Table of Contents

Casteel Commentary

As anticipated for decades, public policy that has neglected the health of the capital-intensive industries like steel castings and forgings has led to a reduction in their capacity and capability. DoD OSD has recognized this concern for years and is assessing the challenges faced by these critical industry segments.

This month’s commentary strives to clarify some of the challenges we face and suggest paths forward.

75th Annual Technical & Operating Conference

Registration is open for the 2021 T&O Conference, which will be held December 8-11 at the Loews Hotel in Chicago. https://sfsa.site-ym.com/event/TO2021

To celebrate the 75th T&O Conference, seven “diamond” presentations by SFSA alumni will be featured, covering several milestone SFSA projects (Project 80, Fundamentals of Steelmaking, and Project A-54) along with sharing expertise in chrome iron, HSLA, engineered investment shells, and GD&T. Conference sessions will include topics on Next Gen Mfg, molding, melting, foundry engineering, finishing quality, EHS, management, technical and featured research such as clean steel and cast preforms. The workshop will feature an extensive presentation on wash – the problems it can create instead of solving, along with Next Gen Manufacturing R&D from ISU on automation of foundry processes and development of improved NDT, and UNI on the Sensor Collective initiative.

Loews Hotel group rate has been extended through November 23: $125/night. https://www.loewshotels.com/chicago-downtown/sfsa-to-conference-2021

Conference program: https://cdn.ymaws.com/sfsa.site-ym.com/resource/resmgr/to/2021_Program.pdf

Workshop program: https://cdn.ymaws.com/sfsa.site-ym.com/resource/resmgr/to/2021_Workshop_Programs.pdf

Research Highlight

The Cast Preform project in collaboration with University of Alabama and University of Alabama at Birmingham under ATI’s Improved Forging Acquisition Manufacture and Materials (IFAMM) Program has now come to a close. This study combined both casting and forging processes to reduce the segregation and micro-porosity sometimes found in castings and improve mechanical properties in critical areas as a result of the strain during forging. Additionally, the casting process provides the opportunity for purchasing specialty steel grades in smaller batches, offering lower lead times for forgings, as well as compositions tailored to application which allows higher performance steels to be utilized at lower economical cost.

Based on previous results from UAB on this technology showing a forging reduction between 1.5:1 to 2:1 is sufficient to eliminate the majority of microporosity for a well-risered casting, a case study on the GET cast preform was proposed to promote transition into industry. Several iterations of concepts were explored during the creation of the final proposed cast preform shape. The approach used focused on moving material in the forging direction to fill the tooth of the GET, resulting in the necessary forging strain in this critical area because this end sees the highest load and wear in application. Once this shape was confirmed, additional review was conducted to include the lifting hook on the top of the part to examine the effect of leaving cast features on the preform geometry. This complicates the design of the forging process but provides the opportunity to produce geometry that is not available for a typical forging.

Sixteen parts were cast of two alloys, with four castings and four preforms of each alloy. All eight preforms (four of each alloy) were successfully closed die forged at Clifford Jacobs and filled out to the final dimensions of the die with a smooth surface in the tooth area and minimal flash. The hook, keyholes, and internal geometry of the parts were successfully maintained and appeared unaffected by the forging process. The parts were waterjet cut into 1” slices for mechanical property testing to compare the properties of the preform after forging with the as-cast parts.

The tensile results provided location specific quasistatic properties to be compared between the as-cast parts and the same geometry after forging the castings. The locations anticipated to be influenced most by the forging process are near the part tip and extend several slices into the part. This was confirmed by the improvement in the elongation for both alloys tested, which can be summarized as roughly a 2% addition in elongation over the as-cast material in areas receiving strain during the forging process. As sample location moves further into the body of the part, the difference in properties decreases, as expected due to less strain in this area from the forging process. The results of the reduction in area confirm the same trend established by the elongation for both alloys. Additional testing is still in progress and is expected to be completed in time to be presented at this year’s T&O.

Comparison of the mechanical properties of the as-cast GETs to the cast preform (forged) GETs confirmed that forging a cast shape with increased material in critical areas provides strain in this region that improves properties when compared with the equivalent geometry of the as-cast part. The conclusion of the authors is that under the best casting conditions, there may be an equivalent between forged and casting properties, however, the casting process is designed to provide this condition in targeted areas and may not be sufficient throughout the component. Therefore, forging can be used as an added processing step to benefit critical areas of a cast product requiring enhanced properties. This effect was attributed to the reduction in pore cluster size as compared to the equivalent cast section through closing of microporosity which forms during solidification.

Changes to ASTM MT Specifications

ASTM E1444 replaced MIL STD 1949 in ’93. Recently, the scope in ASTM E1444-21 was changed (shift to aerospace only plus more requirements and limitations):

- NADCAP required

- Only wet fluorescent particles permitted

- Common industrial magnetizing techniques removed

- Process controls and calibration more restrictive

- Only AS-5282 Ketos rings permitted

- Formulas for determining proper current removed

- Inspection before demagnetization required

- Clarity for magnetic particle bath required

E709 is currently referenced for MPI in the general/common steel casting requirements (such as A703 and A781). E709 is only a “guide” (meant to educate) and does not have any requirements. E1444 is a standard practice, which includes such type of requirements. However, since E1444 had many requirements for the aerospace industry, E3024 was developed for general industry. E3024 does not impose aerospace specific requirements but does include improved and standardized calibration and equipment reliability checks. In ASTM, A903, E125, E709, and E1444 could be used for MPI of steel castings.

The Specification Committee is currently reviewing ASTM MT specifications. In the meantime, if you have customers that use or refer to ASTM E1444, you will likely want to talk about changing to E3024 or another practice. Second, if you have customers that only refer to ASTM E709, you will likely want them to use a standard practice (E3024, A903, MSS-SP-53, etc.) as E709 is only a guide. I would appreciate your assistance in soliciting input from your foundry on ASTM magnetic particle examination (MT) specifications:

- Any concerns if E3024 is recommended as a standard practice for MT for steel castings?

- Do you make any aerospace steel castings (where the use of ASTM E1444 may still be appropriate – if so, please note for what casting process)?

- Do you use A903? If so, what are the advantages or limitations compared to other standards (would it be preferred over E3024), and how common is its use?

- Do you use E3024? If so, do any specific details need to be specified by the purchaser to enable you to use your typical MT practices, and are there any opportunities to improve E3024 for steel castings?

Responses should be sent to Dave poweleit@sfsa.org (questions or additional input likewise). A similar survey will also be sent out to members (responses only need to be sent one way or the other).

As a reminder, SFSA recently published Special Report 34 from Iowa State University on “Best Practices for Magnetic Particle Inspection of Steel Castings” https://wiki.sfsa.org/img_auth.php/e/ea/Sr34.pdf, which only members have access to on the SFSA wiki.

Cast in Steel Competition

SFSA is pleased to announce the fourth annual Cast in Steel Competition! This year’s competition will be using casting technology to creatively design and produce a functioning version of a Celtic Leaf Sword.

Teams will perform all aspects of bringing their Celtic Leaf Sword through the manufacturing process from concept to use. Performance testing and evaluation will be held at the AFS CastExpo Conference in Columbus, OH in April.

Interested in getting a team together? Visit our website, https://www.sfsa.org/castinsteel, to register a team and for more event information.

Steel manufactures, want to get involved? Here are a few ways you can:

- Industry Sponsor – Provide resources, facilities, and technical guidance to university student teams.

- Event Sponsor – Provide a financial gift that helps to cover important program components, including celebrity guest, scholarships, location, etc.

- Team Sponsor – Provide a small gift to cover the costs of the program administration.

Appreciation for sponsoring is presented in all program materials and acknowledged at the event.

If you have questions or you’re interested in becoming a sponsor, contact Renee Mueller at rmueller@sfsa.org.

Market News

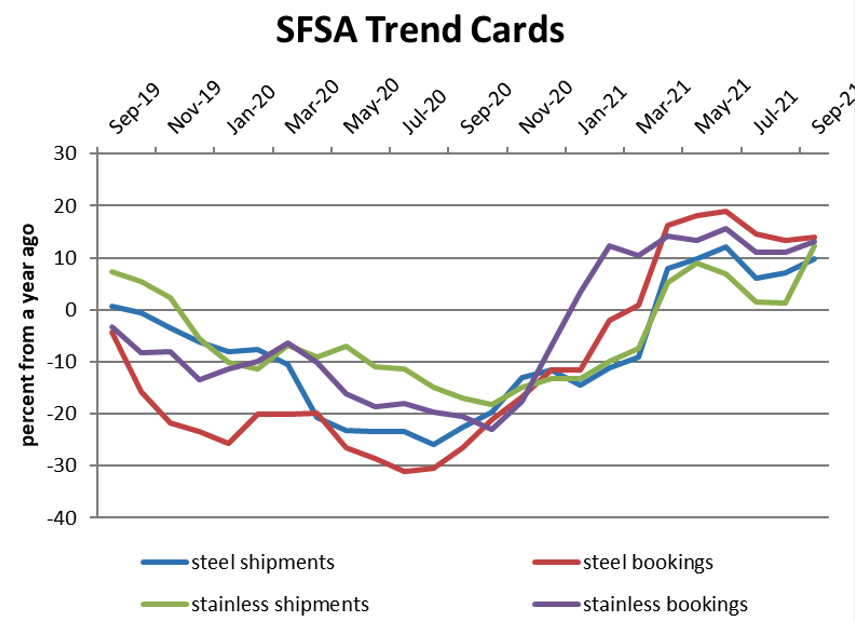

According to the monthly SFSA trends, steel and stainless casting shipments continue their upward trend in September, all posting 10% or more above year ago levels. with slowing growth since June. Steel casting backlog edged up to just over 9 weeks while stainless pulled back slightly from 11 to 10.5 weeks.

Capital goods orders are trending significantly ITR Economics is forecasting accelerated growth in most manufacturing sectors with slowing growth for 2022. SFSA will be working with the marketing committee to finalize the 2022 SFSA Market Forecast which will be presented during the T&O in Chicago. This year’s forecasting has been especially challenging with supply and labor shortages in that foundries and customers have had difficulty in meeting demand. To improve the forecast, the marketing committee is encouraging all members to take a moment and submit your input on the markets you serve. An online survey is available through December 1 and your time and support is appreciated.

Casteel Commentary

Castings and Forgings

Raymond Monroe, SFSA EVP and SPI Director

As anticipated for decades, public policy that has neglected the health of the capital-intensive industries like steel castings and forgings has led to a reduction in their capacity and capability. DoD OSD has recognized this concern for years and is assessing the challenges faced by these critical industry segments.

This document strives to clarify some of the challenges we face and suggest paths forward. The recommendations from this initial consideration are:

(1) National Security requires domestic production of advanced steel castings and forgings, and public policy has imperiled that supply chain. Finding public policy solutions that allow these businesses to prosper and invest is fundamental to our future.

(2) The casting and forging industries are likely to be at their production capacity for several years and will have little incentive to invest to become qualified for DoD business. DoD will need to find ways to have persistent and profitable arrangements with the supply chain to become a preferred customer.

(3) Innovative purchase mechanisms that partner and collaborate with industry would allow a more comprehensive relationship with the supply chain.

(4) Open-ended liability requirements like ITAR or cybersecurity make it undesirable to do business with the DoD. In the current system, the supplier bears the full cost of these requirements without any clear way to establish whether they are in compliance or what additional future requirements there may be.

