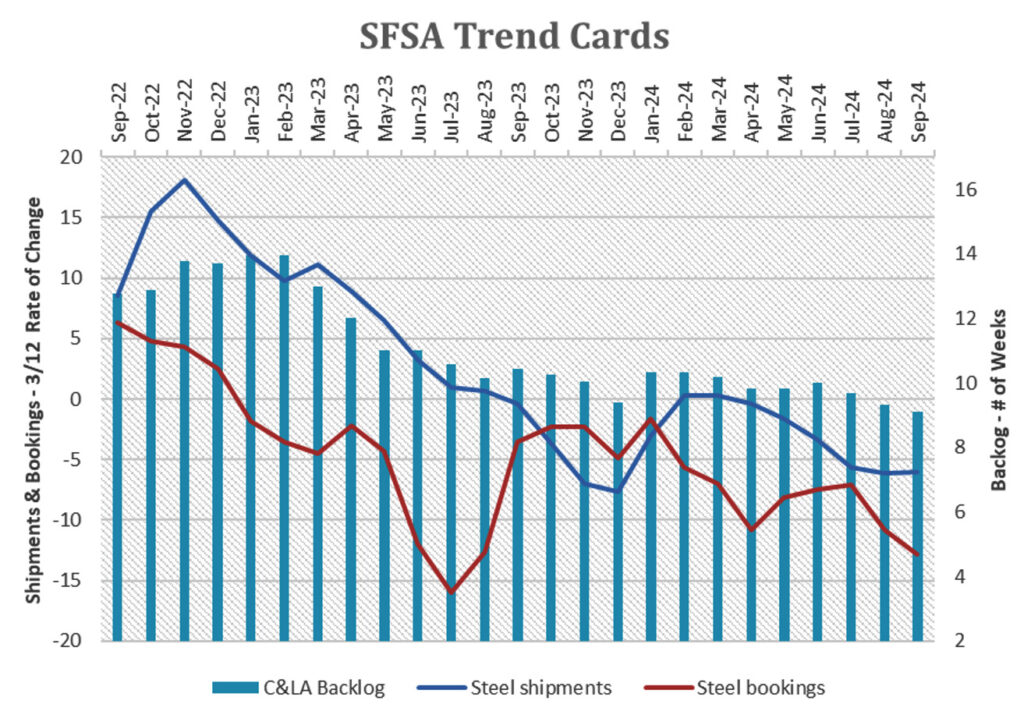

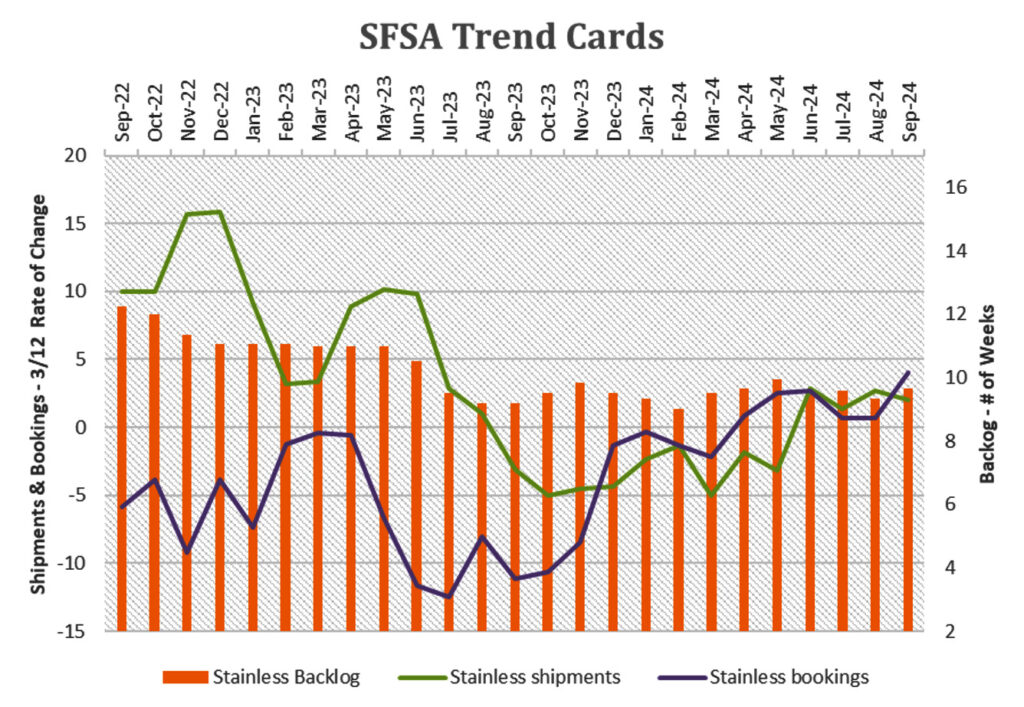

In August, YoY steel casting bookings dipped sharply, reversing the upward trend since April. Steel casting shipments continued its downward trend to 6% below year ago levels. Stainless bookings remained flat just over year ago levels and shipments showed moderate gains. Carbon and low alloy steel casting backlog continues to trend closer to year ago level at -8%. Stainless steel backlog is now higher than year ago levels at 1.65%.

ITR reported in their October Trends Report that most manufacturing sectors remain in the latter stages of the business cycle, but early signs of recovery are emerging in the metalworking, defense, aircraft, and food industries. In 2025, Phase B, Accelerating Growth, will dominate the manufacturing markets, with growth likely to gain momentum in the second half of the year. Interest rate cuts, lowering borrowing costs, will boost spending across most markets late next year and into 2026, although the timing will vary by market.

Overall, the upcoming business cycle will be more subdued compared to recent cycles, partly because any decline this year has been mild for most markets. Many sectors will be building on already high levels in 2025, rather than recovering from contraction. However, individual company data may be more volatile—companies that faced a recession during this cycle could see stronger growth in 2025 due to a lower year-over-year comparison. For additional insight on what may lie ahead for next year, the SFSA 2025 Market Forecast, presented last month at the SFSA Fall Leadership Meeting, is now available online here.

Market News

In September, YoY steel casting bookings continued its downward trend. Steel casting shipments were similar to last month’s trend of 6% below year ago levels. Stainless and steel casting bookings are both trending to year ago levels are trending towards year ago levels.

