It’s the time of year when Raymond rustles up a new set of predictions for how the coming year is going to go. Read on for more…

Table of Contents

Cast in Steel 2025 Competition

Time is ticking! Don’t miss your chance to join the 2025 SFSA Cast In Steel (CIS) competition—sign up your team today!

This year, teams will create their own version of one of George Washington’s swords, taking it from design concept to performance. Mark your calendars! The performance competition and awards ceremony will be held from April 9-12, 2025, in Atlanta, Georgia.

As of January 1st, we already have 47 teams ready to compete.

| UNIVERSITY NAME | FOUNDRY PARTNER |

|---|---|

| Arizona State University | ME West Global |

| Baylor University | Tonkawa Foundry |

| California Polytechnic State University, San Luis Obispo | American Casting Company |

| California State Polytechnic University, Pomona | Miller Casting Inc |

| California State Polytechnic University, Pomona (2 Teams) | SoundCast |

| California State Polytechnic University, Pomona | Aerotec Alloys, Inc. |

| Central Michigan University | Bay Cast Inc. |

| Colorado School of Mines | Western Foundries |

| École nationale supérieure d'arts et métiers | Safe Metal |

| Georgia Southern University | Georgia Southern University |

| Georgia Southern University (2 Teams) | Carolina Metal Casting |

| Grand Valley State University (2 Teams) | Eagle Alloy |

| Instituto Tecnológico de Morelia | ACERLAN MATRIX METALS SA DE CV |

| Instituto Tecnológico de Morelia | Fundidora Morelia |

| Instituto Tecnológico de Saltillo (2 Teams) | FAE |

| Iowa State University | TBD |

| Michigan Technological University (2 Teams) | Temperform |

| Michigan Technological University | Caterpillar |

| Missouri University of Science and Technology | Caterpillar |

| Pennsylvania State University - Erie, The Behrend College | Ashland Foundry |

| Pittsburg State University | Monett Metals |

| Purdue University- West Lafayette (2 Teams) | Kimura Foundry |

| Saint Martin's University | Gil's Foundry & Manufacturing |

| Tennessee Technological University (2 Teams) | Magotteaux Inc |

| Texas State University (2 Teams) | Henderson Manufacturing Company |

| Trine University | Bahr Brothers Mfg. |

| University of Alabama (3 Teams) | Southern Alloy Corporation |

| University of Alabama at Birmingham | Pinson Valley Heat Treating |

| University of California, Irvine | Soundcast |

| University of Dayton | Skuld LLC |

| University of Northern Iowa | TBD |

| University of Wisconsin-Madison | MetalTek International |

| Virginia Tech | Dominion Metallurgical |

| Virginia Tech | Midwest Metal Products |

| Wentworth Institute of Technology | Consolidated Precision Products |

| Wentworth Institute of Technology | DWCLARK |

| Youngstown State University | Trumbull Metals |

78th Technical & Operating Conference

The T&O this past December was another success thanks to the authors, workshop presenters and T&O Committee. With an incredible 70 papers presented by many member foundries represented at the conference, it was a tremendous opportunity to work together in advancing our industry. To foster this collaborative spirit, the T&O committee is sharing the Robert G. Shepherd Best Paper “Melting Furnace Practice and Benchmarking” by John Cory, Magotteaux. We all benefit from foundry members, academic and industry partners, and government personnel who come together to make our industry better. Planning is already underway for this year’s conference; tentatively scheduled for December 10-13 in Chicago. If you would like to recommend a topic and presenter for the 79th T&O, please contact Dave.

Awards

Safety award for achievement of a Perfect Safety Record with 2023 zero DART rate: Bradken Tacoma and Northern Stainless.

Safety awards for achievement of a DART rate equal to or less than the 2022 national average for manufacturing (2.0): Caterpillar Ramos Arizpe, Eagle Alloy, Fimex, Magotteaux – Pulaski, ME Global – Duluth, MetalTek – Wisconsin Centrifugal, POK, PRL, Southern Alloy, Stainless Foundry.

The SFSA Board selected six individuals to receive honorary membership in SFSA for their contributions to further the society and the steel casting industry – Paul Enders, MetalTek-WC; Dave Fazakerley, Eagle Alloy; Jorge Okhuysen, formerly POK; Jeff Slaughter, formerly ACIPCO and Southern Alloy; Joe Korff, Quaker City; Sam Sahu, formerly Waukesha; and Jim Snowden, Southern Alloy.

Scholarships

Steel Founders’ Society Foundation scholarships awarded to member interns selected to present at the T&O: Ryan Bergeman, MetalTek – Wisconsin Centrifugal and Jonathan Thompson, Harrison Steel.