(5) Mantech funds technology development and improvement for existing suppliers but does not support the qualification of new sources and their technology development costs.

(6) There is no Point of Contact with the responsibility and authority to answer ordinary questions on process and schedule for suppliers trying the get qualified or approvals for parts.

(7) U.S specialty steel producers for high-performance steels will require advanced refining capability that is not currently supported by their financial performance or the market demands. Foundries have some limited AOD capability, but the reliable high performance will require vacuum treatment.

(8) The U.S. needs a large HIP vessel if we expect to have the highest quality large steel components. It should be possible to have a GOCO at Rock Island.

(9) Suppliers need the ability to identify the market characteristics for the planned build schedule for castings and forgings needed for Navy vessel construction so potential and current suppliers can be more capable and responsive.

(10) A system needs to be created for modification of T300Rev2 patterned after the ASME BPVC (Boiler and Pressure Vessel Code) consideration of code cases, to allow a case by case modification to T300Rev2 that would be allowed without a full revision being required for any changes. Full revision is problematic since each drawing that included T300Rev2 would have to be reviewed and approved for the new standard, at a cost of millions (billions?)

(11) A system is needed to facilitate approvals for first article castings and forgings that require agreement between the Navy and then OEM.

(12) Suppliers should be able to request waivers for errant test results from a knowledgeable purchase authority to enable the use of reliable and capable components that have minor variations from non-critical requirements.

(13) Support for the Steel Performance Initiative with additional funding could be useful in accelerating the development of steel casting and forging technology directed at DoD needs.

(14) One innovative opportunity to promote DoD technology and engage the future workforce would be to sponsor the Cast in Steel Competition organized by SFSA for the past three years.

State of the Industry

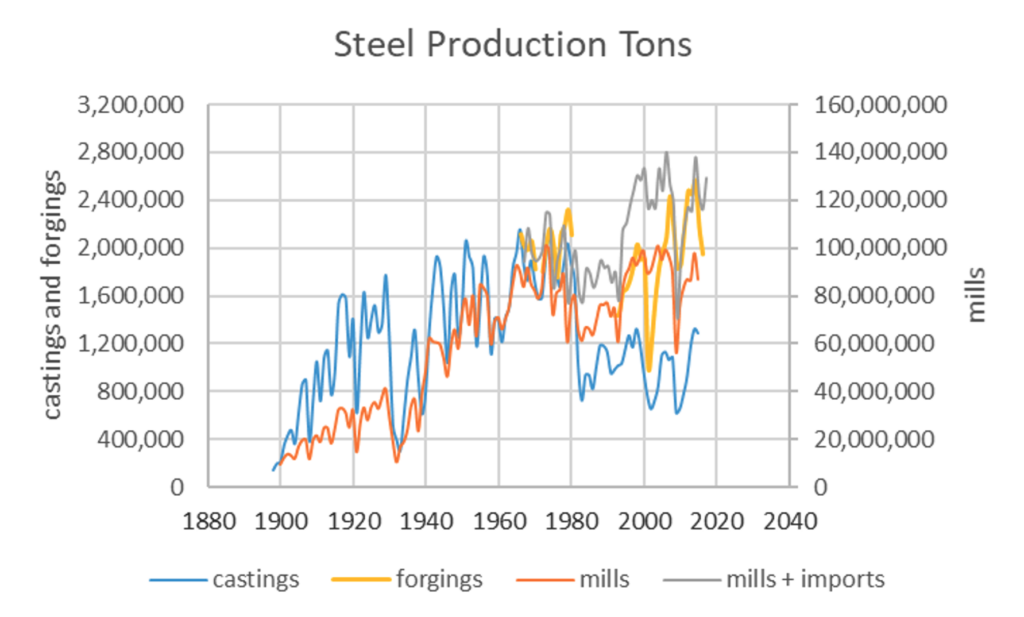

Challenges with the supply chain for steel castings and forgings are the results of developments that have been decades in the making. To resolve the current problems, DoD and industry will need to understand and address these developments. Steel production for industrialization began in 1900 and grew dramatically until the Depression as shown in Figure 1. The first major capital re-investment cycle occurred when industry ramped up for WWII and the post-war conversion to civilian uses in 1940 to 1950. Excess capacity exaggerated the cyclical downturn in production after 1950. Steel is not only consumed for the final products but is an essential construction material for equipment and plants during the capital re-investment. The second capital re-investment boom was during the height of the Cold War when investments were made to provide for defense capabilities and rising consumer demands. This cycle was supported by fiscal policies that encouraged capital investment and monetary policies that led to high interest rates and inflation pulled planned future investments into the present.

This cycle ended with the excess capital infrastructure that allowed for price stability from 1980 to 2000. Excess capacity makes the price of materials in competitive markets reflect the cost of production and not the value of the product. Changes in public policy that discouraged investment in capital intensive industries was not problematic since there was an excess of capacity that was being liquidated in prices that failed to fully recover the stranded investment cost. Low interest rates and marginal tax rates with low inflation resulted in prosperity but also made sustaining or improving steel production problematic. The low levels of demand for steel casting, mill and forging products from 1980 to after 2000 limited any investment in new technology or plant and equipment. One exception was the development of continuous casting with electric melting scrap was lower in cost than traditional integrated steel production and was able to displace primary steel mill production. Casting and forging shops did not see any similar dramatic new technology and were limited in their ability to operate profitably and continue to invest to modernize.

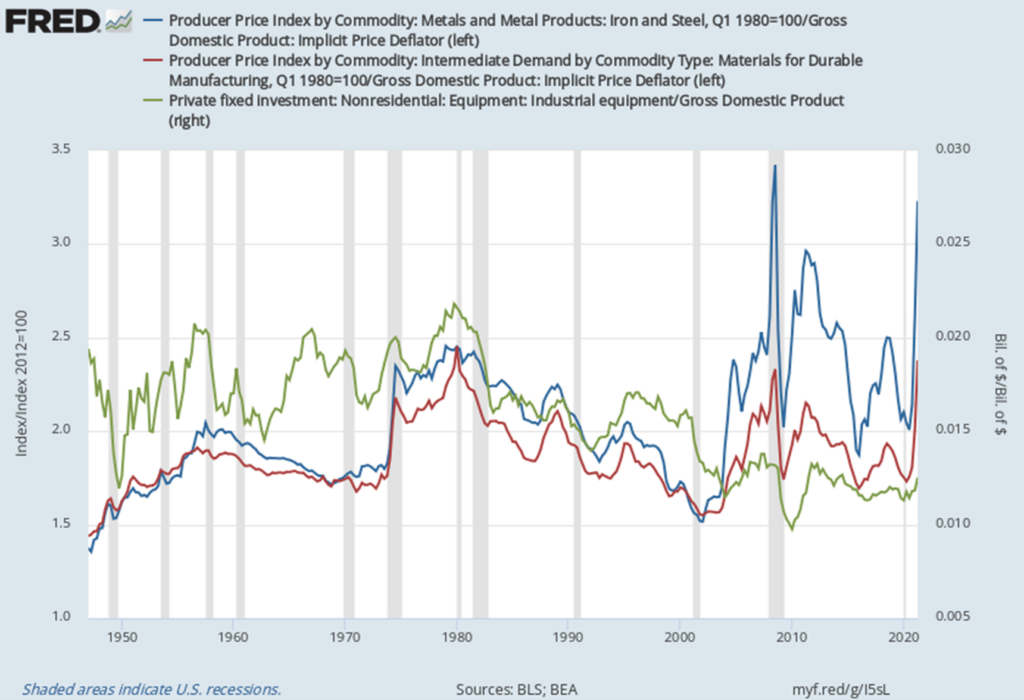

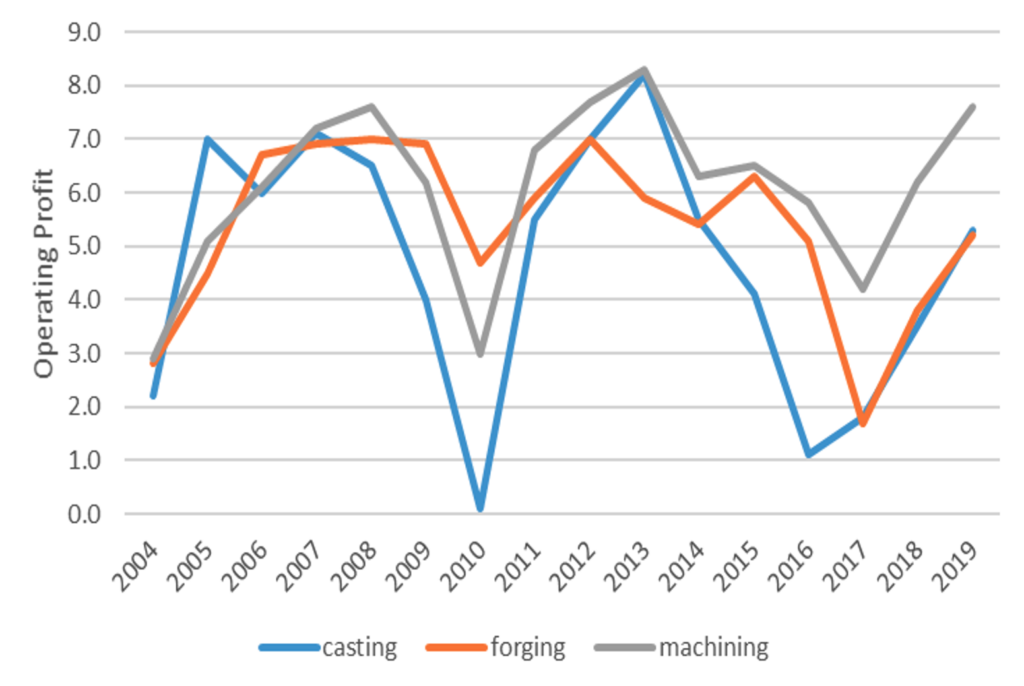

The effect of these changes in supply and demand can be seen in Figure 2. The real change in price for products like castings and forgings is shown as the ratio of the Producers Price Index (PPI) of materials for durable goods divided by the Gross Domestic Product: Implicit Price Deflator (GDPDEF) to convert to real dollars. Steel castings and forgings follow the same pattern as other iron and steel products shown as the PPI-iron and steel divided by the GDPDEF. These measures had a peak in the late 1950’s, around 1980, and around 2010; a thirty-year re-investment cycle. The other line is the fraction of the GDP that is invested in industrial equipment. It peaks in 1980 but sees no increase in investment in the 2010 price peak. Even with strong price increases, no significant increase in the percent of the GDP was invested in domestic capital equipment, the money went to China. Intervention in the economy by the Federal Reserve and large deficit spending were partially responsible for the extreme volatility in pricing after 1990 with the financial meltdown in 2009 shown as well. This volatility added uncertainty and made profitability unpredictable, discouraging investment as seen in Figure 3.

