Table of Contents

79th Technical & Operating Conference

The T&O this past December was another success thanks to the authors, workshop presenters and T&O Committee. With an incredible 66 papers presented by many member foundries represented at the conference, it was a tremendous opportunity to work together in advancing our industry. We all benefit from foundry members, academic and industry partners, and government personnel who came together to make our industry better. Planning is already underway for this year’s conference; tentatively scheduled for December 9-12 in Chicago. If you would like to recommend a topic and presenter for the 80th T&O, please contact Dave.

NGM and FL Meeting

Please save the date for our first 2026 Next Gen Mfg and Future Leaders meeting. It’ll be,in March in Pittsburgh, PA and include a focus on automation with a demonstration of job shop robot grinding plus a foundry tour. Details will be sent to members in the next couple of weeks. Please contact Dave with any questions.

Shrinkage & Cold Shut Class

Tom Stevens will provide a Spanish-translated class on shrinkage and cold shuts in Guadalajara, Mexico February 18-19. Topics include: casting engineering, solidification, shrinkage, cold shut, chemical analysis and problem solving. Space is limited and attendance will be on a first come, first served basis. Please contact Dave with any questions or to register. A series of subject-focused classes are being planned for this year in the US. Further details will be emailed to members and included in future Casteel Reporters.

Research Review, July 7-9

Please make your plans to participate in the annual SFSA Research Review on July 7-9. This year’s meeting will be held in-person in Rosemont, IL. The Review covers the latest in both Carbon & Low Alloy and High Alloy steel casting research under the AMC and STAR programs. The meeting is also your opportunity to interact with the researchers and provide industry steering. The event vets our research portfolio to select the R&D projects to be featured at the National T&O. More details regarding registration and the Design Day are to come. For any questions, contact Caelan Kennedy (ckennedy@sfsa.org).

Additional Keel Bars Needed

To support the development of the SFSA carbon & low alloy atlas, we are looking for additional standard keel block legs:

- 1010, 1035, 1045

- 4330, 4340

- 4120, 4130, 4140

- Any carbon level for the 13XX, 46XX, or 51XX alloy families

SFSA is developing a carbon & low alloy atlas to show the effect of alloying elements and heat treating on the mechanical properties and microstructure of low alloy steels. As-cast and bars from same heat would be preferred, and if you can pour at least 10 from the same heat that is even better. Heat chemistry or mechanicals would be appreciated, but not required. Please contact Caelan (ckennedy@sfsa.org) or Tory (tory@sfsa.org) for shipping details.

Cast in Steel Competition

We’re excited to share that 66 teams have signed up for this year’s Cast in Steel competition.

The Horsemen’s Axes will be on display during the MetalCasting Congress at the DeVos Convention Center, 303 Monroe Ave. NW, Grand Rapids, MI, in the Chase Board Room (2nd Floor) on Tuesday, April 14 and Wednesday, April 15, from 9:00 a.m. to 4:00 p.m.

The Cast in Steel TV series competition will take place at Grand Valley State University’s Innovation Design Center, 227 Winter Ave. NW, just a short walk from the convention center, on Thursday, April 16 and Friday, April 17. Exact times will be announced once finalized. Below are the teams along with their foundry partners. A heartfelt thank you to the foundries that have taken the time to support these students and help them achieve their goals. Hats off to you!

| UNIVERSITY | FOUNDRY NAME | ||

|---|---|---|---|

| Arizona State University | TBD | ||

| Arkansas State University | Southern Cast Products | ||

| Baylor University | Delta Centrifugal | ||

| California Polytechnic State University, Pomona (2 teams) | Soundcast Co. | ||

| California State Polytechnic University, Pomona | Aerotec | ||

| California State Polytechnic University, Pomona | Miller Foundry | ||

| Central Michigan University (2 teams) | Bay Cast Inc | ||

| Colorado School of Mines (2 teams) | Western Foundries | ||

| Ecole Nationale Supérieure D'Arts Et Métiers Campus de Cluny | Safe Metal | ||

| ESFF - Ecole Supérieure de Fonderie et de Forge | Ferry-Capitain | ||

| Ferris State University | Eagle Alloy, Inc. | ||

| Georgia Southern University | Georgia Southern University, N/A | ||

| Georgia Southern University (5 teams) | Carolina Metal Casting | ||

| Grand Valley State University (2 teams) | Eagle Alloy | ||

| Herron School of Art and Design, IU Indianapolis | Harrison Steel Castings Company | ||