ITR reports that US Total Manufacturing Production during the 12 months through September was 0.3% below the year-ago level. Weakness in the manufacturing sector will likely persist for at least the next couple of quarters. Most manufacturing markets will end 2024 on the back side of the business cycle, but a handful are already in 12/12 rising trends, including metalworking machinery and defense in Phase B, Accelerating Growth, and aircraft and food in Phase A, Recovery. The downside pressure from elevated interest rates on both construction and durables markets will linger in the near term.

ITR anticipates 2025 will be a year of rise, with growth weighted more toward the second half of that year. Reshoring and onshoring trends as well as rising incomes will drive US economic activity. Lower interest rates may also contribute to growth in 2025, but the positive effects are often lagged and more likely to benefit 2026. While they anticipate record highs in the overall industrial sector in the coming years, growth will be in the low single digits in 2025 and 2026 in part given the relatively mature US market.

We need your input!

The SFSA Marketing Committee will be meeting next month prior to the SFSA T&O Conference to finalize the 2025 SFSA Market Forecast. The committee would appreciate receiving your input on the markets that you serve in support of the forecast. Please take a moment to complete the market forecast survey: https://www.surveymonkey.com/r/SFSA_4Cast25. Responses are kept confidential and will be aggregated with other member responses. Markets included in the forecast are as follows:

Markets

- Rail/Transit – frames, couplings, bolsters, track components, etc.

- Mining Equipment – axle housing, frame components, suspension, gear case, etc.

- Mining Consumables – G.E.T., liners, hammers, grate plates, cement and aggregate components

- Construction Equipment – axle components, sprocket, end caps, transmission housing, etc.

- Truck – Class 8 – suspension brackets, brake components, axle spindles, fifth wheels, etc.

- Pump – housing, impeller, covers, bowls, etc.

- Valve – strainer bodies, bonnets, butterfly valves, etc.

- Oil & Gas – port adapters, brackets, levers, slip linkages, etc.