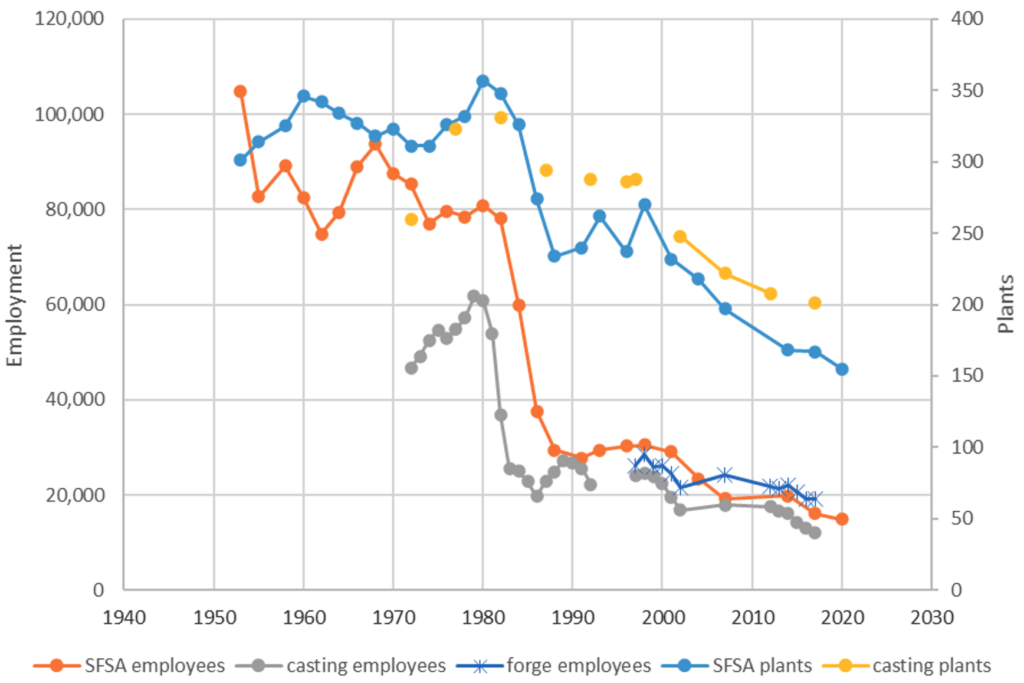

Steel foundries and forge shops are relatively small plants and many key producers have gone out of business as seen in Figure 4. This is due to factors including:

- The overcapacity built in the 1970s resulted in a two-decade long market of excess supply. This excess supply sets the market clearing price close to the cost of production.

- There was a cultural and economic shift away from manufacturing and into financial and other services.

- Trade policy was structured to benefit large multi-national corporations who exploited regional disparities globally to maximize profitability and growth.

- Steel forging and casting producers as small businesses are without market leverage stuck between larger suppliers and customers.

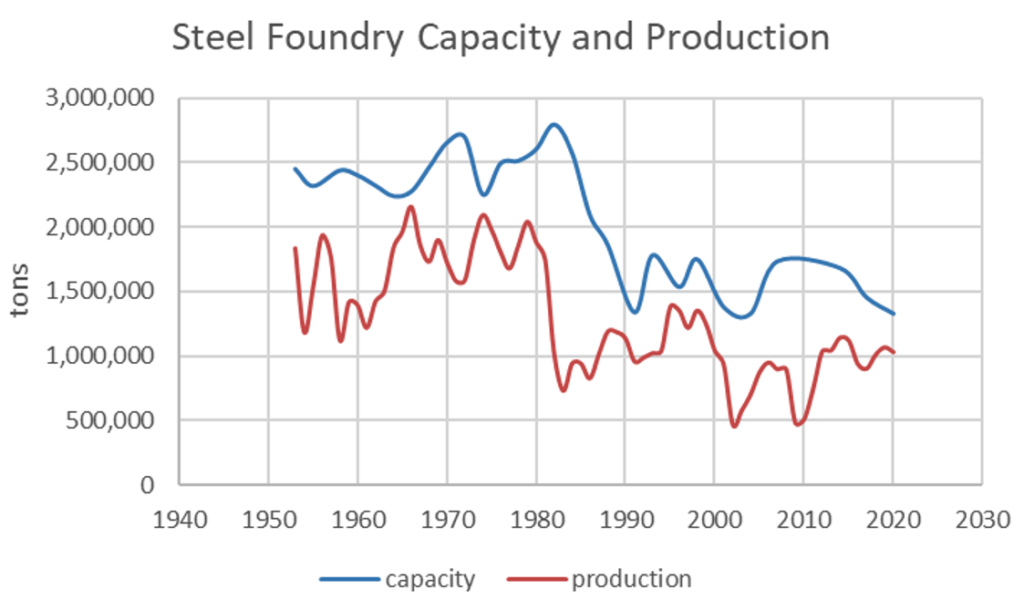

Improvements in labor productivity have allowed domestic producers to continue to provide much of the product volume needed in the economy. However, the industry has been hollowed out with fewer plants, and employees and lacks the resources to meet the needs for Defense. The sharp drop in production after 1980 has resulted in a continuous decline in capacity as seen in Figure 5. Since 1998 when the capacity of the U.S. steel casting industry was 2,030,000 tons per year, about 700,000 tons have closed giving a current capacity estimate of 1,330,000 tons. Over 14 plants closed that reported sales to military uses closing an annual capacity of over 70,000 tons a year.

After the collapse of the Soviet Union and the September 11 attacks, the DoD focused on asymmetric regional conflict, terrorism. This led to an emphasis in providing innovative technology for the protection and lethality of ground forces in rural and urban settings. Support from Air and Naval forces was needed and the emphasis there was affordability. The Air Force had a Metals Affordability Initiative (MAI) to work on the cost of critical parts for engines and structures. The Navy had its Centers including Concurrent Technologies Corp. (CTC) in Johnstown, Applied Research Laboratory (ARL) at Penn State University (PSU) and Edison Welding Institute (EWI) in Columbus and the focus was on reducing the cost of construction and maintenance of the fleet. The Army was active in identifying opportunities to enhance troop protection in an asymmetric environment. The Defense Logistics Agency had the only program focused on the supply chain for castings and forgings that provided critical commercial technology to enhance the supply chain competitiveness and capability.[i]

The growing realization of the failure of open trade policy to change China’s society into a more open, democratic and capitalist system and the increasing regional aggressiveness over the past few years has led to a shift in DoD needs and priorities. The current concern has shifted more to a focus on near peer threats. The industrialization and economic growth in China have made their capabilities a concern. This has created a DoD need to look for the capability of the supply chain for the next generation of basic weapon systems. This also has exposed the hollowing out of the critical steel supply chain for the most advanced systems.

Perhaps most problematic is the challenges faced by the Navy with their submarine build schedule. At DMC 2018, Draper expressed concern that the number of suppliers for required High Yield steels (HY) had fallen by more than 75%. The stock material for welding rod for HY steels required in Tech Pub 200 Mil-100S- ½ filler metal comes from a single source in Germany. With the newest revision to the requirements for HY, Tech Pup 300 Revision 2 (T300Rev2), six suppliers are qualified and three were attempting to qualify. Reliable production of HY steels to T300Rev2 is problematic.

Changes were made in Rev 2 to tighten the requirements without showing the performance benefit or demonstrating that they were consistent with current commercial capability. T300Rev2 however was written into the latest submarine designs so that it is the requirement for these components. The cost of qualification is high, and the market demand is uncertain. Two of the qualified casting suppliers are located in the UK and one of them, Sheffield Forgemasters, was acquired by the government to assure a supply of these castings and forgings.

Reliable performance for the highest levels of toughness required by HY materials in T300Rev2 can be more easily achieved with vacuum treatment after melting to remove hydrogen to less than 2 ppm. Most casting suppliers have no refining capability to reduce sulfur and phosphorus to low levels and control gas contents. Most commercial work does not require that level of processing to get the required properties. There are 10 domestic foundries with an argon-oxygen decarburization (AOD) vessel that allows refining but is limited in reducing hydrogen, struggling to get below 2.5 ppm. Only 4 of these AOD equipped plants have large vessels for the big castings required for ships. Forging ingots and maximum casting properties require hydrogen levels below 2 ppm. One casting plant that was closed, has reopened in Kutztown, PA that does have vacuum treatment and a demonstrated ability to get the property requirements for HY and other high-performance steels like AF96 needed by DoD. They have partnered with another firm to become qualified for HY in T300Rev2.