| Instituto Tecnológico de Morelia | Fundidora Morelia | ||

| Instituto Tecnológico de Morelia | Acerlan Matrix Metals S.A. de C.V. | ||

| Kevin Dukes Career and Innovation Academy | TBD | ||

| Louisiana Tech University | Howell Foundry | ||

| Michigan Technological University | Bay Cast Inc | ||

| Michigan Technological University | Temperform | ||

| Michigan Technological University | Aalberts Surface Technologies | ||

| Minnesota State College Southeast | Midwest Metal Products | ||

| Mississippi State University | TBD | ||

| Missouri University of Science and Technology | Missouri University of Science & Technology | ||

| Missouri University of Science and Technology | Caterpillar | ||

| Missouri University of Science and Technology | TBD | ||

| Penn State Behrend | TBD | ||

| Pittsburg State University | Monett Metals | ||

| Purdue University | Kimura Foundry America | ||

| Purdue University WL | Waupaca Foundry, Plant 5 | ||

| Rose-Hulman Institute of Technology | Harrison Steel Casting Company | ||

| Tennessee Tech University | TBD | ||

| Texas State University (3 teams) | Henderson Manufacturing Co. | ||

| The Ohio State University | Fisher Cast Steel | ||

| The University of Alabama | Southern Alloy | ||

| Trine University | Bahr Brothers Manufacturing | ||

| Universidad Autonoma De Nuevo Leon | Fundiciones Lerma S.A de C.V | ||

| University of Alabama at Birmingham | TBD | ||

| University of Hawaii at Manoa | TBD | ||

| University of Northern Iowa | UNI Metal Casting Center & Factory 4.0 Center | ||

| University of Northern Iowa | TBD | ||

| University of Tennessee-Knoxville (2 Teams) | Magotteaux | ||

| University of Wisconsin - Madison | MetalTek | ||

| University of Wisconsin - Milwaukee (3 teams) | MetalTek | ||

| University of Wisconsin Platteville | Metaltek International | ||

| University of Wisconsin-Madison | Signicast | ||

| Virginia Tech | Midwest Metals | ||

| Wentworth Institute of Technology (3 teams) | DW Clark | ||

| Youngstown State University (2 teams) | Trumbull Foundry and Alloy |

If your foundry is interested in partnering with a team to cast their axe for the 2026 competition, please reach out to Renee rmueller@sfsa.org.

For full competition details, click HERE.

Casting Dreams Competition

This year is shaping up to be an amazing year for Casting Dreams. We have already connected with over 200 students through eight exciting events, and the momentum continues with eight more events scheduled in February. With these upcoming opportunities, we are on track to reach 100 more students and inspire the next generation.

Be sure to stop by the MetalCasting Expo at the DeVos Convention Center, 303 Monroe Ave. NW, Grand Rapids, Michigan, to see all the finalists for the National Competition. The National Competition Awards will be held on Wednesday, April 15, and we will share the exact time as soon as it is finalized. We hope to see you there!

Market News

ITR reported that most core economic indicators have moved into an accelerating growth phase, signaling improving momentum despite residual caution following 2025. Employment remains a lagging indicator but is expected to strengthen later in 2026 as business confidence improves.

The Federal Reserve’s annual revision to Industrial Production data shows activity remains approximately 2.6 percent below prior record highs, prompting an updated outlook. Growth expectations for 2025–26 are largely unchanged, with modest acceleration anticipated into mid-to-late 2026, followed by a flatter and more uneven 2027 depending on end markets. Industrial production is expected to trend higher through at least 2028, with pockets of softness emerging in 2027.

