This month’s Casteel Commentary discusses possible effects of the war in Ukraine on the supply of raw materials.

Table of Contents

Research Highlight

There are 2 new research projects starting under the SPI program.

Cal Poly Pomona is investigating the use of cryogenic heat treatment (HT) to improve strength of duplex stainless steels, particularly Grade 1B and 1C, while maintaining ductility and corrosion resistance. The addition of a tempering cycle to the cryogenic HT will also be evaluated. The project will characterize the influence of cryogenic HT on the microstructure and understand the mechanisms behind the strength improvement, if any. Hardness and tensile testing will be done and select samples will be characterized microstructurally. Appropriate corrosion test method is still being identified.

Lehigh University is evaluating if CF and CN stainless steel grades can be welded without post weld heat treatment (PWHT) which will enable welding after final machining and possibly the use of weld-in or flangeless valves that can be welded in the field. Past research by Carl Lundin showed that low carbon and adding nitrogen in CF grades improves properties and minimized sensitization. The project will investigate how alloy composition and welding heat input influence the mechanical properties and susceptibility to sensitization in order to identify casting alloys and welding conditions in which PWHT is not needed. ASTM A262 Practice C was initially selected to detect all modes of intergranular corrosion (chromium carbide, sigma phase, and end-grain). Additional tests may also be considered.

We are currently looking for test material for these projects. If you are interested in providing material or if you have any suggestions or questions, please contact Diana David, ddavid@sfsa.org .

Specification Committee Meeting

Today we face the challenge of a loss of tribal knowledge plus a short-handed workforce at both steel foundries making castings and OEMs designing and using steel castings. This knowledge gap, due to the aging workforce and limited technical resources, makes it more difficult to educate a new generation workforce, risking the loss of a critical capability. SFSA has successfully developed a program to provide the tools and data needed for today’s designers and users to exploit steel castings. As the program progresses, it will be important to transition technologies in areas such as design, Quantitative Nondestructive Testing (QNDT), and welding best practices into commercial specifications and codes to enable largescale use, and to provide training resources for a new generation of artisans, engineers, and buyers. SFSA is actively involved in American Society for Testing and Materials (ASTM), International Organization for Standardization (ISO), Boiler and Pressure Vessel Code (BPVC), American Welding Standard (AWS), and American Petroleum Institute (API). The specification bodies foster collaborative development of commercial standards, which SFSA will work with to transition technologies into new or existing standards. These efforts are led by our Specification Committee, which will meet on May 17th in Seattle, WA. For more information, please contact Dave, poweleit@sfsa.org.

Next Generation Manufacturing (NGM)

SFSA continues to work with ISU, UNI, EWI and SwRI on our three Next Generation Manufacturing (NGM) focus categories: Smart Automation (job shop steel foundry manufacturing), Smart Data (machine learning and IoT), and ARtisan (Augmented Reality work instructions, training, and video for AI/IoT). ISU and UNI led a hands-on workshop at the T&O with members able to experience the ease of programming cobots and application of sensor technology. The SFSA/UNI Sensor Collective is kicking off projects at nine member foundries with UNI tailoring a sensor package to the specific needs of the foundry. Many of these will focus on getting started with Smart Data, but one of the projects will work to address the valuable need of real-time iron oxide measurements. Knowing your iron oxide levels is important to producing good castings, and it follows Goldilocks – not too little and not too much, but just right. The challenge is there is currently no solution for real-time measurements in the foundry. Through the collective, we will identify which sensors/controllers work best for steel foundry needs; develop guidance for getting started and acquire, display and analyze data; and create references such as open-source code, drivers, or other reference libraries. For more information, please contact Dave, poweleit@sfsa.org.

Market News

These are certainly interesting times. While business activity across the steel casting markets remains strong, the Russian invasion of Ukraine has introduced new challenges for the industry in terms of supply and price volatility of commodities like nickel. This coupled with existing supply and labor shortages and inflation, has created a challenging environment to manage costs and production.

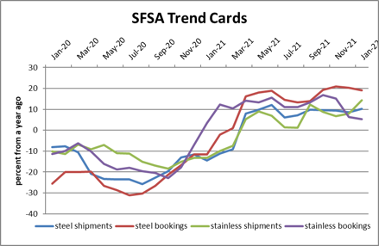

The January SFSA Trends report set a record high backlog for both carbon and low alloy and high alloy steels at 16.5 and 16 respectively. This is 3 weeks higher than the previous high set in January 2012, with data going back to January 2006. Steel casting bookings are holding around 20% over year ago levels and stainless bookings continue to trend downward close to parity over year ago levels.