- Military – ground vehicle and maritime components

- Industrial Furnace & Oven Mfg. – furnace, heat treat, steel mill components – rollers, links, baskets, etc.

- Industrial Machinery – Industrial equipment parts – pulp & paper, food, shotblast – plates, wheels, sprockets, flanges

| STEEL FOUNDERS' SOCIETY OF AMERICA BUSINESS REPORT | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| SFSA Trend Cards (%-12 mos. Ago) | 12 Mo Avg | 3 Mo Avg | September | August | July | |||||

| Carbon & Low Alloy | ||||||||||

| Shipments | -4.2 | -6 | -10 | -3.1 | -5 | |||||

| Bookings | -8 | -12.8 | -13 | -15 | -10.4 | |||||

| Backlog (wks) | 9.7 | 9.1 | 8.3 | 9 | 10 | |||||

| High Alloy | ||||||||||

| Shipments | -1.1 | 2 | -2 | 5 | 3 | |||||

| Bookings | 0.8 | 4 | 10 | 2 | 0 | |||||

| Backlog (wks) | 9.6 | 9.7 | 10 | 9 | 10 | |||||

| Department of Commerce Census Data | ||||||||||

| Iron & Steel Foundries (million $) | ||||||||||

| Shipments | 1,653.50 | 1,650.70 | 1,685 | 1,617 | 1,650 | |||||

| New Orders | 1,680.50 | 1,642.70 | 1,679 | 1,612 | 1,637 | |||||

| Inventories | 3,227.70 | 3,296.70 | 3,381 | 3,286 | 3,223 | |||||

| Nondefense Capital Goods (billion $) | ||||||||||

| Shipments | 83.3 | 87.5 | 84.9 | 87.9 | 89.7 | |||||

| New Orders | 86.9 | 88.1 | 84.2 | 88.1 | 92.1 | |||||

| Inventories | 230.7 | 232.3 | 231.9 | 232.6 | 232.4 | |||||

| Nondefense Capital Goods less Aircraft (billion $) | ||||||||||

| Shipments | 74.1 | 73.6 | 73.5 | 73.6 | 73.7 | |||||

| New Orders | 73.7 | 73.7 | 74.1 | 73.6 | 73.5 | |||||

| Inventories | 163 | 163.2 | 163.3 | 163.3 | 163.1 | |||||

| Inventory/Orders | 2.2 | 2.2 | 2.2 | 2.22 | 2.22 | |||||

| Inventory/Shipments | 0 | 2.2 | 2.22 | 2.22 | 2.21 | |||||

| Orders/Shipments | 0 | 1 | 1.01 | 1 | 1 | |||||

| American Iron and Steel Institute | ||||||||||

| Raw Steel Shipments (million net tons) | 7.2 | 7.2 | 7.1 | 7.3 | 7.2 | |||||

Casteel Commentary

Cast in Steel (CIS) was an effort to reach out to college students who were in programs that worked with SFSA on steel technology. The unexpected success of CIS was due in part to the unique approach, we were not asking if they might be interested in casting steel, we gave them a chance to make a Viking axe for a competition that was to be made by casting. They wanted to make the axe and were happy to learn about casting so they could compete. Many of them then realized that casting was creative, interesting and valuable. Casting plants were important communities doing important things that we need. The impact of the competition can be seen in Figure 1.

| Year | Schools | Teams | Students | Item | Winner |

|---|---|---|---|---|---|

| 2019 | 16 | 20 | 77 | Viking Axe | Instituto Tecnológico de Morelia |

| 2020 | 13 | 17 | 51 | Bowie Knife | Virginia Tech |

| 2021 | 18 | 24 | 109 | Thor's Hammer | Pittsburg State University |

| 2022 | 26 | 35 | 177 | Celtic Leaf Sword | University of Wisconsin - Platteville |

| 2023 | 31 | 42 | 217 | African Spear Point | California Polytechnic University - Pomona |

| 2024 | 34+6+2 | 45+6+2 | 270+29+16 | Halligan Bar | Pittsburg State University |

The enduring success of the competition garnered support from the Department of Defense (DoD) that knows that manufacturing in general and steel foundries in particular need professionals and artisans if we are to be a reliable and capable industry. The success and enthusiasm of the 2024 Halligan bar competition led the DoD Office of the Secretary of Defense (OSD) to ask if we could explore making the CIS a reality television program. After finding a producer that was active making the Modern Marvel episodes, Luke Ellis, we proposed a program for the 2025 CIS competition as a television series. We have announced the competition including the show. The prize money has been increased to $25,000 for the winning team.