Manufacturing trends are increasingly divergent. Durable goods are expected to outperform nondurable goods in 2026. The Federal Reserve’s revisions affected production data but not Census Bureau new orders, with heavy trucks and medical equipment seeing the largest adjustments. Many manufacturing sectors are positioned for growth in 2026, though a softer environment is anticipated in 2027. High-tech manufacturing and related services continue to present the strongest opportunities, while several legacy manufacturing sectors continue to lag. For more detailed information on what lies ahead for the steel casting industry markets, the SFSA 2026 Market Forecast, updated in December by the Marketing Committee, is available online here.

Awards

Safety award for achievement of a Perfect Safety Record with 2024 zero DART rate: ME Global-Tempe, MetalTek – Wisconsin Investcast and Viking Pump.

Safety awards for achievement of a DART rate equal to or less than the national average for manufacturing (1.8): Caterpillar Ramos Arizpe, Eagle Alloy, Fimex, Fundicion Talleres, Magotteaux – Pulaski, ME Global – Duluth, and Vulcan Metals – Tacoma.

The SFSA Board selected six individuals to receive honorary membership in SFSA for their contributions to further the society and the steel casting industry – Joe Plunger, Midwest Metal Products; Bill Reinsel, Andritz; Billy Bobbitt, Southern Alloy; Gloria Webber, Temperform.

SFSA also awarded two members posthumously to honor their legacy – Brian Hudson, ME Global and Mike Porfilio – Stainless foundry & Engineering.

Brian Hudson served on the T&O Committee, supported research, authored T&O papers and had a wealth of foundry knowledge that he was willing to share. The award was presented to his father, Mike.

Mike Porfilio served on the T&O Committee, hosted a range of foundry tours, authored T&O papers and worked to educate others on steel casting. The award was presented to his wife Lisa and sons Sam and Nicholas.

Scholarships

Steel Founders’ Society Foundation scholarships awarded to member interns selected to present at the T&O: Hanna Blake, Harrison Steel; Bryson Duff, Harrison Steel; Josiah Pyles, Howell Foundry; Madison Sauers, Ashland Foundry; Nathan Willcutt, Eagle Alloy.

SFSA Business Report

| STEEL FOUNDERS' SOCIETY OF AMERICA BUSINESS REPORT | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 12 Mo Avg | 3 Mo Avg | October | September | August | ||||||

| Department of Commerce Census Data | ||||||||||

| Iron & Steel Foundries (million $) | ||||||||||

| Shipments | 1,778.80 | 1,857.00 | 1,899 | 1,846 | 1,826 | |||||

| New Orders | 1,791.20 | 1,894.70 | 1,899 | 1,864 | 1,921 | |||||

| Inventories | 3,299.50 | 3,273.00 | 3,272 | 3,282 | 3,265 | |||||

| Nondefense Capital Goods (billion $) | ||||||||||

| Shipments | 87.5 | 89.4 | 90.5 | 88.5 | 89.3 | |||||

| New Orders | 95.4 | 92.8 | 89.8 | 93.9 | 94.8 | |||||

| Inventories | 246.2 | 247.9 | 247.8 | 247.2 | 248.8 | |||||

| Nondefense Capital Goods less Aircraft (billion $) | ||||||||||

| Shipments | 75.8 | 77.1 | 77.8 | 77.2 | 76.3 | |||||

| New Orders | 76 | 77.5 | 78 | 77.6 | 76.8 | |||||

| Inventories | 179.4 | 184 | 184.6 | 184.2 | 183.3 | |||||

| Inventory/Orders | 2.3 | 2.4 | 2.37 | 2.37 | 2.39 | |||||

| Inventory/Shipments | 0.0 | 2.4 | 2.37 | 2.39 | 2.4 | |||||

| Orders/Shipments | 0.0 | 1.0 | 1.00 | 1.00 | 1.01 | |||||

| American Iron and Steel Institute | ||||||||||

| Raw Steel Shipments (million net tons) | 7.6 | 7.8 | 7.7 | 8.0 | 7.8 | |||||

Casteel Commentary

Reviewing my thoughts for 2025:

- 2024-The market value of equities in the major markets is near historic highs compared to their sales. In 2025, the market value went to unprecedented higher levels of valuation. Economic conditions look favorable to a strong year and our anticipation of steady demand for steel castings could be either dramatically pessimistic or optimistic.