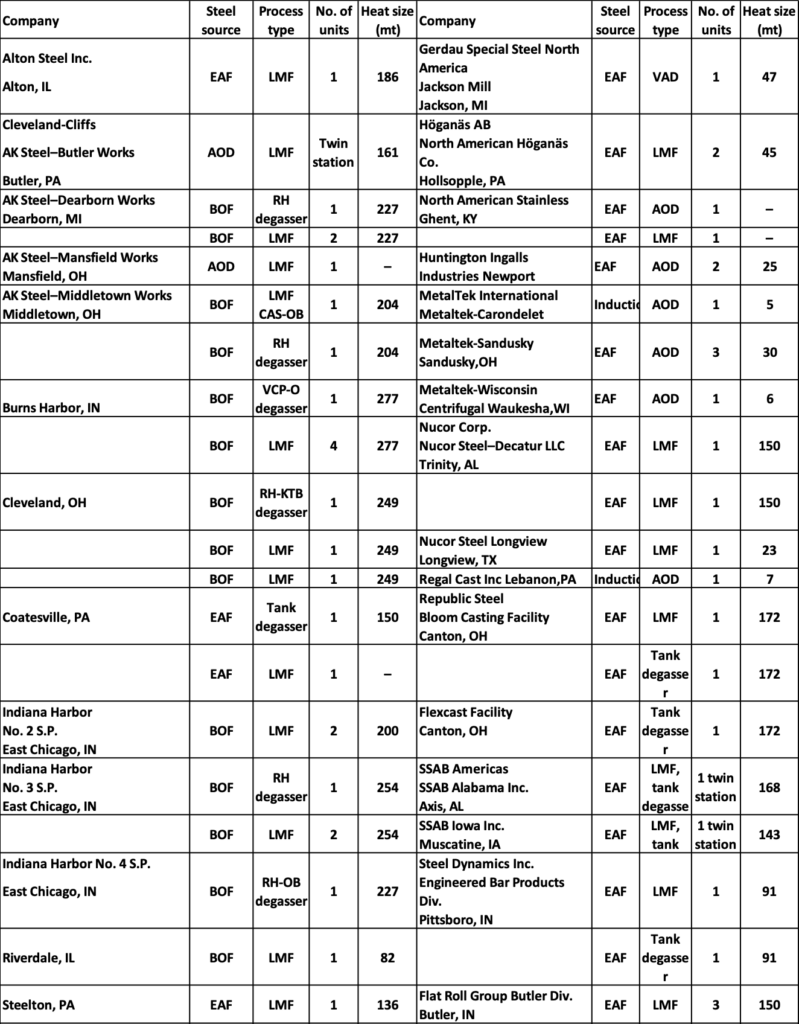

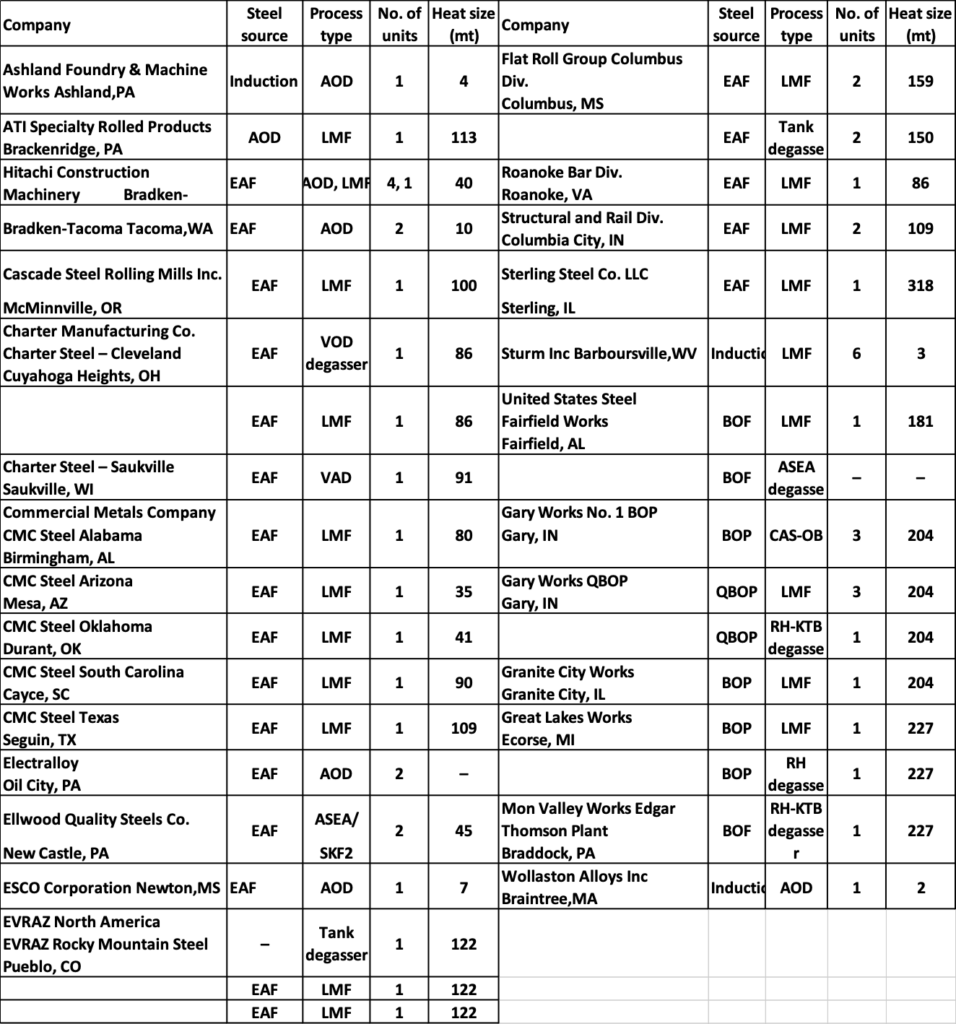

The domestic steel plants identified as having refining capability are included in Appendix A.

The Army has challenges because the high-performance steel industry in the U.S. has not been capable of making the Ultra-High Hard (UHH) armor steel. There is also no qualified domestic source for the high performance steel ingots for forging the large cannon tubes.

One challenge shown by the Army effort for sourcing the muzzle brake for large cannon tubes is the shift in business practices that limit supplier capability. The design and quality requirements for this cast component that was made for decades could not be reliably achieved. New suppliers would begin production, identify the problems with the requirements and either fail to meet the contract or ask for a waiver. Waivers were routinely granted since the purchaser was well aware of the problems. With the generational change in the workforce, the current purchasers are unable to grant the required waivers.

Large custom castings and forgings routinely need collaboration with the purchaser to allow capable parts that fail to meet some requirements to be accepted. Large custom steel parts are not like Craftsman tools or Amazon shipments where if they are disappointing, they can be returned for a new replacement. For example, in T300Rev2, a tensile bar that fails to meet the minimum strength requirement will disqualify a casting. Tensile tests have variability, and the results vary with location in the part. It is routine for a single value to be below the requirement by less than the uncertainty of the test. Historically this was well understood, and the purchaser would waive that test value to allow the casting to be accepted.

The tensile test was required in the early history of steel production because the chemical analysis was limited and expensive and a tensile test could qualify a steel heat for customers. ASTM A6 X2 indicates that the tensile test required for ASTM does not guarantee the required minimum level of strength in every location of the product. X2.1 states:

“Such testing procedures are not intended to define the upper or lower limits of tensile properties at all possible test locations within a heat of steel. It is well known and documented that tensile properties will vary within a heat or individual piece of steel as a function of chemical composition, processing, testing procedure and other factors. It is, therefore, incumbent on designers and engineers to use sound engineering judgment when using tension test results shown on mill test reports.”

There is a procedure for applying for a waiver, but they are not routinely granted. They require both the OEM and Navy to grant them. A 20,000-pound casting with a 6-month production cycle that has one tensile result that is 2 ksi below the 80 ksi requirement in one non-critical location will disqualify the part. This is true even though other tensile samples in critical locations exceeded the requirements. This casting will need to be scrapped and another made. This causes a delay of 6 months in the casting and the new casting is just as likely to have a single value that is problematic.

The DoD institutional drive to raise the performance of components has resulted in raising the minimum requirements above the lower bound of the material performance. Raising the requirement does not raise the expected performance of the material but does cause problems in component acceptance. Design for Army and Navy components is traditional where the part is assumed to have uniform compliant properties in every location.

The producer and purchaser work hard to develop a test method to show compliance even though the lower bound requirement is above the normal distribution of properties in the material. They carefully design the test procedure and test material location to optimize passing. In contrast, the Air Force suppliers develop each component design with fitness for purpose and use the statistically determined design properties for the material to identify the critical performance areas for added testing and inspection.

For non-critical components, DoD efforts should be made to align the quality requirements with the capabilities of the material. In critical components, fitness-for-purpose design strategies should be employed to allow reliable performance. Like DoD suppliers not being able to get the market size and current and future demand, suppliers are also unable to get clear and meaningful answers on question of waivers and fitness for large custom components in production.

For Army and Navy high performance steel requirements, there is no developmental path that allows collaboration and shared risk between the OEMs, Services, and steel producers. This is a problem with large OEMs as well. New requirements are not explored in a collaborative project environment but are released as a request for quotation (RFQ). With new components with high requirements, suppliers are reluctant to quote. When asked to quote, no one knows if the requirements can be met. This failure is not a step in the process but a failure of the supplier. Instead of a funded best effort with a post-production performance evaluation, this is treated as a normal purchase activity. With new component design and fixed high requirements that are based on intuition and not product service analysis, the most qualified plants decline or price in the risk making the project too costly. Sometimes a less capable plant desperate for work will quote and fail. The current system burdens the supplier with the full cost of qualification with no assurance of success or of business to recoup the cost.

The Air Force has supported through their funding and Congressional interest, the development of materials and process technology to support their requirements. Much of this technology is proprietary to the individual companies that provide critical components. Their requirements are the most stringent and the most supported by the equipment performance requirements in service. Their process has allowed the most advanced materials and performance to be integrated into their equipment. They too also suffer from the limited number of suppliers available and the existing capabilities.

The Defense Logistics Agency has partnered with the casting and forging industry to advance the commercial efficiency and part quality in a collaborative program. This program has had a dramatic impact on supporting and improving the casting and forging industry domestically and is the only ongoing program that allows sustained effort at supply chain improvement.

They suffer as do all the services with purchasing requirements that seek to maximize the purchasing value through market forces. Individual purchase requests are typically limited quantities with no continuity of future business. This is a business structure that requires that the producer minimize the investment in production. Even when the producer is well qualified, and the demand is continuous, discrete purchases limit the ability to optimize part quality and cost.

The added imposition of FAR, ITAR, and cybersecurity makes qualifying for DoD work expensive and time consuming. When the industry has small independent plants with limited administrative and management resources, these burdens become a barrier to becoming a supplier.

Question 1.

From your perspective, how has the globalization of the supply chain improved or complicated your ability to source DoD’s requirements?

Globalization had many beneficial effects and allowed an unprecedented surge in prosperity and increased standard of living in poor undeveloped economies. It allowed multi-national firms to locate supply chains in regions that had either a competitive advantage based on market forces or a mercantilist advantage based on regional public policies and practices. Some of these developing economies grew rapidly. Locating sourcing in these growing areas allowed multinational firms to develop markets in these regions. That was an added attraction for investment and sourcing in these regions.

There were unintended consequences of globalization that are now seen as problematic. In the developed regions of the world, supply chains were reduced due to the closure of second tier suppliers essential to the regional supply chain but unable to remain in business when regional customers developed global suppliers. This is a primary cause of the drop in capacity shown in Figure 5. If these supply chain reductions were the result of market forces re-allocating capital to more valued products made profitably, this would have been the desired outcome. In fact, globalization is not primarily about product sourcing finding the most efficient, high valued suppliers but was mainly directed by corporations and policymakers gaming the system to advantage their regional economy or a multi-national corporation.

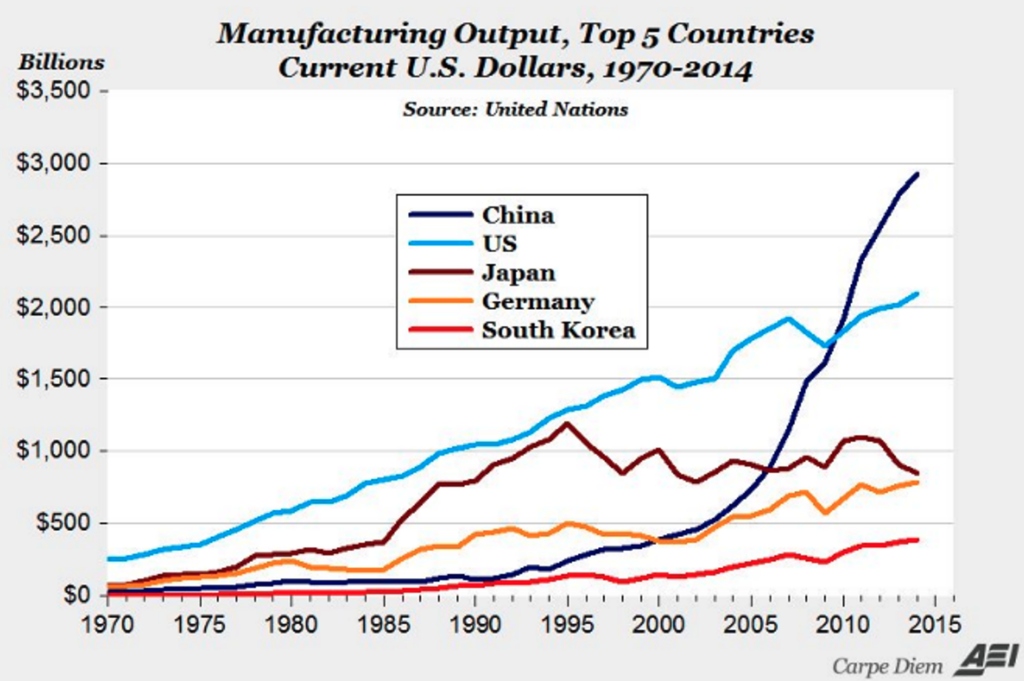

The big winner in globalization was China seen in Figure 6. This was not due to their superior capability or competitive advantage but was dominantly the result of their exploitation of the self-interest of their Western trading partners. Global demand growth took off after 2001 following the liquidation of obsolete capacity in the west. This growth was limited by inadequate capital infrastructure for world demand resulting in higher prices for goods and China used its managed system to capture the largest production capability using imported technology. The multi-national corporations were willing to trade away their intellectual property (IP) for market access to the large and economically growing Chinese economy. They were willing to lean on their suppliers to “partner” with State Owned Enterprises (SOE) for joint ventures to equip and train Chinese suppliers to make advanced products.