Regarding overall markets and US economy, ITR is currently maintaining their forecast of slowing growth for most manufacturing markets. However, there are many unknowns at this time, such as the length and trajectory of the war, that may have a significant impact to the business cycles of various markets.

Casteel Commentary

War. The volatility expected in last month’s commentary arrived with the outbreak of war in Ukraine. The economic expectation of globalization bringing Pax Economica, the end of national conflict and wars is an illusion. (https://www.google.com/books/edition/Pax_Economica_Freedom_of_International_)

Trade like war, “War is the continuation of policy with other means” was understood by our peer competitors as policy, not markets. (https://en.wikipedia.org/wiki/Carl_von_Clausewitz)

Russia has a small economy and is not a factor in most economic areas but has two assets that make them influential. Their nuclear arsenal makes them a force to be reckoned with even with the dismal performance of their military so far in this conflict. The threat of using a tactical nuclear weapon is significant.

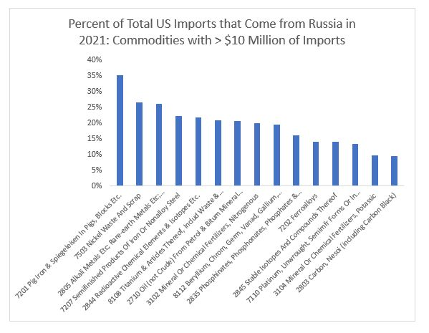

Russia is also a major supplier of basic industrial materials. Many of these materials are used in steel casting production. Pig iron, nickel, chromium are all supplied by Russia as shown below.

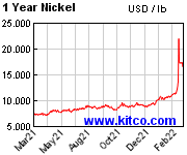

As seen above, nickel is particularly affected by Russia being cut off as a supplier in the world economy. While speculation and bad economic futures bets drove nickel out of sight earlier, the price remains high. With the ongoing interest in electrification and the dependence on nickel of current lithium battery technology, the demand for nickel was already expected to grow dramatically. The removal of Russia from the supply chain will exacerbate this challenge. Russia will likely supply China and so this would mitigate the impact.