This was a miss on my part as the market piddles along without strong growth or sharp downturn. Valuations for new technology like AI remain a promise supporting valuations unprecedented in the history of the stock market.

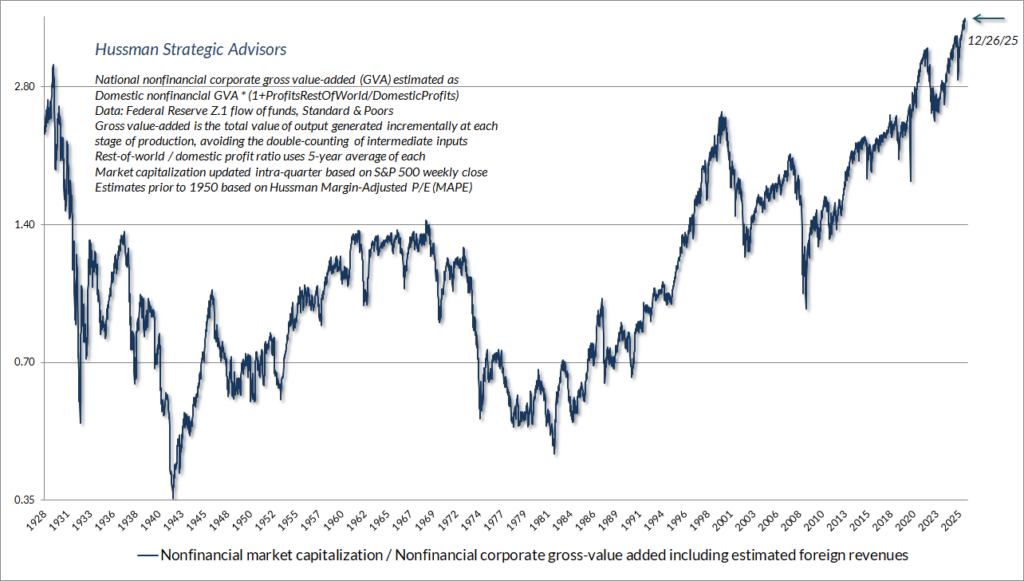

The graph shows the “Price” of the stock market compared to it ability to create “value”, The market remains at or above any prior public market values. This remains true even as the growth of our economy continues to slow, falling from 5% in 1960 to near 2% in 2025.

Our industry was essential to the investments and growth in years until 1980 but has continued to see slow declines in economic growth due both to declining a number of new workers and lack of investment. Post 1980, public policy limited the profitability of capital-intensive industries and global supply chains with other regions with lower costs had lower prices and gained global market share. It was challenging not only for us but also for our suppliers and customers. Tariffs on steel mill products did alleviate some of the problem for steel producers but contributed to the erosion of demand by penalizing the customers that need steel.

- 2024- The de-industrialization of the U.S. economy over the past 4 decades is finally and fundamentally problematic. 2025- The continued closure of additional steel foundries has exacerbated the underlying systemic vulnerability of our industry’s capacity and capability. We are likely to see vertical integration as aggressive manufacturing investments in North America grapple with the need to improve their products by integrated design, build and test following the SpaceX model.