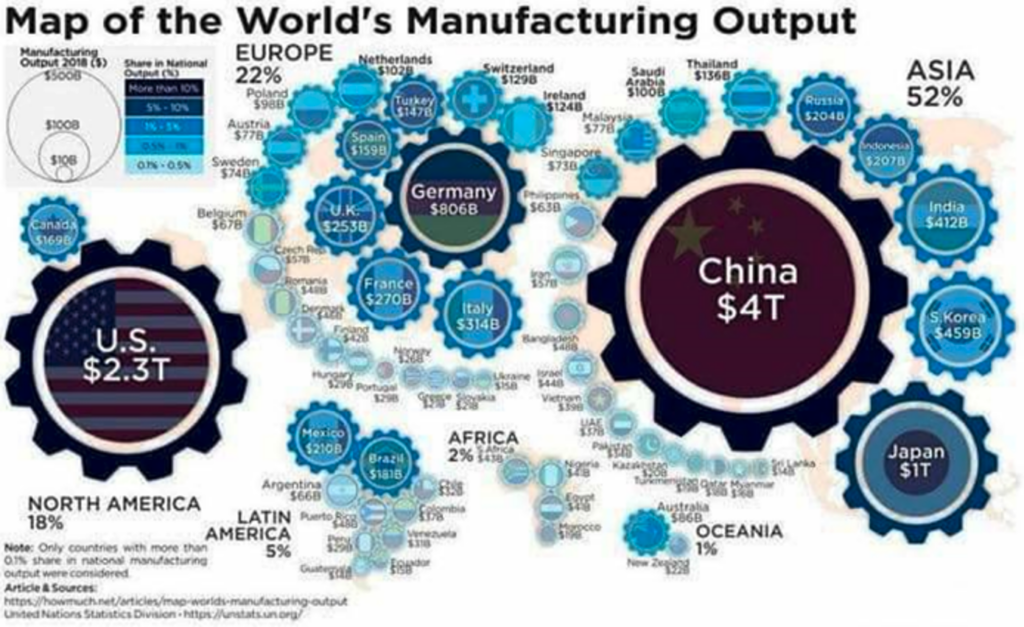

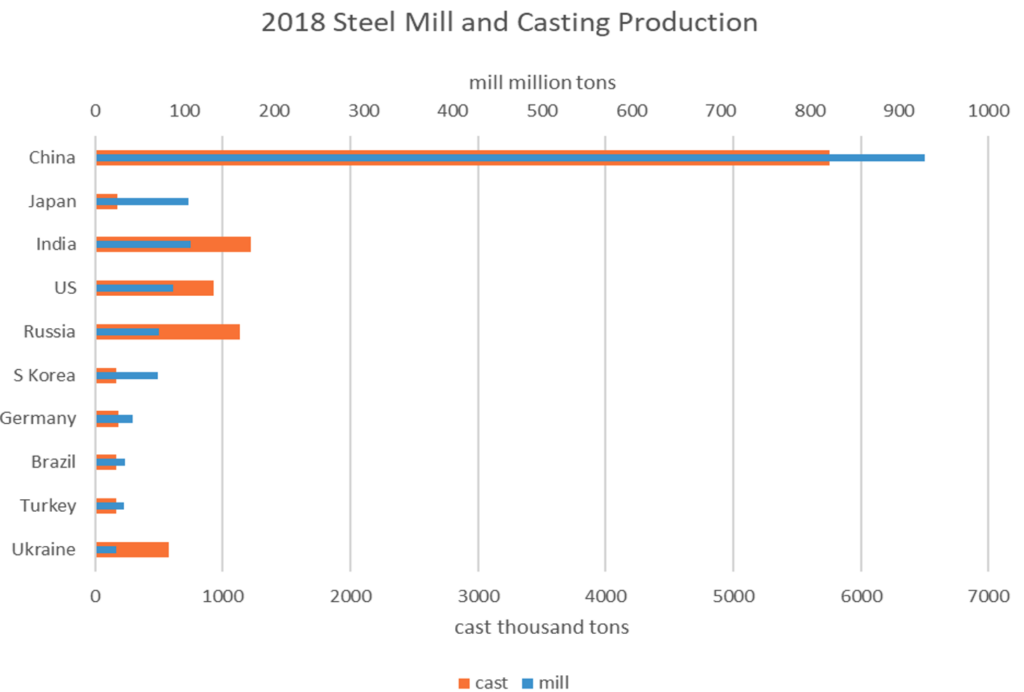

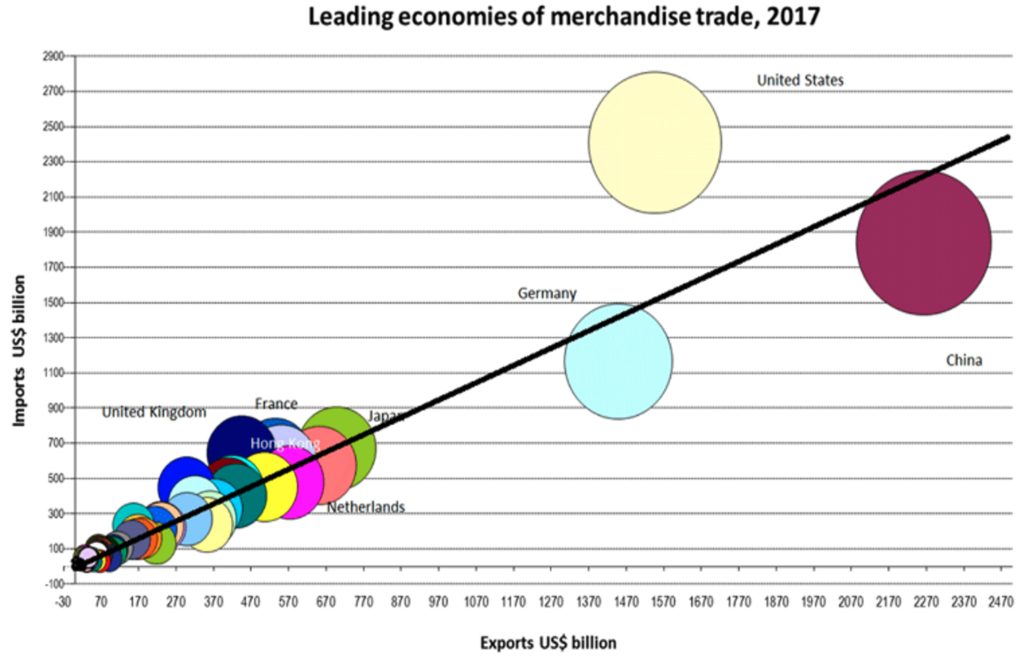

After China succeeded in joining the WTO, it moved to develop dominant positions in all areas of basic manufacturing seen in Figure 6 and Figure 7. They had an explicit strategy of investment and public policy to allow their economy to capture a plurality in most critical markets. In many ways, China’s aim was to dominate the world economy.

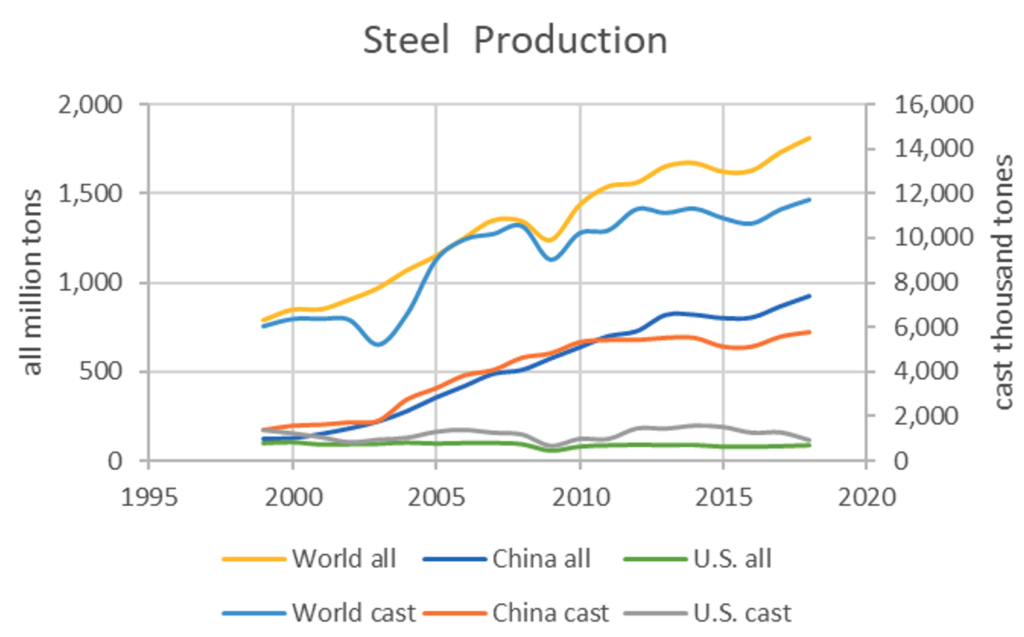

For steel products, mill and castings, China went from parity before 2000 to a dominant position in the marketplace. The explosive growth in China’s steel production for mill products and castings can be seen in Figure 8 and Figure 9. China has no raw material, low cost energy, technology process or location advantage in steel manufacturing. U.S. suppliers like NUCOR and Steel Dynamics are the most efficient producers in the world. Steel producers are the most aggressive users of the U.S. trade remedies for non-market practices. Even with these trade remedies available, China now dominates the world in steel production. The trade remedies were not able to arrest China’s abuse in the trade of commodity steel products. Not apparent from these graphs of commodity steel is the predatory acts of China on specialty or advanced manufacturing sectors. Our trade rules are pre-containerization and are unsuited to deal with small profitable market predatory practices.[ii]

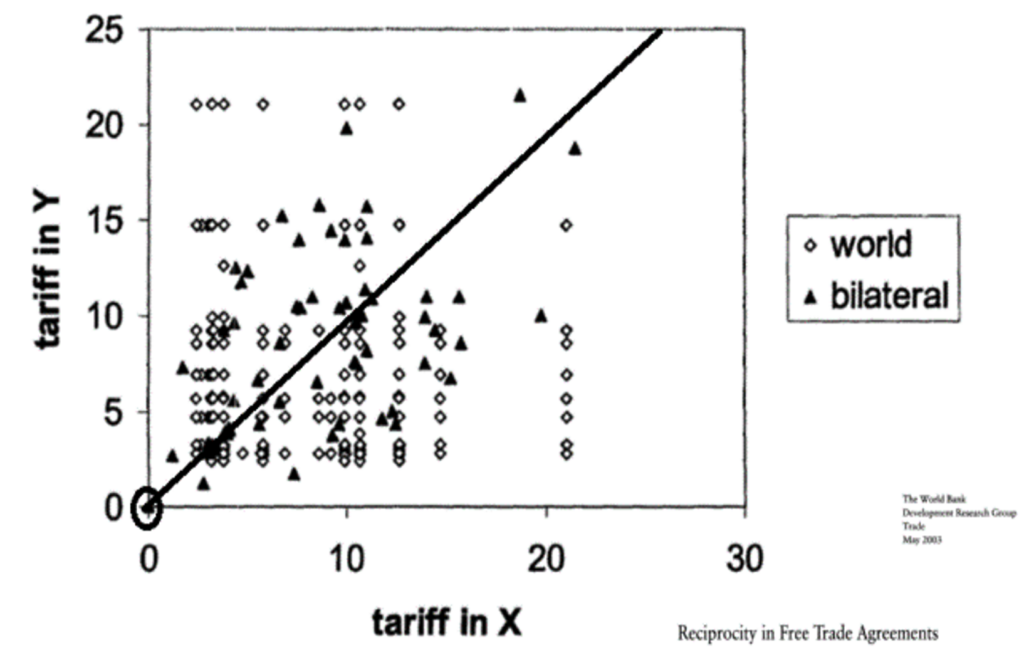

The graph in Figure 10 shows the imbalance of tariff treatments in the world and bilateral trade agreements. Free trade should move these rates to the circle at the origin. Fair trade has two different definitions in trade policy. The intuitive definition of reciprocity would align tariffs on the line in the graph, import and export tariffs would be matched. An alternative measure of fairness is to treat everyone the same, evenhandedness. The U.S. uses evenhandedness as the measure of fair trade, treating China the same as Canada.