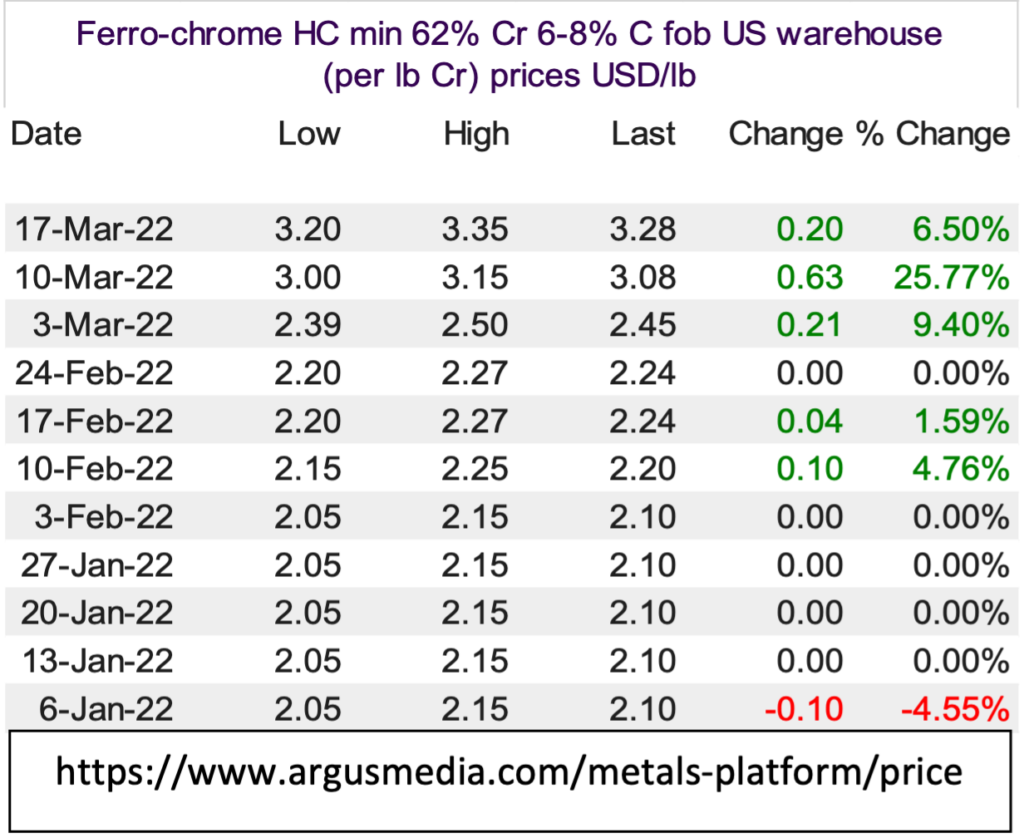

Chrome prices have also risen with the conflict. Chrome is a smaller factor since Russia is a less important source for this material.

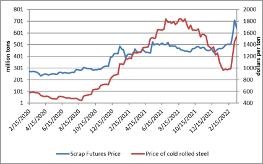

Steel product costs and scrap prices have risen as Russia pig iron and slabs are no longer available. This can be seen in the weekly numbers for prices in the graph.

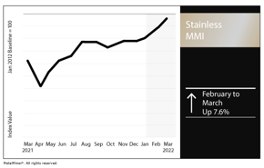

Nickel remains the biggest issue and will likely remain at elevated pricing levels for a while. Pricing for stainless mill products has been rising as seen and is likely to continue to climb.

These dramatic price increases on alloys and scrap are on top of an accelerating inflation on energy, labor and other costs of production. It is critical for our industry to carefully manage or costs and market strategies to remain profitable and adjust to the full cost of production.

Raymond

| STEEL FOUNDERS' SOCIETY OF AMERICA | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| STEEL FOUNDERS' SOCIETY OF AMERICA | ||||||||||

| BUSINESS REPORT | ||||||||||

| SFSA Trend Cards (%-12 mos. Ago) | 12 Mo Avg | 3 Mo Avg | January | December | November | |||||

| Carbon & Low Alloy | ||||||||||

| Shipments | 8.5 | 10.3 | 8 | 14.9 | 8 | |||||

| Bookings | 17.3 | 19 | 25 | 12 | 20 | |||||

| Backlog (wks) | 10.5 | 14.8 | 16.5 | 14 | 14 | |||||

| High Alloy | ||||||||||

| Shipments | 7.4 | 14.3 | 10 | 27.8 | 5 | |||||

| Bookings | 11.8 | 5.3 | 11 | -4.9 | 9.7 | |||||

| Backlog (wks) | 11.1 | 13.4 | 16 | 12.2 | 12 | |||||

| Department of Commerce Census Data | ||||||||||

| Iron & Steel Foundries (million $) | ||||||||||

| Shipments | 1,330.80 | 1,421.30 | 1,437 | 1,432 | 1,395 | |||||

| New Orders | 1,464.60 | 1,574.30 | 1,513 | 1,709 | 1,501 | |||||

| Inventories | 2,380.70 | 2,492.00 | 2,488 | 2,517 | 2,471 | |||||

| Nondefense Capital Goods (billion $) | ||||||||||

| Shipments | 79.4 | 82.5 | 84 | 82.3 | 81.1 | |||||

| New Orders | 86 | 93.2 | 97.1 | 93.1 | 89.5 | |||||

| Inventories | 201.5 | 207.4 | 208.1 | 207.7 | 206.3 | |||||

| Nondefense Capital Goods less Aircraft (billion $) | ||||||||||

| Shipments | 74.7 | 77.7 | 79.1 | 77.6 | 76.3 | |||||

| New Orders | 76.9 | 79.5 | 80.1 | 79.3 | 79 | |||||

| Inventories | 135.7 | 141.8 | 143 | 142 | 140.3 | |||||

| Inventory/Orders | 1.8 | 1.8 | 1.78 | 1.79 | 1.78 | |||||

| Inventory/Shipments | 0 | 1.8 | 1.81 | 1.83 | 1.84 | |||||

| Orders/Shipments | 0 | 1 | 1.01 | 1.02 | 1.03 | |||||

| American Iron and Steel Institute | ||||||||||

| Raw Steel Shipments (million net tons) | 7.9 | 7.8 | 7.8 | 7.9 | 7.9 | |||||