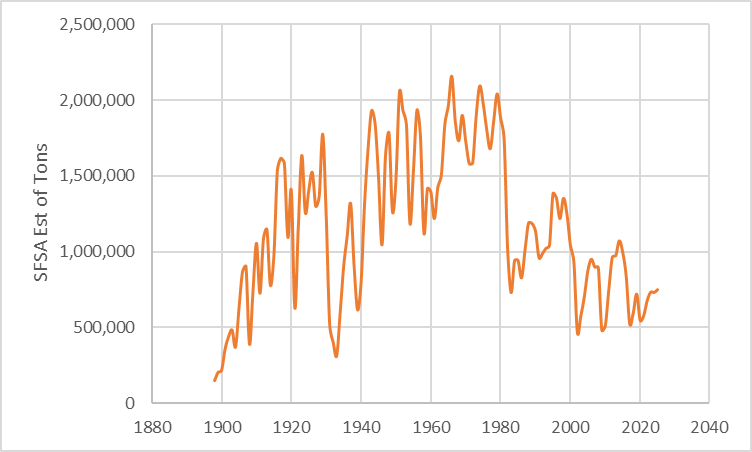

2025 failed to change this dynamic and has resulted in continued closures of steel foundries in North America. The current number of steel foundry sand casting operations fell from 230 to around 140. As seen in the appendix, the capacity has fallen by almost 800,000 tons.

Part of the dramatic drop post 1980 was due to the cyclical investment to build the infrastructure for our current economy in the post WWII era. Much of the highway, manufacturing, urban infrastructure was created in the boom from 1940 to 1980. Post 1980, capital intensive industries not only suffered from excess capacity, but public policies also that taxed and regulated us, limited our ability to operate profitably. Cultural and policy frameworks encouraged developing global supply chains that would allow our economy to shift to advanced manufacturing, neglecting industries like ours that remain essential to economic and national security.

The lack of profitability and the loss of domestic customers and suppliers will pose a challenge as we reindustrialize to rebuild and expand our infrastructure. In particular, the need for dramatic investments in electrical production and distribution, construction and operating expanded manufacturing and producing large, needed equipment for national and economic security like ship building is problematic. The comments from last year remain true but premature.

In looking ahead, it would be good to try to identify metrics that give insight into the likely business environment in 2026. Prior to 2004, the situation seemed understandable. The excess investment in capital equipment production for the infrastructure build during the 60’s and 70’s was being liquidated as our industry failed to recover the excess investment in lower profitability. This was exacerbated in the 90’s as OEM dominant firms used their global presence to pursue lower costs without regard to the health of their domestic suppliers.

