Table of Contents

Keel Bars Needed

We urgently need your extra keel bars. We are looking for 10xx and 86xx grades within two weeks. We would prefer multiples from the same heat. Please contact Dave.

Introduction to Artificial Intelligence (AI)

University of Utah’s AI 101 webinar is available on the wiki. Taylor Sparks provided an overview of AI and machine learning, including how these tools work, where they’ve succeeded, and where they still fall short. He distinguished between AI, machine learning, and deep learning, and highlighted their real-world applications—particularly in materials science, where they’re accelerating discovery in ways traditional approaches cannot.

NGM at Robotic Grinding Conference

Grinding automation continues to advance; however, the needs for job shop grinding of steel castings is still largely unsolved. SFSA Next Gen Mfg members will be able to learn about the state of the industry by attending Automate’s Robotic Grinding & Finishing Conference in Minneapolis, MN on July 22-23 (registration required). A group dinner and round table discussion will be setup. For more information and to RSVP for dinner, please contact Dave.

79th Technical & Operating Conference

The conference and workshop will be December 10-13 at the Loews Hotel in Chicago. If you would like to recommend a topic and presenter, please contact Dave.

UT Round Robin

If you use ultrasonic inspection for NDT, please contact Dave to participate in our round robin study (US locations only for now). Whether you use single beam (e.g. ASTM A609) or phased array UT (PAUT), likely for informational purposes, we need you to do ultrasonic testing on a set of reference blocks and bars. This will establish the state of the industry and focus on-going research to develop a commercial practice.

DoD Study on Adopting Smart Manufacturing Technologies

The Interdisciplinary Center for Advanced Manufacturing Systems (ICAMS) at Auburn University is conducting a study on behalf of the Department of Defense to understand the issues and hurdles manufacturers face when adopting smart manufacturing technologies. That information then helps inform development of solutions to overcome those challenges and help manufacturers become more successful. (You can read last year’s results here. ENG—ICAMS-SMART-Report_2023_020624.pdf)

The survey should not take more than 10 minutes of your time. We will not be asking for any sensitive information, and your name and company’s name will not be associated with any information provided. Your insights will help us better understand several overarching industry issues. If you would like, we will provide you with this year’s resulting publication once it is completed.

We hope that you are willing to help with this project. If so, please begin the survey by clicking on the following link: https://auburn.qualtrics.com/jfe/form/SV_77JLrDPwSfGDvBc?Source=S3

AWS Structural Welding Code – Steel

The 2025 AWS D1.1 code was released in April 2025. ASTM A216 WCB and WCC are included in the 2025 code as prequalified base materials. Prequalified materials are exempt from WPS qualification testing as long as they are within certain welding parameter bounds detailed in the code. This makes prequalified materials easier for designers of steel structures to use in their designs.

Research Review, July 8-10

Please make your plans to participate in the annual SFSA Research Review on July 8-10. This year’s meeting will be held in-person in Rosemont, IL. The Review covers the latest in both Carbon & Low Alloy and High Alloy steel casting research under the AMC and STAR programs. The meeting is also your opportunity to interact with the researchers and provide industry steering. The event vets our research portfolio to select the R&D projects to be featured at the National T&O. Registration can be found here. Registration is required and must be completed by June 23.

Similar to previous years, we request you consider inviting a handful of key contacts at your customer or even a potential customer for the Design Day on July 8th. A separate registration link is provided for non-members here: https://www.surveymonkey.com/r/2025DIDDESIGNDAY

For any questions, contact Caelan Kennedy (ckennedy@sfsa.org).

| Tuesday July 8th 8am-5pm | ||||

|---|---|---|---|---|

| Microstructural Investigation towards Industrial HY Steel Casting and Heat Treating | Colorado School of Mines | Emmanuel De Moor | ||

| QLT Heat Treatment of Ultra-High Strength, High Toughness Steels | Colorado School of Mines | Emmanuel De Moor | ||

| Alloy and Process Improvement of Q&P Plate Steels for Dynamic Impact Performance | Colorado School of Mines | John Speer | ||

| Evaluating High Strength Welding Feedstocks for HSLA Steel Repair | Colorado School of Mines | Jonah Klemm-Toole | ||

