Automation, modernization, and innovation are essential for our steel casting industry’s future. We have been handicapped by public policy, excess global capacity and economic market conditions that have not allowed us to be profitable enough to make or justify the investments needed. Our industry is likely to face a challenging future where we have neither the capability nor the workforce to meet market needs for economic and national security…. Read more about this in this month’s Casteel Commentary.

Table of Contents

Value of the Person Seminar

Value of the Person – Theory R was created to drive transformational change throughout the organization by creating a culture of Love, Dignity and Respect. The program teaches you with new ways to inspire, lead, develop, love and grow your people.

Nancy McDonnell, President and CEO, shared the story of how her father, Wayne Alderson, founded the Value of the Person and the impact it has had on many organizations including several foundries. Nancy and her team are hosting a two-day business seminar on June 18-19 near Pittsburgh, PA. For more information and to register, please visit: https://www.valueoftheperson.com/theory-r-seminar/.

Cast in Steel

One of the key strategic directives is workforce development and providing resources to grow and sustain the next generation of leaders serving the steel casting industry. The annual Cast in Steel competition attracts hundreds of university students to introduce them to the exciting and challenging world of manufacturing steel castings. The SFSA Foundation provides scholarships and research opportunities to support future founders.

The Cast in Steel Award was established as a scholarship opportunity to help a student with a demonstrated interest in the steel casting industry who is struggling to find resources to pursue an education for his or her career in the industry. It remains a tool to assist when the need presents itself.

Cast in Steel Competition

The 6th annual Cast in Steel competition was held Monday, April 22nd with the awards ceremony on Tuesday morning at the Grohmann Museum in downtown Milwaukee, WI. This year’s competition had an impressive 37 teams from 34 universities mentored by 30 industry partners casting a Halligan Bar. Nearly 300 students and more than 100 guests were in attendance between the competition and awards ceremony.

A few new things were offered to the students at the competition this year. Members were given the opportunity to connect with the students by having a table. Seven foundries met with students to share company information and job postings for full-time and intern positions. The students were excited about this opportunity. SFSA also coordinated plant tours for the students at MetalTek and Scot Forge.

The Grand Prize was based on the top 5 rankings below. Weighting of the scores were as follows: (1) Design and Process 25%, (2) Spear Authenticity 15%, (3) Casting 25%, (4) Video 10%, and (5) Performance 25%.

Grand Prize

- Pittsburg State University “Graduate Gorillas“

Best Sand Casting

- Cal Poly Pomona “Halligan Heroes“

Best Investment Casting

- Cal Poly Pomona “Molten Metal Militia“

Best Performance

- Pittsburg State “Graduate Gorillas“

Best Design and Process (Tie)

- University of Tennessee – Knoxville “Steel T’s“

- Penn State Behrend “We are Halligan State“

Best Authentic Halligan Bar

- Virginia Tech “Halli McHalligan Face“

Best Video

- Cal Poly Pomona “Halligan Heroes“

Like prior year’s competition, SFSA is donating the Halligan Bars except for the Grand Prize Winner to FEF to be auctioned. Auction details to be announced by FEF.

Casting Dreams Competition: Judging and awards were held on Wednesday, April 24th in conjunction with the AFS MetalCasting Congress. A total of 67 students, ages 14-18, participated in this competition.

All in Steel Competition: The All in Steel competition included America Makes (additive) and Forging Industry Association (forging). Judging and awards were held in Milwaukee on Thursday, April 25th. There was a total of 6 teams for forging and 2 teams for additive. The team from Cleveland State University won the grand prize for the forged Halligan bar and Colorado School of Mines won for additive.

Steel Founders’ Society Foundation Scholarships

Recruiting students to join our industry and grow into leadership positions remains a critical need in the steel casting industry and a strategic initiative of the Society. The Steel Founders’ Society Foundation remains devoted to helping members by encouraging companies to hire student interns. We want to recognize these student interns at our SFSA National T&O Conference.

New this year…the Foundation is offering $2000 scholarships to interns that have worked at a SFSA member foundry during 2024!.

- The Schumo Scholarship was established in memory of Robert M. Schumo, a former president of SFSA and Pennsylvania Electric Steel, in recognition of his generous gift to SFSA that formed the basis of the Foundation.

- The Peaslee Scholarship was established by the SFSA Board in honor of the late Dr. Kent Peaslee, the Chair of Steelmaking Technology and Curators’ Teaching Professor of metallurgical engineering at Missouri University of Science and Technology.

The intern should be responsible for a particular project and not simply used as an extra pair of hands during their employment with the company. To qualify for the Peaslee Scholarship, the intern’s project must be in the area of melting or refining.