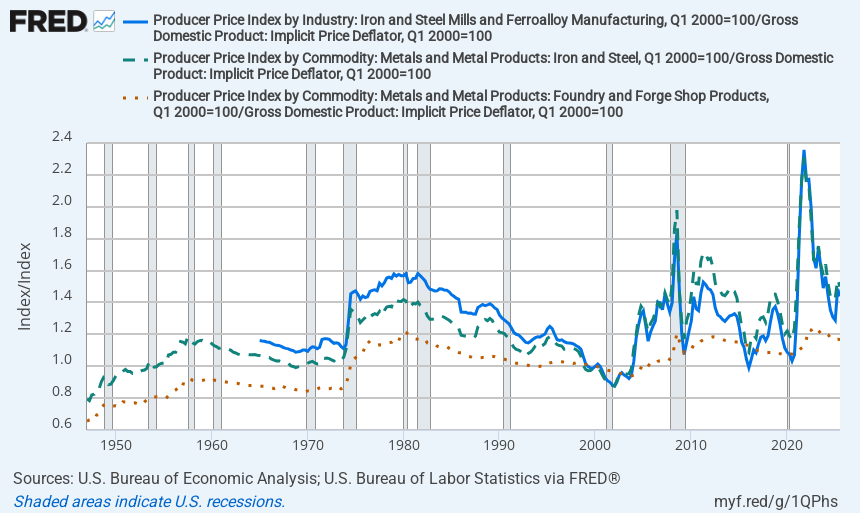

The graph in Figure 2 shows the increasing instability of our fiscal and monetary system. Pre-1972, the gold standard was in place and prices remained relatively stable throughout the economic cycle. Capital investments were long term, and depreciation taxed the life value of these investments. Post-1972, volatility increased with rising interest rates and inflation through 1982 incentivizing capital infrastructure investment. Values of assets rising and costs of borrowing declining with inflation encourages pulling forward investment. When the cycle ended with excess investment both in infrastructure and production capacity, investment dropped, and prices eroded. It seemed that when this excess investment was liquidated in time, a new cycle of re-investment and modernization would occur. The liquidation of 1999 to 2022 and the demand from global growth can be seen in the sharp uptick in value in 2004 for steel products.

Two unexpected things though limited the reinvestment in North America, the high cost of the economic externalities imposed on our regional economy by legacy commercial practices and public policy and the desire of global dominant firms to invest in suppliers and production in developing economies, primarily China. The abandonment of traditional constraints on debt, monetary policy, and regulatory practices for the financial industry has resulted in dramatically enhanced volatility. The support of the financial institutions during the housing collapse in 2009 and Covid in 2020 resulted in dramatic increases in financial support that is seen in the dramatic volatility in pricing of steel mill product.

Steel Foundries saw less volatility and less price realization. The longer lead times and more value added diluted more dramatic price shift for castings. It is clear that our industry has not seen pricing that allows the profitability we need to invest and innovate.

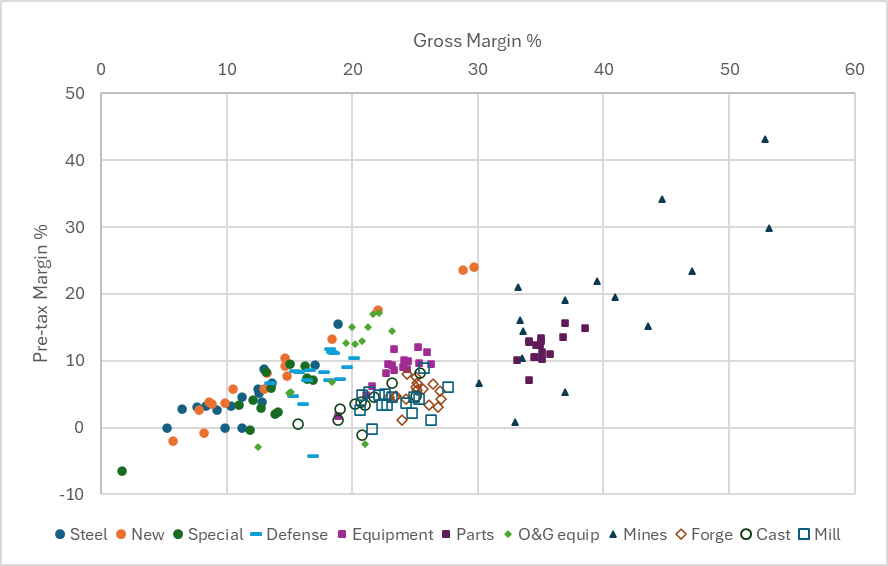

In Figure 3, the recent profitability of the industry shows the challenge we face. The recent SFSA survey has suggested changes to policy that may be helpful. How can we anticipate what may happen throughout 2026?

