Hiring the right people is most critical to our future. With a limited potential workforce, few potential employees and many potential employers, we will need to engage young people with our vision of meaningful important work in a community that cares and collaborates that needs their contribution. Before we are able to recruit, we must engage them with our vision and culture to evangelize them into our team…

Table of Contents

Research Review, July 9-11

Please make your plans to participate in the annual SFSA Research Review on July 9th-11th. This year’s meeting will be held in-person in Rosemont, IL. The Review covers the latest in both Carbon & Low Alloy and High Alloy steel casting research under the DID, ICT, SPI, and STAR programs. The meeting is also your opportunity to interact with the researchers and provide industry steering. The event vets our research portfolio to select the R&D projects to be featured at the National T&O. More details regarding registration and the Design Day are to come. For any questions, contact Caelan Kennedy (ckennedy@sfsa.org).

Registration is required and must be completed by June 27th, Tuesday: https://sfsa.site-ym.com/event/researchreview24. Hotel information can be found on the registration page. The hotel reservation cutoff is June 17th.

Similar to previous years, we request you consider inviting a handful of key contacts at your customer or even a potential customer for the Design Day on July 9th. A separate registration link is provided for non-members here:https://www.surveymonkey.com/r/VWMF5LQ

CA6NM Heat Treating Study

SFSA is looking for as-cast CA6NM material to support a new project at Missouri S&T. Mario Buchely is evaluating the critical heat treating temperatures for CA6NM: what factors are most important and how much do the critical temperatures change. Missouri S&T is beginning with modeling and dilatometry, and would like industrially produced material to experiment with. If you have some material on hand, or are pouring CA6NM in the near future, and would like to participate please send a note to Caelan Kennedy at ckennedy@sfsa.org.

Making Steel Castings webinar

Led by SFSA alumni George Hartay, Steve Gear, and Tim Hays, this member webinar series brings forward past concepts from Wlodawer’s book, “Directional Solidification of Steel Castings” while linking it to today’s simulation technology to provide a core understanding of the trade-offs that can be made in making steel castings. If you miss one or want to watch ahead, they can be viewed on the wiki webinar page.

Part 1:

- Introduction to the topic and panelists.

- Limitations of simulation and why it is important to look at a casting as a whole as all of the steel that goes into a mold (part cavity and rigging) will be affected by the directional solidification of the steel. This topic also stressed three other key items: the effects of variation, reality v. modeling (get out to the shop floor and get data), and “making steel castings” is much more beyond just rigging with many factors playing into the total cost of a casting.

Part 2:

- What is rigging – terminology, history and how this series will focus on sand casting

- Casting engineering – who is it, what this is and what you need to know

Members will be sent a link to register for Part 3, which will cover an introduction to Wlodawer, and the influence of shape and dimensions on solidification. Please email Dave comments or questions. Also, Wlodawer’s “Directional Solidification of Steel Castings” can be purchased as an eBook.

Halligan Bar Auction

It’s time for the annual FEF auction! This year, the Halligan Bars from the 6th Annual Cast in Steel competition, held by SFSA, will be auctioned off.

The auction runs from June 17th – July 1st. Bids can be made for any of the available bars with the high bidder receiving the bar corresponding to their winning bid. The minimum bid is $125.00. All the funds raised will go to the schools that participated in the competition to support their scholarship funding.

To find more information about the bars, and to make your bid, on the bar of your choice, please click here or go to the FEF website (www.fefinc.org).

The winner of the 2024 Cast in Steel competition was Pittsburgh State (pictured above). Their bar will not be auctioned off.

We hope you have fun and take advantage of this unique opportunity to own an original FEF student casting. Help us support our FEF schools – bid high and bid often!

If interested, auction winners may also want to consider loaning or donating the bar back to the school for enjoyment & encouragement of future generations.

Steel Founders’ Society Foundation Scholarships

Recruiting students to join our industry and grow into leadership positions remains a critical need in the steel casting industry and a strategic initiative of the Society. The Steel Founders’ Society Foundation remains devoted to helping members by encouraging companies to hire student interns. We want to recognize these student interns at our SFSA National T&O Conference.