| Automatic Non-Destructive Testing of Steel Castings Using AI and XR | Grid Raster | Bhaskar Banerjee | ||

| AIA For Radiography and Fracture Surface | University of Alabama at Birmingham | Sam Misko | ||

| Advancement of Phased Array Ultrasound (PAUT) for Steel Castings | Iowa State University | David Eisenmann | ||

| Practical Approach for Ultrasonic Phased Array Inspection of Cast Steel Materials | Rhyton Technologies | Hossein Taheri | ||

| Automated Inspection Assistance System | Purdue | Shirley Dyke | ||

| Digital Surface Standard | Iowa State University | Frank Peters | ||

| Enabling Performance-based Design and Analysis of Cast Components with Quality Features | Texas A&M | Ankit Srivastava | ||

| Microporosity-Derived Quality Details: Impact of Geometry and Grade on Performance | Michigan Tech | Alexandra Glover | ||

| Application of Fracture Mechanics for Strength Prediction of Steel Castings - Phase II | University of Memphis | Ali Fatemi | ||

| Generalzied Fatigue Assessment for Steel Castings - Phase II | Baylor University | Brian Jordon | ||

| Cast Steel Components for Building Construction | University of Arizona | Robert Fleischmann | ||

| Wednesday, July 9th, 8am-5pm | ||||

| Automated Arc Air Riser Removal | Iowa State University | Frank Peters | ||

| Collaborative Robot Applications | Iowa State University | Frank Peters | ||

| Automated Grinding - Phase II | Iowa State University | Frank Peters | ||

| Integrated Production Welding Automation | Iowa State University | Frank Peters | ||

| Augmented Reality Implementation into Steel Foundry Applications | University of Wisconsin, Madison | Hannah Blum | ||

| Developing an IoT Talent Pipeline for the Foundry Industry | University of Northern Iowa | Nate Bryant | ||

| Optimization of Technologies and Processes to Improve Productivity and Efficiency in the Steel casting Industry | University of Northern Iowa | Nate Bryant | ||

| Automated Grinding - Scan and Plan | SwRI | Matt Robinson | ||

| Tele-Gouge Arc Air Phase II | EWI | Ian Gibbs | ||

| Autonomous Robotics and DART | Deierling Consultants | Phil Deierling | ||

| Development Of A Standalone Retrieval-Augmented Generation System for Steel Casting Wiki | University of Utah | Taylor Sparks | ||

| Examining Transformation Temperatures in Martensitic Stainless-Steel Castings | Missouri S&T | Mario Buchely | ||

| Designing Additive Molds for Shakeout | Youngstown State University | Brian Vuksanovich | ||

| Program-less Auto-grinding Robots for Metal Castings | Carnegie Mellon University | Tianhao Wei | ||

| Thursday, July 10th, 8am-12pm | ||||

| Commercial Quench Tank Facility Characterization | University of Alabama at Birmingham | Robin Foley | ||

| Tankless Water Quenching of Production Steel Castings | University of Alabama at Birmingham | Robin Foley | ||

| Modeling of Oxide Films in High Alloy Steel Castings | University of Iowa | Richard Hardin | ||

| Prediction of Macrosegregation in Steel Castings | University of Iowa | Richard Hardin | ||

| Working Group Updates | SFSA | Tory Wendlandt | ||

SFSA Foundation Scholarships

Recruiting and developing the next generation of leaders is a top priority for the steel casting industry. As part of a strategic initiative by the Steel Founders’ Society of America (SFSA), the Foundation remains committed to investing in the industry’s future by encouraging member companies to hire student interns and by recognizing the valuable contributions these interns make.

Through the Steel Founders’ Society Foundation, we are proud to offer $2,000 scholarships to student interns who have worked at an SFSA member foundry during 2025. These scholarships aim to honor students for their meaningful contributions and to inspire their continued growth within the steel casting industry.

- The Schumo Scholarship

- Established in memory of Robert M. Schumo, former president of SFSA and Pennsylvania Electric Steel. This scholarship recognizes his generous contribution that helped establish the Foundation.

- The Peaslee Scholarship

- Created by the SFSA Board in honor of the late Dr. Kent Peaslee, Chair of Steelmaking Technology and Curators’ Teaching Professor of Metallurgical Engineering at Missouri University of Science and Technology.