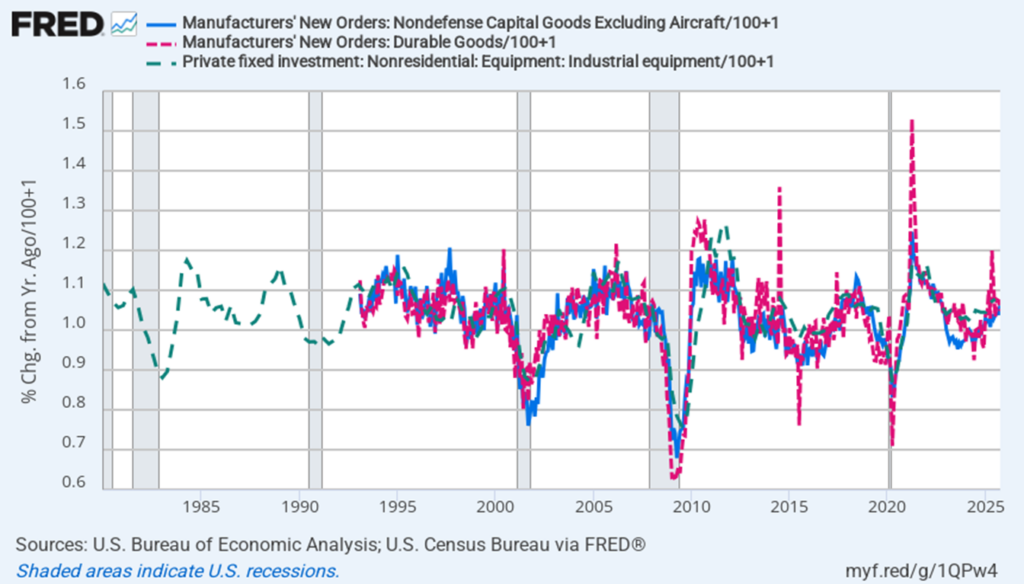

In Figure 4, the new orders indicators are out monthly and are highly correlated with steel casting sales and production annually. SFSA also tracks weekly number and the production of steel reported is a leading indicator for steel casting shipments.

So for 2026, what is likely to be our markets. The safe and likely answer is we keep kicking the financial and investments needed down the road. Deglobalization, aging infrastructure, new requirements for electrical power and national security are recognized needs but the current government and corporate budgets and policies have not changed enough to support significant increases in business.

It’s possible that with erratic leadership, instability in the world and financial volatility that we have a crisis like Covid that disrupts us and causes significant slowing of the economy and reduces our production.

More likely though is a steady but continuous rise in demand as our smaller industry is called upon to support the typical annual needs for consumables and replacement equipment and the need for more.

As an industry and as our smaller size results in limited capability, we need to find customers who recognize their need for us as capable partners like it was during the last build up in the 70s. We will need customers committed to have us profitable enough to provide their needs. We will need to be able to invest, modernize and automate to meet their requirements and production needs. Those resources must come from our customers from our sales. Our industry will need to see a cultural change that results in new commercial arrangements that recognize the need for our products.

Our challenge will be to show ourselves capable and find customers who recognize their need for us and establish long term relationships that make us all capable and profitable.