New this year…the Foundation is offering $2000 scholarships to interns that have worked at a SFSA member foundry during 2024!.

- The Schumo Scholarship was established in memory of Robert M. Schumo, a former president of SFSA and Pennsylvania Electric Steel, in recognition of his generous gift to SFSA that formed the basis of the Foundation.

- The Peaslee Scholarship was established by the SFSA Board in honor of the late Dr. Kent Peaslee, the Chair of Steelmaking Technology and Curators’ Teaching Professor of metallurgical engineering at Missouri University of Science and Technology.

The intern should be responsible for a particular project and not simply used as an extra pair of hands during their employment with the company. To qualify for the Peaslee Scholarship, the intern’s project must be in the area of melting or refining.

The scholarships are competitive. Each applicant is required to submit a paper and PowerPoint presentation on a project they have completed during their employment. The submissions will be judged by the SFSA Scholarship Selection Committee. Committee members are individuals who have held both technical and operating positions and who have served within other SFSA committees.

To apply for the scholarships, each intern must submit a paper and presentation to Renee Mueller, rmueller@sfsa.org, by August 16, 2024. Before submitting to SFSA, the paper and presentation must be reviewed and approved by the intern’s supervisor. The winners of the scholarships must present at the SFSA National T&O Conference in Chicago on December 13, 2024.

For any questions, please contact Renee Mueller, rmueller@sfsa.org, (815)-770-2925.

For those students that are interested in other available scholarships, please visit:

American Foundry Society (AFS) Association for Iron and Steel Technology (AIST)

Scholarship funds are to by the student to pay for qualified education expenses as defined by the Internal Revenue Service.

Fall Leadership Meeting

Mark your calendars to attend the Fall Leadership Meeting on September 20-23, 2024, at the Fairmont Banff Springs in Banff, Alberta, Canada.

This year’s business sessions will include:

- Economic and Global Update, Lauren Saidel-Baker, ITR

- From Washington to Your Workplace – Strategies for Business Leaders, Gene Marks, The Marks Group

- Building an Industrial Workforce for Young People, David Hataj, Craftsman With Character

- State of the Steel Casting Industry, Raymond Monroe, SFSA

- Industry roundtable

- SFSA market forecast

- Invited: Kelly Visconti, Deputy Director, Department of Energy Office of Manufacturing and Energy Supply Chains

Registration is now open. A reduced rate has been established for first time attendees, spouses, and SFSA Alumni.

SFSA Steel Casting Design & Manufacturing Engineering Videos 11 & 12 Now Available

Mike Gwyn completed the 1th and 12 video of the Steel Casting Design Series and SFSA has posted them to the Steel wiki along with a shareable link for customers.

Design Video 11: Prototyping New Steel Casting Designs Part 1: What to Accomplish and Why. This episode is Part 1 of a 2-Part series addressing a steel casting producer’s challenge of launching new business… the launch of a customer’s new design. These two episodes profess the rarely used, but undeniably efficient use of “Immediate Prototyping.”

In the zeal to realize the new business from a new design’s launch, it is tempting to assume a new steel casting is similar to what is done every day… business as usual. But, business as usual today came with a lot of grief, cost, and delays yesterday, and those difficulties have faded from memory over time.

Instead, tooling up quickly and temporarily for “Immediate Prototypes” with today’s solid model-based technologies enables discovery of all the new casting’s manufacturing issues. Then, those issues don’t get wrapped up in production tooling that was built too soon and expensive and time-consuming to fix.

Design Video 12: Prototyping New Steel Casting Designs; Part 2: The Power of Additive Manufacturing to Enable Prototyping Quickly. Part 2 addresses the need for and ability of “Immediate” when applying the power of Additive (and Subtractive) manufacturing processes. Because of the continuing expansion of the breadth and depth of Additive Manufacturing processes and materials, “Immediate” really is not confined to prototype tooling. Rather, and even more powerfully, the capability has become “Immediate Prototype Mold Cavities.” After all, it is the steel casting prototype mold cavity, whether made in sand or investment ceramic, that is needed quickly and that can be revised quickly.