If you are interested in the details of the competition, go to www.castinsteel.org. We have support from members to be the industry partners for teams for CIS. It is a great opportunity to connect with a university and to get to know potential team members before they graduate.

This year we want to broaden the competition to include artisans, skilled workers at technical schools. If you have a good local technical school that could compete, please let me know. We want to include not only our needed engineers but in some ways more importantly, future highly skilled artisans. You could be their industry partner and gain access to the most skilled students in those programs.

We are also sponsoring Casting Dreams to introduce pre-college kids to casting. The site for this effort is at https://castingdreams.org/. This could be supported by your plant locally and introduce local young people to your plant the possibility of being on your team making castings.

CIS is already allowing the steel casting industry to change perceptions of young people. Our social media outreach in October 2024 –

- Facebook: 3.2M reach, 36.4k followers (5.2k added)

- YouTube: 226.2K views, 2921 subscribers (293 added)

- TikTok: 55k views, 1756 followers (26 added)

- LinkedIn: 5,748 reach, 976 followers (26 added)

- Instagram: 4.3k views, 118 (23 added)

- X: 196 followers

Most of our reach is to people less than 40 years old.

These are exciting developments and provide you with an opportunity to use and participate. If you need more information or want to help, please let me know!

Raymond

| STEEL FOUNDERS' SOCIETY OF AMERICA BUSINESS REPORT | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| SFSA Trend Cards (%-12 mos. Ago) | 12 Mo Avg | 3 Mo Avg | August | July | June | |||||

| Carbon & Low Alloy | ||||||||||

| Shipments | -3.6 | -6.1 | -3.1 | -5 | -10.3 | |||||

| Bookings | -6.7 | -10.8 | -15 | -10.4 | -7 | |||||

| Backlog (wks) | 9.9 | 9.3 | 9 | 10 | 9 | |||||

| High Alloy | ||||||||||

| Shipments | -1.6 | 2.7 | 5 | 3 | 0 | |||||

| Bookings | -1.7 | 0.7 | 2 | 0 | 0 | |||||

| Backlog (wks) | 9.5 | 9.3 | 9 | 10 | 9 | |||||

| Department of Commerce Census Data | ||||||||||

| Iron & Steel Foundries (million $) | ||||||||||

| Shipments | 1,648.50 | 1,639.30 | 1,609 | 1,650 | 1,659 | |||||

| New Orders | 1,680.80 | 1,616.70 | 1,606 | 1,637 | 1,607 | |||||

| Inventories | 3,213.00 | 3,231.70 | 3,263 | 3,223 | 3,209 | |||||

| Nondefense Capital Goods (billion $) | ||||||||||

| Shipments | 83.2 | 87.8 | 88.1 | 89.7 | 85.6 | |||||

| New Orders | 88.5 | 82.7 | 91 | 92.1 | 64.9 | |||||

| Inventories | 230.2 | 232.5 | 232.9 | 232.4 | 232.2 | |||||

| Nondefense Capital Goods less Aircraft (billion $) | ||||||||||

| Shipments | 74.1 | 73.7 | 73.6 | 73.7 | 73.9 | |||||

| New Orders | 73.7 | 73.6 | 73.7 | 73.5 | 73.7 | |||||

| Inventories | 163 | 163.2 | 163.4 | 163.1 | 163 | |||||

| Inventory/Orders | 2.2 | 2.2 | 2.22 | 2.22 | 2.21 | |||||

| Inventory/Shipments | 0 | 2.2 | 2.22 | 2.21 | 2.21 | |||||

| Orders/Shipments | 0 | 1 | 1 | 1 | 1 | |||||

| American Iron and Steel Institute | ||||||||||

| Raw Steel Shipments (million net tons) | 7.3 | 7.2 | 7.3 | 7.2 | 7.2 | |||||