Raymond

Appendix – Steel Foundry Closures since 2000

| Company | Annual capacity (tons) | Year closed |

|---|---|---|

| American Foundry Group | 5000 | 2025 |

| POK | 4800 | 2025 |

| Sivyer Steel | 24000 | 2024 |

| Quality Electric | 12000 | 2024 |

| Esco Portland | 14400 | 2023 |

| Columbia Steel | 18000 | 2023 |

| Frog Switch | 18000 | 2022 |

| Goltra Casting | 3600 | 2021 |

| Talladega Castings | 4200 | 2021 |

| Barber Steel | 3600 | 2019 |

| Pacific Steel | 44000 | 2019 |

| Castwell | 240 | 2019 |

| Hazelton Casting | 1200 | 2019 |

| Penberthy | 960 | 2017 |

| Northern Steel | 5000 | 2017 |

| Columbus Steel Castings | 110000 | 2017 |

| Delray Steel Casting, Inc. | 4800 | 2017 |

| McConway & Torley Kutztown | 24000 | 2017 |

| Falk Corporation | 12912 | 2017 |

| Hendrix Manufacturing Company, Inc. | 4800 | 2017 |

| IIT Industries, Inc | 120 | 2017 |

| Marengo Valve & Foundry Corporation | 600 | 2017 |

| Michigan Steel, Inc. | 6000 | 2017 |

| Vancouver Iron & Steel, Inc. | 4200 | 2017 |

| Vancouver Iron & Steel, Inc. | 3360 | 2017 |

| American Industrial Casting | 540 | 2017 |

| Cast-Rite Steel Castings | 720 | 2017 |

| Amite | 12000 | 2016 |

| Flowserve | 3600 | 2016 |

| Esco Portland | 48000 | 2016 |

| May Foundry | 4800 | 2016 |

| Bradken-Atlas Chehalis | 2040 | 2015 |

| Precision Metalsmiths - Cleveland | 1020 | 2015 |

| Johnstown | 6000 | 2013 |

| Ancast, Inc. | 720 | 2012 |

| American Centrifugal | 7200 | 2011 |

| Cicero Casting Company | 30000 | 2010 |

| Richmond | 16800 | 2010 |

| Bartels Co. | 6000 | 2010 |

| Smith Steel Texas | 4800 | 2010 |

| Reliance Foundry Company, Ltd. | 2880 | 2010 |

| Ferralloy, Inc. | 2040 | 2010 |

| Casteel Service, Inc. | 1800 | 2010 |

| Midwest Metallurgical Laboratory, Inc. | 1800 | 2010 |

| Independent Steel Castings Co., Inc. | 720 | 2010 |

| Alloy Cast Products, Inc. | 360 | 2010 |

| Carolina Casting Corporation | 360 | 2010 |

| Shogun Precision Castings, Inc. | 300 | 2010 |

| Casting Technology, Inc. | 48 | 2010 |

| Funk Finecast | 1080 | 2010 |

| Western | 3600 | 2010 |

| Empire | 4800 | 2006 |

| Penncast | 1200 | 2006 |

| Berne | 9600 | 2004 |

| St Louis Sterling | 1560 | 2004 |

| Hiler | 1200 | 2004 |

| Durametal Tuallatin | 1200 | 2004 |

| Independent | 720 | 2004 |

| Nadler | 720 | 2004 |

| Gold | 240 | 2004 |

| Kramer | 700 | 2003 |

| Grede Milwaukee | 22800 | 2003 |

| Texas Steel Ft. Worth | 20400 | 2003 |

| Racine Milwaukee | 18000 | 2003 |

| Thomas Birmingham | 8400 | 2003 |

| K O San Antonio | 7500 | 2003 |

| Quaker Myerstown | 6000 | 2003 |

| Missouri Steel | 6000 | 2003 |

| WCC Dayton | 4800 | 2003 |

| Electric Indianapolis | 3900 | 2003 |

| Western Seattle | 3600 | 2003 |

| Westlectric | 3600 | 2003 |

| U S Castings Canal | 3000 | 2003 |

| St Louis Sauget | 2400 | 2003 |

| BCI | 2280 | 2003 |

| Castmasters | 1200 | 2003 |

| Specialty | 720 | 2003 |

| Big 4 | 600 | 2003 |

| Process metals | 240 | 2003 |

| B&S | 240 | 2003 |

| Aelco | 5400 | 2003 |

| ASF East Chicago | 24000 | 2002 |

| Claremont | 9600 | 2002 |

| Penn Steel | 3300 | 2002 |

| Beloit | 3600 | 2002 |

| ABC NACO Anderson | 5400 | 2002 |

| ABC NACO Melrose | 24000 | 2002 |

| ABC NACO Dominion | 24000 | 2002 |

| McConway Anniston | 6000 | 2002 |

| Durametal Tualatin | 1200 | 2002 |

| Pelton | 8400 | 2002 |

| Newell | 9600 | 2002 |

| Flow Technology | 1320 | 2002 |

| Metso | 8400 | 2002 |

| Sulzer | 480 | 2002 |

| Smith | 4800 | 2002 |

| Racine | 18000 | 2002 |

| Process Metals | 240 | 2002 |

| Joy | 4000 | 2000 |

| Electro-Alloy | 4000 | 2000 |

| Total Capacity Closed Annual tons | 792,380 |