This Episode 12 includes a brief overview of the Additive and Subtractive processes directly applicable to making “Immediate Prototype Mold Cavities,” including examples of how dimensional and solidification integrity compliance can be accomplished quicker and more reliably. There is a concluding segment explaining how “Immediate Prototyping” can demonstrate capability in producing more as-cast surfaces in final steel casting net shape. More net shape as-cast surfaces and less machining can enable a steel casting producer to be more price competitive while retaining better margins.

Market News

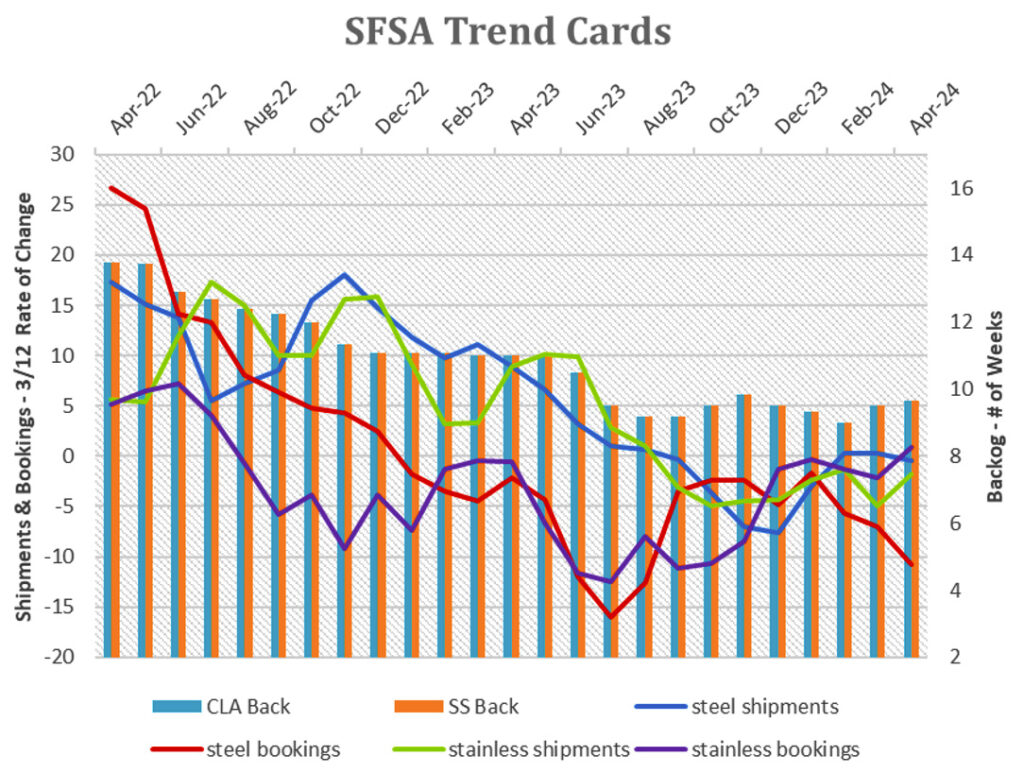

The SFSA Trends Report for April shows YoY steel casting bookings have continued to decline that started in January while steel casting shipments remain at parity to year ago levels. YoY stainless bookings have outpaced shipments for the past two months and are slightly higher than year ago levels for the first time since July ’22. Steel and stainless backlogs are still well below year ago levels but trending up slightly. The YoY for carbon and low alloy steel is -18% and stainless is -12%.

In the next 3 months, nearly 50% of members anticipate their business bookings to remain flat and 30% anticipate a decrease. For the same time frame, 70% of member respondents are forecasting a stable size workforce with the remaining responses split at 15% each between expand and downsize.