To be eligible, the student’s project must focus on melting or refining processes.

- Created by the SFSA Board in honor of the late Dr. Kent Peaslee, Chair of Steelmaking Technology and Curators’ Teaching Professor of Metallurgical Engineering at Missouri University of Science and Technology.

Two Additional Scholarships in 2025

- Jim and Betsy Cooke Memorial Scholarship Fund

- Christoph Beckermann Memorial Scholarship Fund

Scholarship Criteria

To be considered, interns must:

- Have worked at an SFSA member foundry during 2025

- Be responsible for a defined project (not used for an extra set of hands)

- For the Peaslee Scholarship, the project must focus on melting or refining

- Submit a written paper and PowerPoint presentation detailing their completed project

All submissions will be evaluated by the SFSA Scholarship Selection Committee, composed of experienced professionals who have served in both technical and operational roles and who have served within other SFSA committees.

Recognition at the 2025 National T&O Conference

Scholarship recipients will be recognized at the 2025 SFSA National Technical & Operating Conference, held in Chicago on Friday, December 25, 2025. Each scholarship winner will be expected to present their project during the event.

Submission Details

To apply, each intern must:

- Submit a paper and PowerPoint presentation on the project they have completed during their employment.

- Ensure both are reviewed and approved by their supervisor before submission

- Send materials to Renee Mueller at rmueller@sfsa.org by August 15, 2025

For questions, please contact: Renee Mueller at rmueller@sfsa.org or 847-431-5405.

Market News

Despite elevated uncertainty, hard data indicates that consumer and business spending are on the rise. Although a surge in imports and a slight dip in US government expenditures slightly weighed down first-quarter GDP, gains in consumer spending and fixed investment made positive contributions. The Dallas Fed’s Weekly Economic Index suggests that GDP is more likely than not to increase in the second quarter.

ITR reports that the US Total Manufacturing Production Index is beginning to show signs of accelerating growth, though individual market trends vary. Markets such as heavy trucks, construction machinery, light vehicles, and medical equipment remain in decline. In contrast, sectors including chemicals, food, aircraft, and computers and electronics are showing upward momentum. Most sectors are projected to see peak growth rates around mid-2026, entering slowing growth by year-end. In 2027, the landscape will likely shift to a mix of plateaus and downward trends.

ITR’s forecast for US Heavy-Duty Truck and North America Light Vehicle Production were revised downward, primarily due to the ongoing trade war’s disruption of their complex supply chains. Outlooks for the industrial sectors in Mexico and Canada have also been lowered. Additionally, they downgraded projections for US Metalworking Machinery New Orders, closely tied to the automotive sector.

SFSA Business Trends

To benchmark your facility with other steel foundry members, SFSA encourages you to participate in the monthly SFSA business trends survey – only participants have access to the results. The quarterly data will no longer be included in the Casteel Reporter. Please complete the business trends survey for April 2025: https://www.surveymonkey.com/r/SFSA_BTB_Apr25. Survey results are provided to participants early the following month.

Casteel Commentary

Steel Foundries in North America and Tariffs

Macro-economists live in an ideal world where people are sophisticated biochemical machines programed to be economic value maximizers striving through their efforts to maximize their worth. Markets allow these value units called people to exploit their local and personal knowledge and insights to efficiently allocate scarce resources to their most productive use. The freer market transactions are from constraints and costs, the more value they generate.

But…

There are constraints external to market value that are necessary. Some activities that could take place in the market are unacceptable. If a vendor sells at a lower cost because they lie and misrepresent the quantity or value of the product, that distorts the market. A robbery where a thief allows you to live if you give him your money is a valid market transaction. Both parties get value, the thief gets money and the victim remains alive. We forbid these transactions. These rules are external constraints on market transactions that are needed to restrict unacceptable exchanges.