Our largest global trading partners prefer this situation as seen in Figure 11. The EU’s largest economy, Germany, and the largest trading economy, China, have the largest trade surplus. The U.S. has the largest trade deficit.

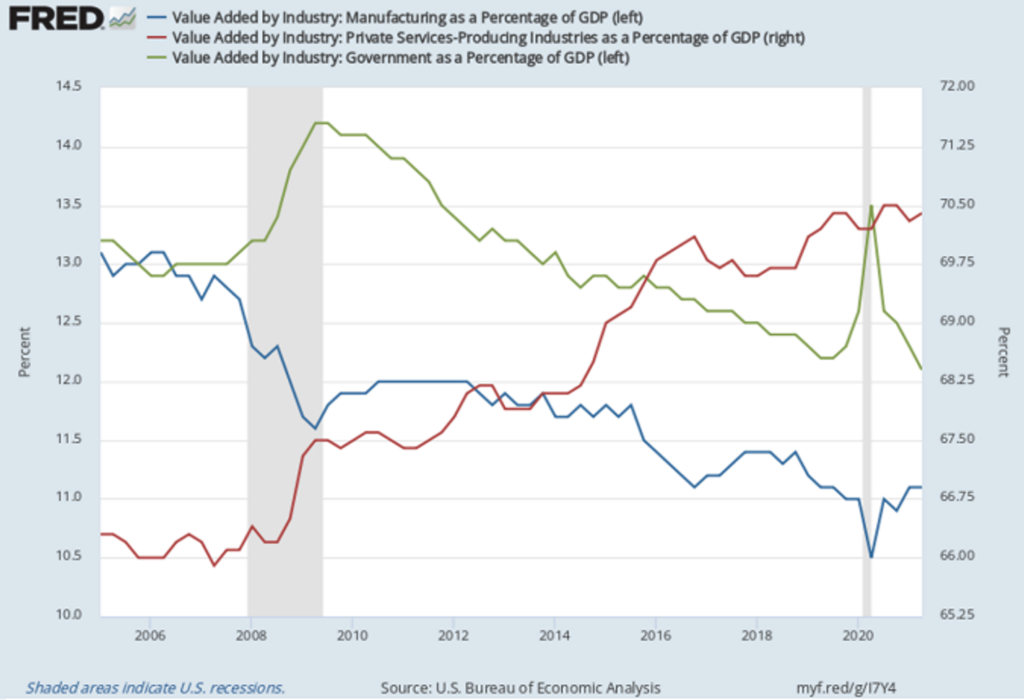

Trade agreements are fundamentally mercantilist documents. While the ideals of fair and free trade are used publicly to press for more favorable treatments, the reality is that trade agreements are large, complex and detailed documents where each participant attempts to gain the largest benefit. The U.S. has been disadvantaged in promoting these ideas and the WTO dispute resolution process has been abused to open U.S. markets to imports. The U.S. has seen that the fundamental benefit in these agreements is to benefit the service economy. Figure 12 shows that services constitute over 70% of the U.S. economy while manufacturing is 11%.

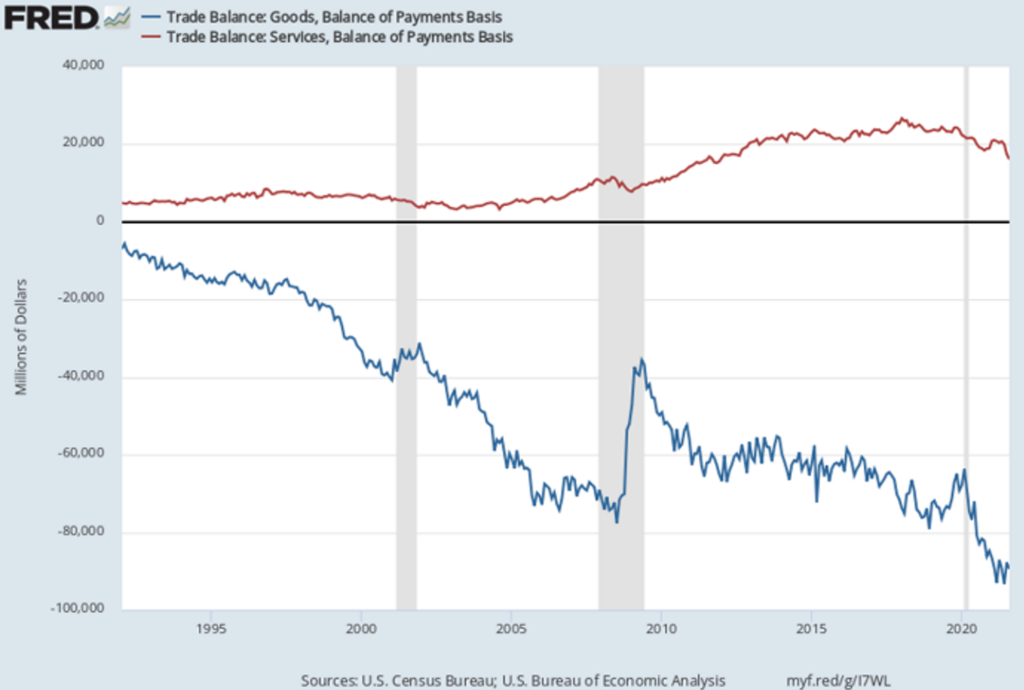

Figure 13 shows a large and growing surplus in the trade of services and the deficit in goods that is offset to an extent by that surplus. In trade negotiations, protection and favorable treatment for services like financial or entertainment or software is more valued than creating a market-based trading system for goods that gains the benefit of efficiency and value identification.

The ability of domestic suppliers to succeed in domestic U.S. markets with the current trade and investment public policies is problematic. For example, economists believe that the value of the currency has little effect on the ability to profit in a global economy, thinking that prices adjust seamlessly. This is not supported by reality. Figure 12 shows that services are the dominant force in the economy and our domestic and foreign policies are driven by supporting them, as they should be. But, core manufacturing is necessary for both national security and domestic economic stability and plays a role in improving the standard of living. The graph also shows that government is larger than manufacturing. The ability to profit from trade depends more on public policy than on manufacturing capability. Between trade policy, environmental and other regulatory costs, the value of the dollar, and the cultural assumptions supported by education and government leaders; manufacturing is seen as unattractive.

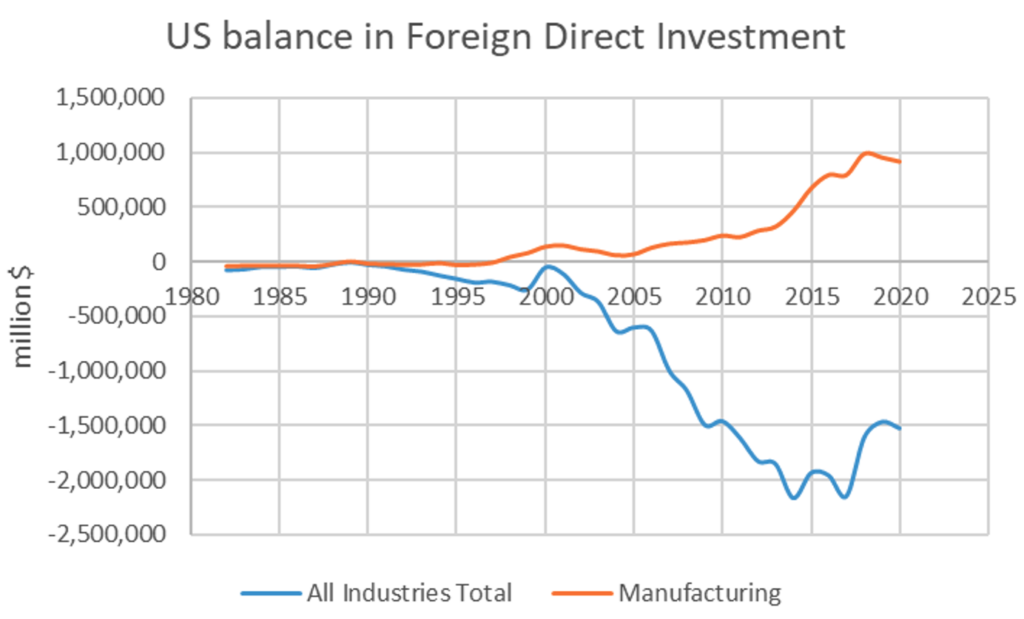

his can be seen in Figure 14 that shows the balance of foreign direct investment (FDI) in the U.S. The rest of the world has a surplus U.S. FDI when considering all industries. But for manufacturing, the U.S. is the target with a surplus of FDI from the rest of the world. This is painfully obvious in the steel world.

Our economy has the most investable resources but for domestic actors, manufacturing is less attractive than other investments. One result of globalization that is problematic from a national security point of view is the acquisition of domestic plants by foreign ownership. Until this past year, ArcelorMittal was a major owner of steel mills in the U.S. including the critical supplier of plate for defense applications in Coatesville, PA. Cleveland-Cliffs acquired the plant as part of a major deal for ArcelorMittal plants in North America. This creates some uncertainty in the future support for that plant. The primary supplier for steel castings for Navy applications was purchased by the Australian firm, Bradken. Bradken is now owned by Hitachi creating the same type of uncertainty of future support.

The excess financial resources of the U.S. were a primary source of global investment as seen in Figure 14 above with over $2 trillion in net U.S. foreign investments elsewhere in all industries but with a $1 trillion net foreign investment in U.S. manufacturing. The foreign ownership of U.S. suppliers of steel products is a direct result.

Dealing with the issues of currency, trade, tax policy, and cultural structures is not the responsibility of the DoD, but these issues have compromised the capability of the specialty steel industry to provide the support critical to the DoD mission. Steel Founders’ Society of America (SFSA) has taken a lead role in initiating a program supported by Congress in the DLA to develop the innovative steel technologies for DoD systems, working with leading academic investigators that will also provide the community of experts required and engaging the steel producers to develop and transition industrial technologies that will be competitive and improve the industry. This effort is the Steel Performance Initiative (SPI).

Question 2.

What are the one or two greatest challenges your firm/association/industry faces operating in a distributed environment?

The two greatest challenges faced by the specialty steel industry, particularly the suppliers of castings and forgings are the lack of an adequate workforce and even more critical, the lack of capital for investment in technology, equipment and automation.

The workforce challenge is well known. The general challenge has been recently summarized in the Demographic Drought (https://www.economicmodeling.com/demographic-drought/). This challenge is not short term or able to be overcome with immigration. Historically, casting and forging producers relied on the newest immigrant class to provide the skilled and capable workers required. This was true globally, even in China. Chinese plants relied on internal immigration from rural countryside to urban factories for staffing.