The scholarships are competitive. Each applicant is required to submit a paper and PowerPoint presentation on a project they have completed during their employment. The submissions will be judged by the SFSA Scholarship Selection Committee. Committee members are individuals who have held both technical and operating positions and who have served within other SFSA committees.

To apply for the scholarships, each intern must submit a paper and presentation to Renee Mueller, rmueller@sfsa.org, by August 16, 2024. Before submitting to SFSA, the paper and presentation must be reviewed and approved by the intern’s supervisor. The winners of the scholarships must present at the SFSA National T&O Conference in Chicago on December 13, 2024.

For any questions, please contact Renee Mueller, rmueller@sfsa.org, (815)-770-2925.

For those students that are interested in other available scholarships, please visit:

American Foundry Society (AFS) Association for Iron and Steel Technology (AIST)

Scholarship funds are to by the student to pay for qualified education expenses as defined by the Internal Revenue Service.

Research Review, July 19-22

Please make your plans to participate in the annual SFSA Research Review on July 9-11. Registration information will be sent to members when it becomes available.

Spring Leadership Meeting and Tours

This year’s Spring Leadership meeting and foundry tours will be held in Pittsburgh, PA on Tuesday, May 14 and Wednesday, May 15. Along with the Industry Roundtable and Board Meeting, we’ll be touring Standard Forge, Duraloy Technologies, and McConway & Torley. The cost to attend the meeting is $199. For more information and registration, visit: https://sfsa.site-ym.com/event/SLM2024

78th Technical & Operating Conference

The T&O Committee is in the process of setting up this year’s conference. It will be on December 11-14 at the Loews Hotel in Chicago. If you would like to recommend a topic and presenter, please contact Dave.

Market News

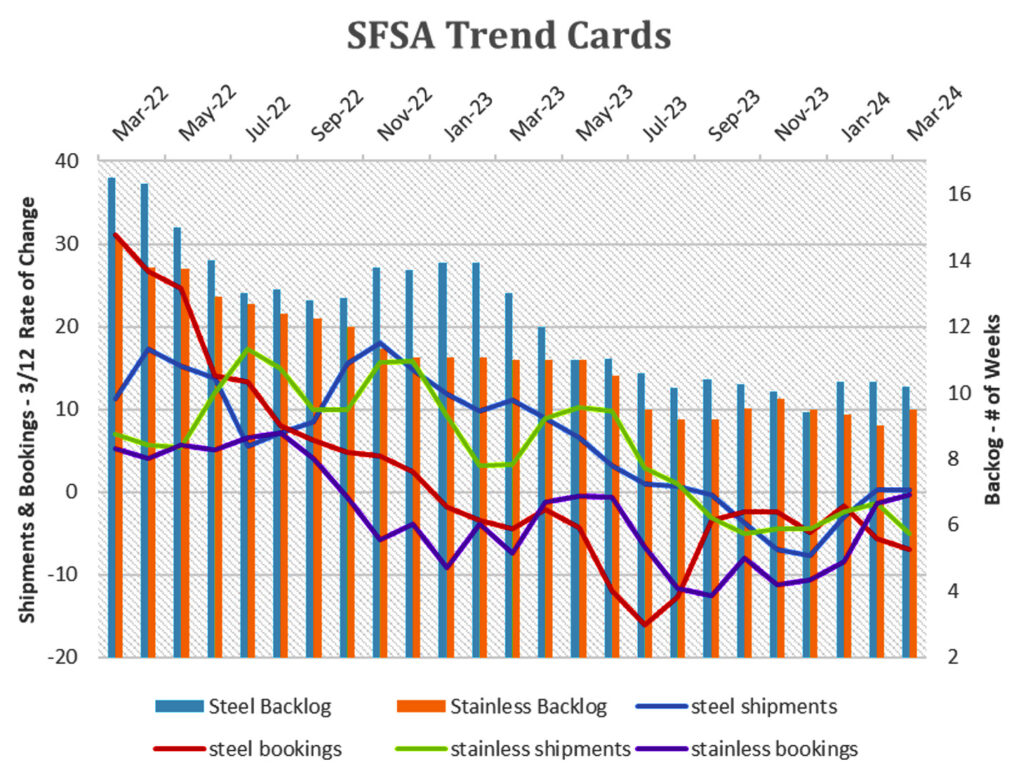

In March, YoY stainless bookings outpaced shipments which may be an early signal for an upswing in the market. Conversely, YoY steel casting bookings continue to decline and while shipments remain flat and at parity to year ago levels. YoY backlog for carbon and low alloy steel is -21.79% and stainless is -13.79%. ITR reported that while the US Total Industry Capacity Utilization Rate 1/12 declined in April, the overall trend of the 1/12 is horizontal. This would imply that the US Industrial Production 12/12 will remain relatively level in the months ahead, which is in line with their forecast for flatness to slight decline in industrial activity.