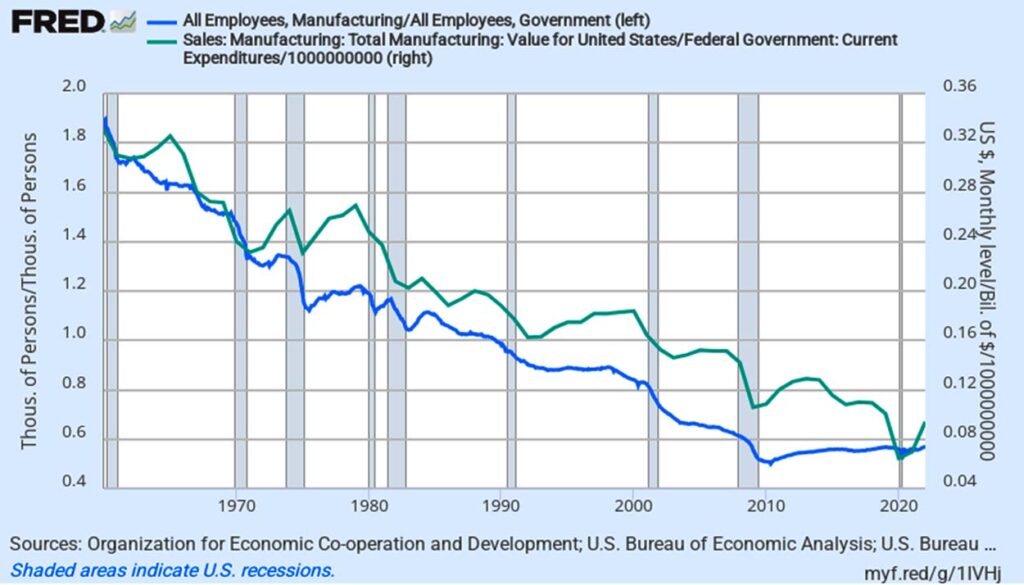

One role of government is to oversee the market to ensure that deceit or force is not used to allow markets to operate properly. Unfortunately, all government intrusions into the market place distort the markets. Manufacturing was over 25% of non-farm employment in 1960 and government was 15%. The graph below in

Figure 1 shows the relative shrinkage of manufacturing sales and employment compared to government.

Manufacturing prior to 1980 was a regional business that was profitable and vulnerable to governmental policies and costs. The prosperity of manufacturing and competitiveness during the growth and modernization of our region allowed the government to burden manufacturing companies with cost to deal with externalities. These costs were paid for by the customers who benefited from the insurance, safety, environmental improvement, health care and taxes paid for as the result of requirements from the government. These costs were uniform for all firms competing like steel foundries and the active market pressed firms to become better and more efficient. Customers knew they needed the products and the suppliers and allowed pricing that supported the suppliers’ need to invest in innovation and modernization.

The capital boom from 1970 to 1980, built the infrastructure of the U.S. and North America in the period of inflation and high interest rates. The collapse of demand for products made by capital intensive industries like steel foundries after 1980 led to price stability and incremental liquidation for 20 years. This was exposed in 2003 when global production could not keep up with demand and prices for steel products soared. It was expected that this rise in pricing would allow North American producers to modernize and reinvest. Instead in the global market, those investments were made outside of North America to exploit the lower costs. These costs were not primarily due to lower labor costs but to the supportive economic and public policies in other regions that were targeted in capturing those markets.

Policy makers in the U.S. were confident that the failure of domestic suppliers to be able to compete on price with offshore sources was due to their inability to operate efficiency and offset labor costs with enhanced productivity. Policy makers and economists were aware that often the offshore sources were exploiting the system with subsidies and other predatory tactics to capture market share. They believed that this was a benefit to the domestic economy because we were able to buy these goods at lower prices. If these suppliers tried to use their market share to gain excess profits, another competitor of the domestic industry would invest to recapture those markets.

The cost and price of a common low-cost steel product is shown in Figure 2. Economists would think that U.S. producers with the better price compared to cost should be more profitable. This was not the case for example in 2019 NUCOR had a gross profit of 11.9%, USS was at 6.6%, Nippon was at 12.7% and Gerdau was at 10.6%. The higher price of steel in the U.S. is not due primarily to production costs but to policy costs from taxes, trade, etc. COVID exposed the risk of reliance on global suppliers for things fundamental to economic and national security. The notion that we were in a new era where old national interests and cultures were obsolete was shown to be incorrect.