ITR forecasts in the June Trends Report that US Industrial Production is anticipated to reach a plateau this year, leaning slightly downward. The latest data indicates this trend, with results dipping just below last year’s levels. However, the prevailing evidence indicates that production is unlikely to experience a significant decline. Factors such as government spending and nearshoring trends are expected to bolster investment in the market.

Within the industrial production landscape, different sectors are poised for varied outcomes. Industries associated with renewable energy, high technology, and non-discretionary consumer spending are expected to excel, outperforming discretionary markets and sectors vulnerable to high interest rates, such as heavy-duty trucks or construction machinery.

Casteel Commentary

One of the best periods in the steel casting industry was in the 1970s when the demand for castings often exceeded our capacity. Inflation and increasing interest rates during a major effort to build the industrial base to grow, modernize our economy, and win the Cold War resulted in a capital boom that build our existing infrastructure. The need to both produce the needed products for the economy and the equipment to expand production led to a dramatic build out requiring steel castings. Purchasers of steel castings during this time had to collaborate with foundries to have access to the castings they needed.

Steel casting production in the U.S. was over 2.1 million tons in 1968, at 2.039 million tons in 1979 and fell to 0.729 in 1985. In 1980 the industry had 358 plants with 80,885 employees. By 2020 we had 155 plants with 14,883 employees and made an estimated 0.795 million tons. Since 1990, our industry has lost 38% of the reported capacity.

During the period from 1980 to 2004, the drop in demand and employment created a different set of market conditions. Prior, during the boom, profitability was limited by through put that was limited by supplies, workers and plant capacity. Businesses depended on suppliers and collaborated to maximize value. After the 1980 and the boom, the excess capacity and existing workforce made steel casting businesses difficult to operate profitably. Prices were no longer reflective of the need for profitability and continuous investment to modernize but were more determined by cash flow and the need to operate the plant in the black. The excess capacity made pricing near the cost of production and reduced the ability to gain the profitability to maintain or reinvest. Customers used the excess capacity to push pricing down to the cost of manufacturing. Relentless pressure on pricing was possible because there were plenty of other suppliers anxious for the business.

Manufacturing jobs during the boom were seen as desirable jobs with stability, good wages and benefits. Even with stagflation, manufacturing for capital goods, steel casting markets, benefited from the investment in capital equipment and infrastructure needed for modernization.

From 1980 to 2004, the price for steel castings was low enough that the industry did not fully recover the cost of the excess capacity installed. Price stability meant our casting value was eroded by inflation. Survival meant aggressive management to reduce costs and improve productivity. The final liquidation of the excess capacity in 1999 to 2003 was expected to result in sharply increased prices and profitability that would create the capital for reinvestment and modernization.

Globalizations, trade policy, deindustrialization and continuous increases in regulatory costs weighted on steel casting producers limiting the profitability and the ability to invest. Lack of investment in basic infrastructure and global competitors made domestic customers able to continue to have leverage on pricing, limiting profitability. Most customers continued to see that there were plenty of potential suppliers and expected to gain leverage with market forces by having alternative suppliers to North American producers after the volatile pricing environment from 1980 until today. There were brief blasts of capacity limitations that created some periods of better profitability. There remain occasions where a particular customer will accommodate and support investment in the plant to increase production and improve quality for critical cast components with current suppliers. But most of the large institutional buyers still believe that there is an active market with an excess number of producers who would replace their existing suppliers if they were unwilling, unable or too costly.

With the hollowing out of the domestic steel casting industry and the need and plans to dramatically invest in infrastructure and manufacturing in North America, our industry is already seen as a supply chain vulnerability. The need for profitability adequate to justify modernization, automation and innovation should be reflected in the collaboration between our suppliers, us and our customers.

I expect this crunch to happen in less than five years. Smart medium and small customers are already sensitive to the need for collaboration to have a stable supply base that is able to invest to remain capable for future demands. We could easily see a sea change in attitude where purchasing refocuses on finding the best suppliers and partnering with them to ensure that they have the resources to be reliable. Institutions and companies that fail to recognize the need for successful suppliers rather than the low-cost provider may be unable to find the products they need to be successful.