Casteel Commentary

Automation, modernization, and innovation are essential for our steel casting industry’s future. We have been handicapped by public policy, excess global capacity and economic market conditions that have not allowed us to be profitable enough to make or justify the investments needed. Our industry is likely to face a challenging future where we have neither the capability nor the workforce to meet market needs for economic and national security.

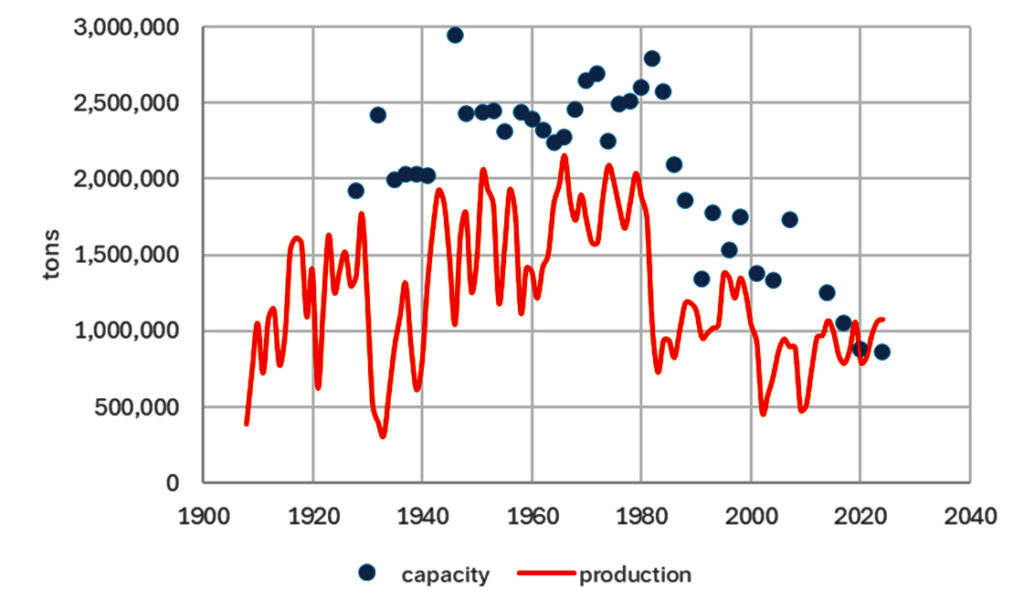

The graph in Figure 1 shows the ongoing reduction of capacity and production since 1980. The boom in the 1970s constructed much of the infrastructure that now needs to be replaced. The combination of inflation making things more valuable and expensive and rising interest rates making money worth less led a huge wave of investment. Steel foundry products were needed not only for the energy, infrastructure, and transportation; it was also needed to create the industrial capacity to build all of that. Much of our existing infrastructure that is essential to modern life was built then and is only now becoming obsolete and in need of replacement. Replacing this infrastructure and manufacturing capability will require steel castings while the decline of globalization and re-regionalization will require our products. This should lead to an opportunity for profitability that will allow re-investment and expansion. Our most critical initial investments will be automation as a part of the modernization of our plants.

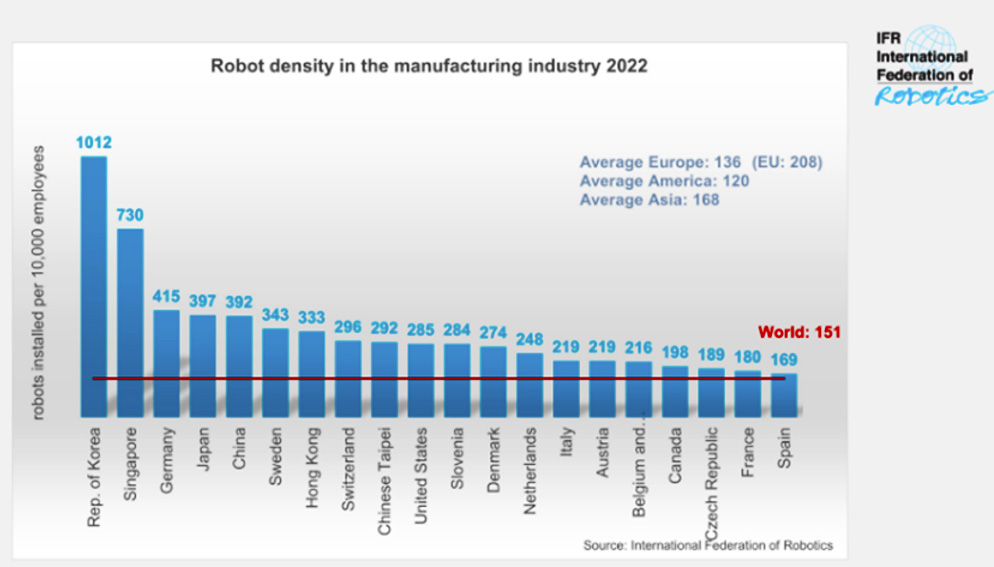

The countries in Figure 2 with the highest robot density are also the countries with the lowest birth rates. In 2023, the U.S. birthrate was 1.62 per woman compared to a rate of 2.1 just to maintain the current population. Industrialization includes both manufacturing and urbanization that results in a falling birth rate. Urban manufacturing centers need then to compensate for the falling number of workers.