Trump1 recognized that while policy makers and business leaders had prospered from this global approach, it had significant and observable costs to our North American region. The tariffs imposed were expected to cause economic damage that would be painful and expose the fallacy of tariffs as a tool to use for managing trade. Steel was in many ways the most prominent product involved. Steel manufacturers had always been the most insistent on using the trade remedies of antidumping and countervailing duties to prevent predatory practices from offshore competitors.

The tariffs of Trump1 were retained and increased by the Biden administration. Tariffs are ubiquitous in the global economy. An analysis of tariff policy from the World Bank in 2003 is shown in Figure 3. Free trade is clearly not the current situation, tariffs are often more than 20%. Fair trade is not seen as reciprocity but as evenhandedness, we treat all imports the same.

The U.S manufacturers have other fundamental challenges. The WTO has ruled that Value Added Taxes (VAT) can be border adjustable and do not affect trade, but our corporate taxes cannot be border adjustable. VAT taxes are commonly around 20%. The dollar is the reserve currency but macro-economists believe that changes to VAT rates and currency values is rapidly neutralized by changes in the product prices. This means that they believe that VAT and currency values do not affect trade.

North American economic and national security will require domestic suppliers of critical steel castings. Our current trade policies and policy costs make capital intensive industries including steel foundries inadequately profitable to modernize, automate and innovate. All of the major integrated steel producers globally are not profitable enough to sustain their business. The Price to Book (PB) is less than one. Arcelor Mittal sold their U.S. mills because they were not sustainable and their current PB is 0.41. USS had no bidding war of North American organizations trying to buy them. Nippon Steel with a PB is 0.57 is trying to purchase them. Steel makers are a traditional sunk cost investment operating to remain in the black and stay in business hoping for changes in the future markets. The global supply chain is in the early stages of decline as the largest exporters run out of a workforce. Demographic collapse is a major factor in implementing robotics and automation.

Tariffs have not routinely been a factor in steel castings because the legal system required targeting discrete products. Castings come in as parts or embedded in products and do not have a category that can be targeted. Even more damaging to our industry is the erosion of our customers as they has been replaced by global producers and no longer operate in North America. Importing steel castings embedded in historic customer products like pumps, valves, industrial equipment cause most of the reduction in demand for steel castings.

Trump2 tariffs are incoherent, rapidly changing, indeterminate and disruptive. They are causing fundamental economic damage and making business operations and planning risky. They are not informed by identifiable abuses or targeted to resolve historic abuses. It is not clear how tariffs will affect our industry, and no one knows. To the extent they are successful and avoid economic collapse and hopefully they spur the return not only of our products to North America but maybe more important if our customers return we will benefit.

Raymond

| STEEL FOUNDERS' SOCIETY OF AMERICA BUSINESS REPORT | |||||

|---|---|---|---|---|---|

| 12 Mo Avg | 3 Mo Avg | March | February | January | |

| Department of Commerce Census Data | |||||

| Iron & Steel Foundries (million $) | |||||

| Shipments | 1,674.60 | 1,700.30 | 1,751 | 1,717 | 1,633 |

| New Orders | 1,687.70 | 1,662.70 | 1,684 | 1,670 | 1,634 |

| Inventories | 3,313.60 | 3,386.70 | 3,399 | 3,382 | 3,379 |

| Nondefense Capital Goods (billion $) | |||||

| Shipments | 85.2 | 87.2 | 86.1 | 87.7 | 87.9 |

| New Orders | 87.1 | 98.1 | 114.9 | 88.7 | 90.6 |

| Inventories | 232.5 | 233.1 | 233.4 | 232.8 | 233.1 |

| Nondefense Capital Goods less Aircraft (billion $) | |||||

| Shipments | 74 | 74.4 | 74.6 | 74.5 | 74 |

| New Orders | 74.1 | 75.1 | 75.1 | 75 | 75.3 |

| Inventories | 163.2 | 163.3 | 163.6 | 163.3 | 163.2 |

| Inventory/Orders | 2.2 | 2.2 | 2.18 | 2.18 | 2.17 |

| Inventory/Shipments | 0 | 2.2 | 2.19 | 2.19 | 2.2 |

| Orders/Shipments | 0 | 1 | 1.01 | 1.01 | 1.02 |

| American Iron and Steel Institute | |||||

| Raw Steel Shipments (million net tons) | 7.2 | 7.4 | 7.7 | 7 | 7.4 |