Manufacturing is underrated and design is overrated. Elon Musk September 2021

I expect us to see our manufacturing economy that has survived on sunk investments in infrastructure and manufacturing to need to grapple with this reality that will change the way we do business. Manufacturing will become as critical as performance for success.

We though face the same challenge in recruiting the next generation of employees. We have the notion that young people are looking for a job to get be able to get married, have a family, buy a house and grow up. Like our customers who assume that the market has plenty of suppliers and that their task is to find the low-cost alternative, we think that there are a number of potential employees and that we need to find the most capable to hire.

Like Musk’s quote about the challenge of manufacturing being more critical than the design, hiring the right people is most critical to our future. With a limited potential workforce, few potential employees and many potential employers, we will need to engage young people with our vision of meaningful important work in a community that cares and collaborates that needs their contribution. Before we are able to recruit, we must engage them with our vision and culture to evangelize them into our team.

Raymond

| STEEL FOUNDERS' SOCIETY OF AMERICA BUSINESS REPORT | #colspsan# | #colspsan# | #colspsan# | #colspsan# | #colspsan# |

|---|---|---|---|---|---|

| SFSA Trend Cards (%-12 mos. Ago) | 12 Mo Avg | 3 Mo Avg | April | March | February |

| Carbon & Low Alloy | #colspsan# | #colspsan# | #colspsan# | #colspsan# | #colspsan# |

| Shipments | -1.5 | -0.4 | 1.8 | -5 | 2 |

| Bookings | -7.7 | -10.8 | -11.5 | -9 | -12 |

| Backlog (wks.) | 10.3 | 9.8 | 11 | 8.5 | 10 |

| High Alloy | #colspsan# | #colspsan# | #colspsan# | #colspsan# | #colspsan# |

| Shipments | -1.6 | -1.8 | 7.5 | -18 | 5 |

| Bookings | -5.7 | 0.8 | 6 | -0.5 | -3 |

| Backlog (wks.) | 9.5 | 9.7 | 10 | 10 | 9 |

| Department of Commerce Census Data | #colspsan# | #colspsan# | #colspsan# | #colspsan# | #colspsan# |

| Iron & Steel Foundries (million $) | #colspsan# | #colspsan# | #colspsan# | #colspsan# | #colspsan# |

| Shipments | 1,635.70 | 1,633.70 | 1,690 | 1,603 | 1,608 |

| New Orders | 1,675.10 | 1,684.70 | 1,758 | 1,709 | 1,587 |

| Inventories | 3,189.70 | 3,201.70 | 3,186 | 3,216 | 3,203 |

| Nondefense Capital Goods (billion $) | #colspsan# | #colspsan# | #colspsan# | #colspsan# | #colspsan# |

| Shipments | 82.2 | 81.2 | 82 | 80.2 | 81.4 |

| New Orders | 92 | 86 | 85.4 | 86.9 | 85.8 |

| Inventories | 227.9 | 230.7 | 231.4 | 230.7 | 230 |

| Nondefense Capital Goods less Aircraft (billion $) | #colspsan# | #colspsan# | #colspsan# | #colspsan# | #colspsan# |

| Shipments | 74.2 | 74.3 | 74.4 | 74.1 | 74.4 |

| New Orders | 73.7 | 73.9 | 73.9 | 73.8 | 73.9 |

| Inventories | 162.6 | 162.9 | 163 | 162.8 | 162.8 |

| Inventory/Orders | 2.2 | 2.2 | 2.2 | 2.21 | 2.2 |

| Inventory/Shipments | 0 | 2.2 | 2.19 | 2.2 | 2.19 |

| Orders/Shipments | 0 | 1 | 0.99 | 1 | 0.99 |

| American Iron and Steel Institute | #colspsan# | #colspsan# | #colspsan# | #colspsan# | #colspsan# |

| Raw Steel Shipments (million net tons) | 7.4 | 7.3 | 7.4 | 7.3 | 7.1 |