The SFSA SPI program is supporting a range of projects and investments to facilitate members automation and modernization. Our challenge has been the poor profitability of our industry. Policy makers attribute our low profitability to our inefficiency and poor business practice. As noted in prior Casteel Commentaries, our profitability is not primarily the result of our poor performance but is an artifact of our national public policy. Our excess capacity plus trade plus tax policy plus regulatory compliance plus mandatory reporting all result in a burden of operating in the U.S. of 25 to 40%. Our investment in capital equipment-machinery is between 1.5 and 3% of sales compared to 3 to 5% prior to 1980. Surviving steel foundries are going to need to improve profitability and we should have that opportunity when the demand necessary to maintain our economy and infrastructure finally exceeds our production capability.

Automation will be necessary given the change in demographics and technology. One clear need for each plant is to form a group of capable employees, identify some small pilot projects and start. Successful automation is almost always driven by the operating people who understand the requirements and details with support from suppliers or tech schools to understand the equipment.

Modernization will require an analysis of the customers and parts that achieve the necessary profitability to make the investment. Clearly this requires a market demand, a capable plant, and the ability to efficiently produce. Finding the customers and parts is essential. Trimming the current customer list may be necessary to focus on work profitable enough to invest for the future.

Modernization should already be planned out with the core investments not only in equipment but also plant layout.

Innovation is different than modernization and requires a willingness to develop new processes and products that go beyond current practices. It is useful to make some small investments on crazy ideas that could make dramatic changes if they work. Innovation should be possible as sensors and chips become increasingly affordable and more capable. Innovation should come not from the IT folks but from operating experts who see new ways of using this capability to change the way we do business.

Raymond

| STEEL FOUNDERS' SOCIETY OF AMERICA BUSINESS REPORT | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| SFSA Trend Cards (%-12 mos. Ago) | 12 Mo Avg | 3 Mo Avg | March | February | January | |||||

| Carbon & Low Alloy | ||||||||||

| Shipments | -1.1 | 0.3 | -5 | 2 | 3.9 | |||||

| Bookings | -6.8 | -7 | -9 | -12 | 0 | |||||

| Backlog (wks) | 10.3 | 10.2 | 8.5 | 10 | 12 | |||||

| High Alloy | ||||||||||

| Shipments | -0.7 | -5 | -18 | 5 | -2 | |||||

| Bookings | -6.6 | -2.2 | -0.5 | -3 | -3 | |||||

| Backlog (wks) | 9.7 | 9.5 | 10 | 9 | 9.5 | |||||

| Department of Commerce Census Data | ||||||||||

| Iron & Steel Foundries (million $) | ||||||||||

| Shipments | 1,629.80 | 1,602.00 | 1,579 | 1,595 | 1,632 | |||||

| New Orders | 1,671.80 | 1,629.70 | 1,688 | 1,631 | 1,570 | |||||

| Inventories | 3,184.10 | 3,202.70 | 3,220 | 3,206 | 3,182 | |||||

| Nondefense Capital Goods (billion $) | ||||||||||

| Shipments | 82.1 | 80.6 | 80.3 | 81.8 | 79.8 | |||||

| New Orders | 91.8 | 83.8 | 87.5 | 83 | 80.9 | |||||

| Inventories | 227.4 | 230 | 230.5 | 230 | 229.6 | |||||

| Nondefense Capital Goods less Aircraft (billion $) | ||||||||||

| Shipments | 74.2 | 74.5 | 74.3 | 74.3 | 74.8 | |||||

| New Orders | 73.7 | 73.6 | 73.8 | 73.7 | 73.4 | |||||

| Inventories | 162.5 | 163 | 162.9 | 162.8 | 163.1 | |||||

| Inventory/Orders | 2.2 | 2.2 | 2.21 | 2.21 | 2.22 | |||||

| Inventory/Shipments | 0 | 2.2 | 2.19 | 2.19 | 2.18 | |||||

| Orders/Shipments | 0 | 1 | 0.99 | 0.99 | 0.98 | |||||

| American Iron and Steel Institute | ||||||||||

| Raw Steel Shipments (million net tons) | 7.4 | 7.3 | 7.3 | 7.1 | 7.4 | |||||