Like Japan, with their low birth rates and limited immigration for decades, had to automate and reduce labor requirements, the U.S. manufacturing community will automate to supplement a limited workforce. SFSA is working with DoD partners on major efforts to develop artisan-like robotics that can handle a broader range of tasks and products without individual fixturing and programming. This is critical for limited production advanced components. SFSA is also working with DoD partners to develop the robotic operators and integrators that will be required.

One small effort that has seen remarkable success in steel castings is our Cast in Steel competition for university engineering programs. This program uses a Forge in Fire type competition and challenges the student teams to produce an edged weapon to test. The competition has included a Viking Axe, a Bowie Knife, and Thor’s hammer. This year the challenge is to make a Celtic Leaf sword. Details are here: https://www.sfsa.org/castinsteel/

More challenging than the workforce is the need for investment capital which requires better profitability in the industry. One effect of globalization that helped devastate the casting and forging industry is the suppression of pricing due to non-market competition. China would commonly invade a market with pricing 40% below market prices. Often this pricing was below the cost of production. Multi-national OEMs would pressure domestic casting and forging businesses to match these prices and to support joint ventures, Chinese plants to produce their products. The OEMs wanted not only the cost benefits but also a source in China to support their growth in that dynamic market. These joint venture agreements normally included sharing state of the market technology and proprietary information on the products and processes used. These agreements were abused in many ways. One direct result was the suppression of normal market forces that would have raised pricing in the U.S. market to allow re-capitalization of these casting and forging plants. As discussed above, the sharp rise in prices for castings and forgings in 2004 to 2014 did not result in significant new investment in domestic manufacturing.

Public policy has been formulated to support the large and profitable financial, IT, entertainment, and other services. The excess investment in the 1970s made it possible to change the tax code to discourage capital intensive industry investment while the excess capacity kept the market clearing price close to the cost of production. This excess investment from the 1970s was finally liquidated in 1999-2002. That was a primary reason for the dramatic increase in prices of commodities like steel. Global supply chains could not provide the products needed in a growing global economy.

Multi-national OEMs used the period of excess capacity to negotiate the lowest price while at the same time expecting the supply chain to reinvest and develop new technologies. The OEMs allowed their subject matter experts to retire without replacement and relied on suppliers to provide the technical support needed. This loss of expertise in the purchasing community forms a barrier to the introduction of new technology. Even for existing technology and products, the lack of expertise means that the process becomes inflexible and non-responsive. Ordinary changes in process or requirements are disallowed since the purchaser is unable to assess the effects of any change.

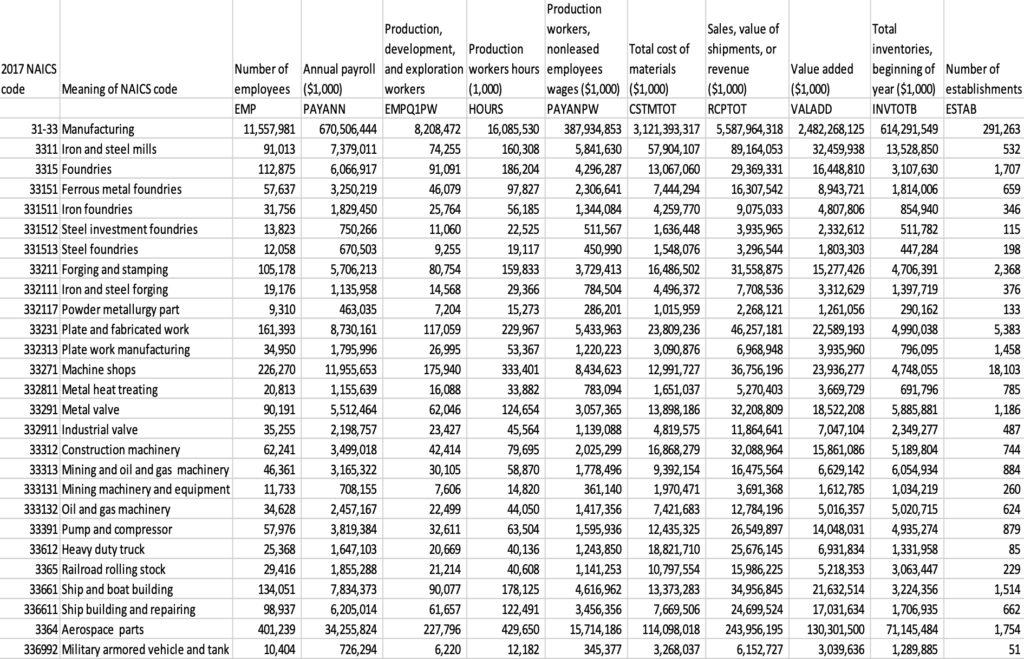

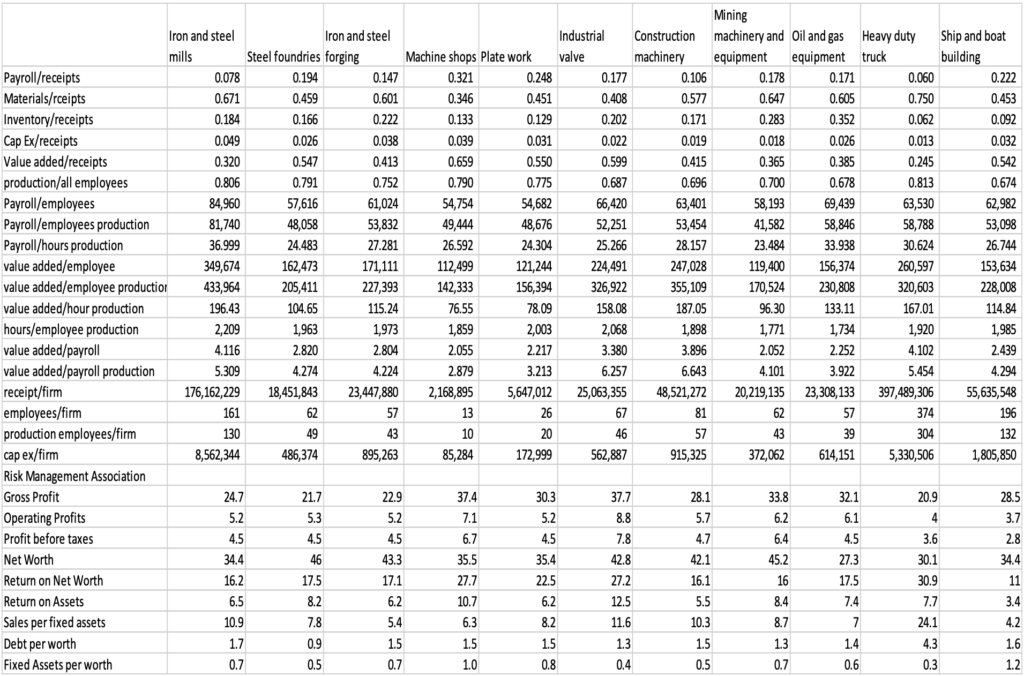

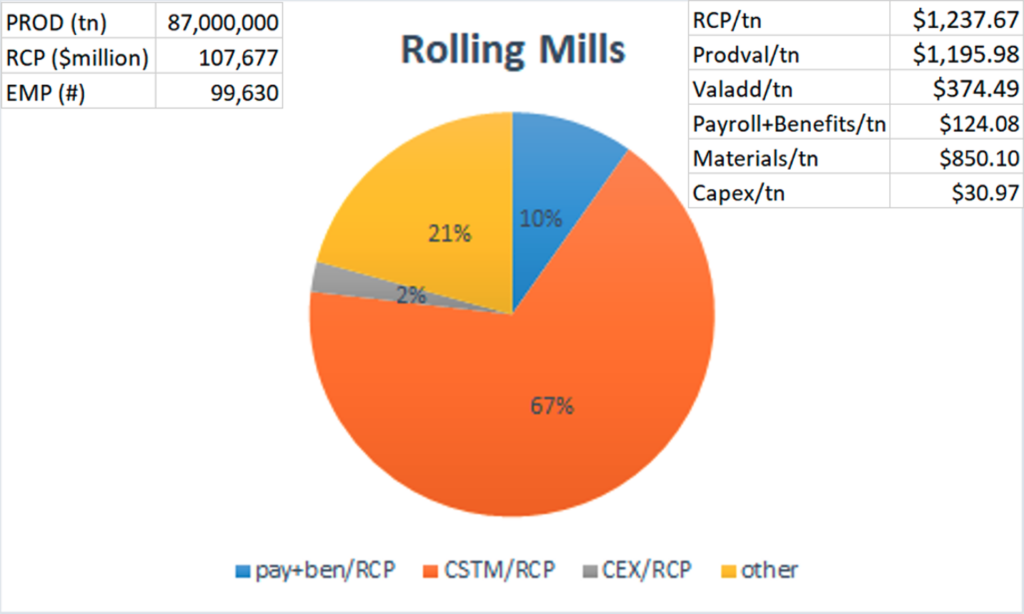

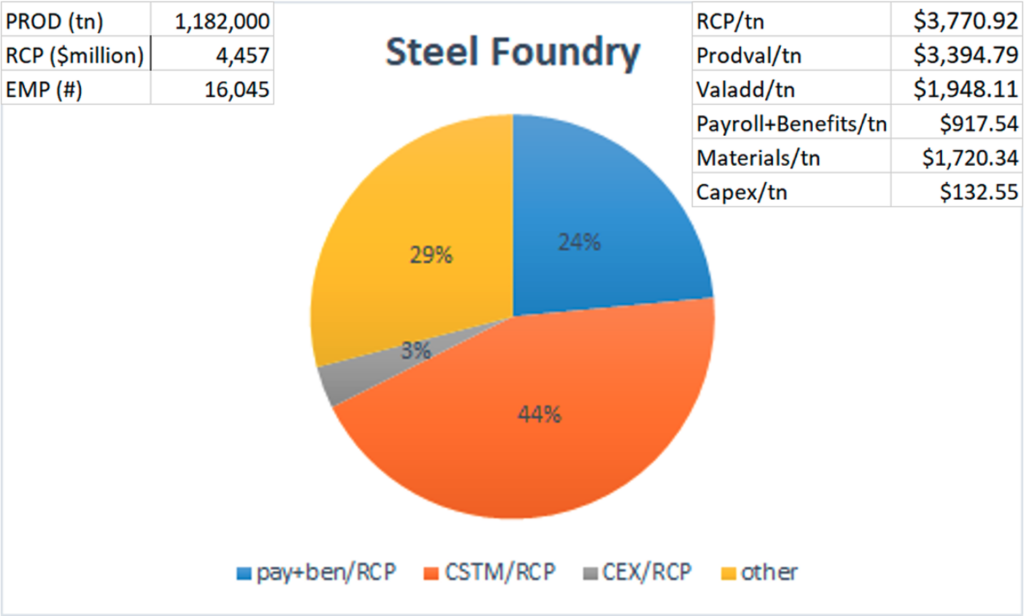

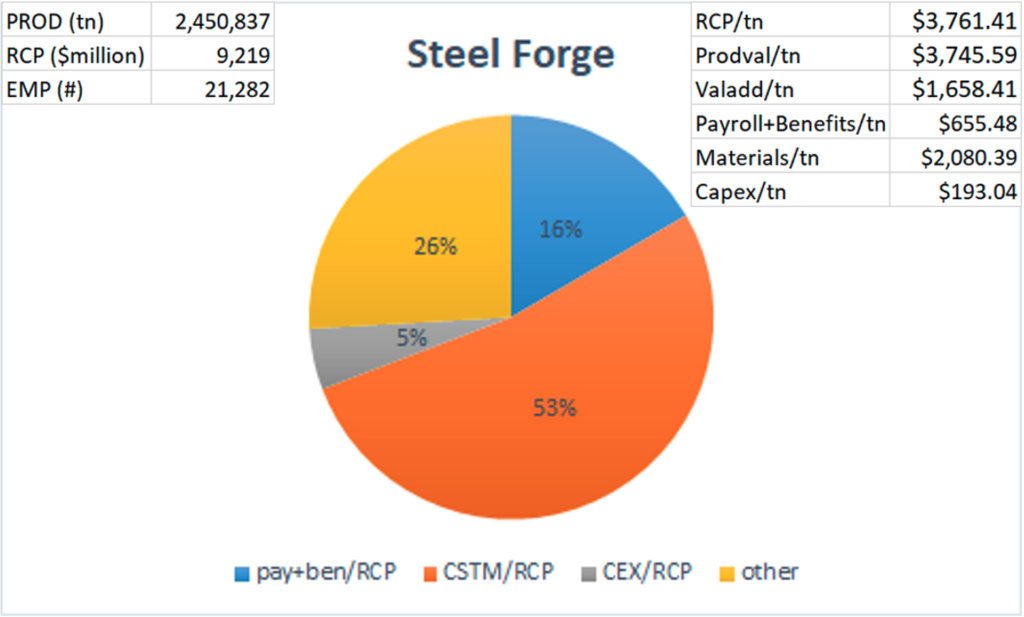

The volatility of prices shown in Figure 2 resulted in large, greater than 30% year-over-year (YOY), variable demand for castings and forgings. The excess stimulus dumped into the U.S. domestic market did not result in the inflation of commodities since the supply chain globally supported by the dramatic growth in China was able to meet the market demand at current price levels. This excess liquidity did cause ahistorical inflation in securities and debt. The low interest rates and liquidity did not stimulate investment in capital intensive equipment but reflected the lack of economic growth. The lack of investment for over two decades and the slowing growth of the incoming workforce, results in slower economic growth that is reflected in low interest rates. Low interest rates mean that money has little time value and makes the risk of significant capital equipment investment undesirable. Volatile demand and poor rates of return as a result of globalization and domestic policy have resulted in a hollowing out of the industry and a continued decline in the number and capabilities of existing plants. A summary of the size and characteristics of the capital-intensive industries including steel foundries and forge shops are given in Error! Reference source not found. and Error! Reference source not found. at the end of the document. Steel foundries and forge shops have low gross profits, low operating profits, high net worth, and low sales per fixed assets.

Question 3.

Are there ways DoD can better support your efforts to mitigate such challenges?

DoD is a difficult customer to serve. This is exacerbated when the items needed are subject to qualifications and restrictions that are beyond normal transactions. DoD like large OEMs has had the experience for decades of a multitude of willing suppliers who were able to support the administrative burdens, qualification requirements, payment terms and product requirements as a part of their ongoing business. This has eroded so that only a few already qualified suppliers who have made incremental investments to retain the business are still active in these markets.

DoD expects their suppliers including foundries and forge shops to bear the cost of becoming qualified for blast testing, first articles qualification, source qualification to stringent DoD specific standards like the Navy requirements for HY materials that typically take over a year and cost on the order of a million dollars. This initial investment in qualification gives no guarantee that if successful, they will get the business required to recover the costs. This investment in qualification also must create a cybersecurity system compliant with DoD requirements that remain undefined. ITAR is another liability that has open-ended requirements. The legal liability of supplying DoD exceeds the risk in any other commercial transaction. DoD does not provide usable forecasts of demand for size and type of product to justify the investment in qualification.

When initiating production or resolving questions of acceptability, DoD has the same challenges identified above with the changing workforce. The lack of expertise or authority makes resolution difficult. This makes it costly and frustrating to supply complex, high-performance components.

In an industry that struggles to be profitable and invest in modernization, automation and innovation, DoD is not seen as a cooperative partner. Often when a supplier has questions about a requirement or schedule, it is difficult to find anyone who can provide an answer.

Federal acquisition requirements often are a barrier with short term purchases of limited quantities limiting the producer from investing in improvements or quality. The lack of a consistent supply arrangement that reduces the purchasing overhead and allows a longer term, larger volume agreement would be more cost effective and allow the supply chain to profit and be committed.

Question 4.

How does the federal government effectively mitigate supply chain risks?

A fundamental question for the DoD supply chain is how an industry can serve DoD with adequate profitability and confidence in future business to prioritize DoD needs. If qualified for defense production, DoD can impose their production requirement and this is another risk of becoming a supplier. Much of the existing federal policy burdens capital intensive industries like casting and forging producers.

DoD is not a large customer and is a challenging one to serve. DoD correctly wants to maximize the value of the purchasing activity but does not provide the kind of ongoing collaboration needed for the industry to invest and develop. The need to minimize the initial cost of acquisition with a marginally profitable supply chain makes that chain less capable and more costly overall.

The domestic steel casting and forging industry will likely be challenged with inadequate capacity to meet the demand over the next decade. The industry needs to see price realization adequate to invest in automation, modernization and innovation. This is critical for DoD if the U.S. is to have domestic sources for the most advanced steel products to enable superior performance in the defense weapon systems. Most of the policy issues that challenge the casting and forging industry are beyond the scope of DoD but the need to develop a collaborative community of suppliers from the casting or forging producer to the OEM designer and integrator to the service to the warfighter is not functioning well.

Question 5.

What can the government do differently to better address supply chain risks and vulnerabilities in our major weapon systems/platforms ( e.g., PGMs) and critical components ( e.g., microelectronics)?

DoD is often a stove piped organization and each sub-community strives to manage its area of concern. With a broad array of policy concerns, the supply chain has constant and accelerating new requirements that make support for DoD needs difficult. New EPA and OSHA rules, climate change and sustainability efforts and documentation, workforce management not only to attract needed workers but to address or document the involvement of underserved communities, shifting recommendations and requirements to deal with the pandemic are all time and resource consuming.

The average steel foundry has 61 employees and 47 of them are in production roles, making castings. All the burdens of regulations fall on the 14 people that are needed to run the business. Similarly, steel forge shops have an average of 51 employees with 39 in production. This is made more difficult since foundries and forge shops make custom engineered parts that require engineering support out of those 14 or 12 people. This is before any added requirement from ITAR or cybersecurity or quality requirements.

Small changes in requirements, additional reports, non-responsive staff to inquiries are all burdens that challenge these industries. There is no oversight to manage or reduce the full scope of the burden required for a small business to make these types of products.

Question 6.

What can the government do differently to successfully implement industrial base cybersecurity processes or protocols, attract skilled labor, implement standards, and incentivize the adoption of manufacturing technology?

Cybersecurity is unworkable for SMEs with a small percent of work for defense. The cost to implement and maintain is an undue burden compared to other markets that are likely more profitable to begin with. CUI stymies collaboration and advancement. The patent process or foundry tours are two different ways to share information for the good of the industrial base while not disincentivizing the company that shares. Skilled labor used to be high paying jobs that sustained a middle class, which warranted time invested in apprentice programs. Today job hopping is more common for wage gain. Incentivizing profitability and reinvestment of those profits is important. Low cost loans and reduced taxes for capital investment, training and hiring are all essential.

One program initiated by SFSA with congressional support and hosted by DLA is the Steel Performance Initiative (SPI). This is an effort to create and transition the most advanced steel technology to the DoD Systems. The strategic efforts currently underway include:

- Improving the MRL and TRL of Advanced High Strength Steels (AHSS)

- Developing process-driven performance modeling to enable Fitness for Purpose (FFP) designs.

- Formulating quantitative nondestructive testing (QNDT) assuring part performance.

- Mining properties of existing materials from DTIC and commercial data with smart analytics for improved alloys, modeling and design properties.

- Tailoring Industry 4.0 for short-run steel parts from Small and Medium Enterprises (SME).

- Coupling manufacturing processes for hybrid capability and geometry with superior properties and cost-effective solutions.

- Providing a guide for the use of current steel specifications for obsolete requirements in legacy weapon systems.

- Enabling predictable blast and ballistic performance from high strain rate data.

This program engages the few universities and the most advanced steelmakers with the current OEMs and DoD experts to identify the technologies and transition targets for success.

These issues have been addressed briefly above. It is difficult to see how DoD will move forward given the cultural and institutional framework of our current structure. The future state needs to be a collaborative community that has the responsibility and the authority to achieve the needed performance. Opportunities with Industry 4.0 and automation, harvesting the advances in steel technology to create new and hybrid processes and alloys, design and prototyping tools enabled by AM and a new and capable workforce can make the difference. We need to begin to address these systemic issues with changes in policy and practice to enable a successful future.

Appendix A: Steel Plants with Refining Capability

Raymond

[1] This is opinion based on my participation as an industry advisor on the JDMTP Metals Sub-panel since 1994.[1] This section on trade and tariffs is informed by my service on the Industry Trade Advisory Committee for Steel (ITAC 7), a Congressionally authorize effort appointed by the administration and responsible to provide industry input for trade policy. This activity is jointly administrated by the U.S. Trade Representative (USTR) and the Department of Commerce. I served on the Committee from 2001 until 2019.Business Report

| STEEL FOUNDERS’ SOCIETY OF AMERICA | |||||

| BUSINESS REPORT | |||||

| SFSA Trend Cards | 12 Mo Avg | 3 Mo Avg | August | July | June |

| (%-12 mos. Ago) | |||||

| Carbon & Low Alloy | |||||

| Shipments | -1.9 | 7.0 | 8.5 | 3.3 | 9.4 |

| Bookings | 3.1 | 13.3 | 15.0 | 13.0 | 12.0 |

| Backlog (wks) | 8.4 | 9.0 | 10.0 | 8.0 | 9.0 |

| High Alloy | |||||

| Shipments | -3.7 | 1.3 | 11.0 | 1.7 | -8.9 |

| Bookings | 4.8 | 11.0 | 14.6 | 3.5 | 15.0 |

| Backlog (wks) | 10.0 | 10.8 | 10.0 | 10.5 | 12.0 |

| Department of Commerce | |||||

| Census Data | |||||

| Iron & Steel Foundries (million $) | |||||

| Shipments | 1,238.0 | 1,356.3 | 1,386 | 1,400 | 1,283 |

| New Orders | 1,347.3 | 1,453.3 | 1,436 | 1,493 | 1,431 |

| Inventories | 2,209.1 | 2,354.0 | 2,354 | 2,357 | 2,351 |

| Nondefense Capital Goods (billion $) | |||||

| Shipments | 75.9 | 79.3 | 79.5 | 79.2 | 79.1 |

| New Orders | 78.6 | 86.7 | 90.1 | 82.5 | 87.6 |

| Inventories | 196.5 | 200.4 | 201.3 | 200.3 | 199.6 |

| Nondefense Capital Goods | |||||

| less Aircraft (billion $) | |||||

| Shipments | 71.8 | 74.4 | 75.0 | 74.4 | 73.7 |

| New Orders | 73.7 | 76.8 | 77.2 | 76.7 | 76.5 |

| Inventories | 130.5 | 134.2 | 135.0 | 134.3 | 133.2 |

| Inventory/Orders | 1.8 | 1.7 | 1.75 | 1.75 | 1.74 |

| Inventory/Shipments | 0.0 | 1.8 | 1.80 | 1.80 | 1.81 |

| Orders/Shipments | 0.0 | 1.0 | 1.03 | 1.03 | 1.04 |