Mold Wash Working Group

Mold wash is a significant driver of surface quality for many steel castings, but can also led to quality issues if the wash itself is not well understood and controlled. From the evening discussion session at the 2024 T&O conference, there is a clear need for a collaborative evaluation of mold washes and how to effectively use them. Because of this, a working group is being developed to address common issues with mold washes, working toward the following goals:

- Perform trials to look at foundry conditions (such as types of binder/wash) and trials to look at factors (such as thickness, application, etc.)

- Develop a quality control method for washes

- Identify or develop a best method for measuring wash coat dryness

- Develop general best practices

- Explore new wash materials, methods, and opportunities

This group is open to all members, and anyone with interest in improving mold washes and procedures is encouraged to join! To join, please email Tory Wendlandt (tory@sfsa.org) and check out the group’s SFSA Wiki Page to be kept up-to-date as the group begins.

Steel Casting Metallurgy Seminar

SFSA will be “piloting” introductory metallurgy training targeted for interested engineers without metallurgy backgrounds, or metallurgists with a few years of experience in the industry. The seminar will be led by faculty of the Advanced Steel Processing and Products Research Center at Colorado School of Mines, who have complimentary expertise in steel design, microstructure development and heat treatment, solidification and welding, and mechanical testing and performance.

Planned topics: 1) introduction to physical metallurgy, 2) principles of melting and solidification, 3) phase diagrams, heat treatment and microstructure, 4) mechanical properties and performance, and 5) welding. The seminar will be March 19-20 and registration limited. Additional details emailed to members.

Research Review, July 8-10

Please make your plans to participate in the annual SFSA Research Review on July 8-10. This year’s meeting will be held in-person in Rosemont, IL. The Review covers the latest in both Carbon & Low Alloy and High Alloy steel casting research under the AMC and STAR programs. The meeting is also your opportunity to interact with the researchers and provide industry steering. The event vets our research portfolio to select the R&D projects to be featured at the National T&O. More details regarding registration and the Design Day are to come. For any questions, contact Caelan Kennedy (ckennedy@sfsa.org).

Market News

The November SFSA trends showed YoY steel casting bookings at 5% below year ago levels but trending upward since September. Steel casting shipments have remained below year ago levels since March 2024. Stainless bookings and shipments dipped just below year ago levels. Carbon and low alloy steel and stainless backlogs trended downward to -14.53% and -13.56% YoY respectively.

ITR reported that the manufacturing sector is expected to generally rise this year as consumer financial positions improve and nearshoring trends persist. Decline will linger into the middle of the year for some segments such as construction machinery and heavy truck production, but these segments will turn upward in the second half of this year. Growth in many of the manufacturing markets will be strongest from late 2025 through mid-2026. Accordingly, they lowered their forecast for US Construction Machinery New Orders. For more detailed information on what lies ahead for the steel casting industry markets, the SFSA 2025 Market Forecast, updated in December by the Marketing Committee, is available online here.

| STEEL FOUNDERS' SOCIETY OF AMERICA BUSINESS REPORT | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| SFSA Trend Cards (%-12 mos. Ago) | 12 Mo Avg | 3 Mo Avg | November | October | September | |||||

| Carbon & Low Alloy | ||||||||||

| Shipments | -4.2 | -9.3 | -8 | -10 | -10 | |||||

| Bookings | -7.5 | -5.3 | -3 | 0 | -13 | |||||

| Backlog (wks) | 9.5 | 8.6 | 8.3 | 9.2 | 8.3 | |||||

| High Alloy | ||||||||||

| Shipments | -0.7 | -1 | 5 | -6 | -2 | |||||

| Bookings | 0.2 | -1 | -16 | 3 | 10 | |||||

| Backlog (wks) | 9.2 | 8.5 | 7.5 | 8 | 10 | |||||

| Department of Commerce Census Data | ||||||||||

| Iron & Steel Foundries (million $) | ||||||||||

| Shipments | 1,652.50 | 1,675.30 | 1,704 | 1,646 | 1,676 | |||||

| New Orders | 1,685.20 | 1,735.30 | 1,821 | 1,703 | 1,682 | |||||

| Inventories | 3,252.90 | 3,375.30 | 3,375 | 3,370 | 3,381 | |||||

| Nondefense Capital Goods (billion $) | ||||||||||

| Shipments | 83.2 | 83.2 | 82.1 | 82.8 | 84.6 | |||||

| New Orders | 85.8 | 86.5 | 86.9 | 87.6 | 85 | |||||

| Inventories | 231.3 | 231.5 | 232 | 230.8 | 231.7 | |||||

| Nondefense Capital Goods less Aircraft (billion $) | ||||||||||

| Shipments | 74 | 73.8 | 74 | 73.8 | 73.5 | |||||

| New Orders | 73.7 | 73.9 | 74.1 | 73.8 | 73.9 | |||||

| Inventories | 163.1 | 163.3 | 163.6 | 163.3 | 163.2 | |||||

| Inventory/Orders | 2.2 | 2.2 | 2.21 | 2.21 | 2.21 | |||||

| Inventory/Shipments | 0 | 2.2 | 2.21 | 2.21 | 2.22 | |||||

| Orders/Shipments | 0 | 1 | 1 | 1 | 1 | |||||

| American Iron and Steel Institute | ||||||||||

| Raw Steel Shipments | 7.2 | 6.9 | 6.7 | 7 | 7.1 | |||||

Casteel Commentary

My Ideas for 2024 revisited and thoughts on 2025 for the our Steel Foundry Industry:

As a result of the COVID shortages, the U.S. has been officially grappling with the concerns about the industrial capacity to provide us with economic and national security. Several segments identified as potential vulnerabilities and needed future capabilities depend fundamentally on a healthy and capable steel casting industry. SFSA has been deeply involved in discussing with DoD and DoE what path forward would allow our industry to invest profitably to support national and economic security.

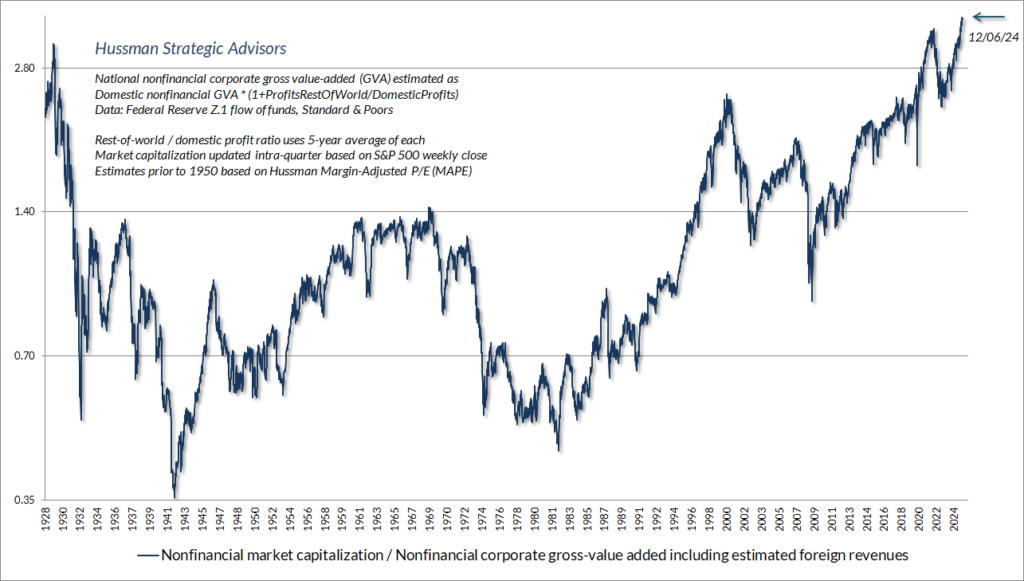

- 2024-The market value of equities in the major markets is near historic highs compared to their sales. 2025- The market value went to unprecedented higher levels of valuation. Economic conditions look favorable to a strong year and our anticipation of steady demand for steel castings could be either dramatically pessimistic or optimistic.

Here is the update of the graph showing the ratio of market capitalization to the total gross value added. This is a rough analog to the market value of the company compared to the annual sales. Hussman has used this to indicate whether on an historic basis, equities- the value of the companies are inexpensive or expensive. A value of one is common for the value of companies in normal conditions. In a detailed regression analysis, when this ratio is one, the total return on the S&P 500 in excess of Treasury bonds for the next 12 years is about 10%. The analysis suggests that at the current ratio of over 3, the average loss for the following 12 years would be 11%. A 11% loss compared to bonds, not a gain. (https://www.hussmanfunds.com/comment/mc250107/)

Last year I thought that the equity markets were likely to see some sharp losses or little in the way of gains for the next year. The markets instead saw a sharp increase that moved valuations compared to growth or sales to the highest levels every. Almost all of the excessive valuations are sunk into the dominant growth companies called the Magnificent Seven. We will eventually see a return to valuations commensurate with sales and profits, but we have not yet.

I expect financial concerns to weigh on the market as realism returns and investors expect some return on their money.

- 2024- The de-industrialization of the U.S. economy over the past 4 decades is finally and fundamentally problematic. 2025- The continued closure of additional steel foundries has exacerbated the underlying systemic vulnerability of our industry’s capacity and capability. We are likely to see vertical integration as aggressive manufacturing investments in North America grapple with the need to improve their products by integrated design, build and test following the SpaceX model.

Our industry has become so limited that I think even with a significant economic event that will challenge us for a short period, our production will not be able to meet the demand. We will be needed just to keep the lights on. Because of this, I expect us to be in a period when the foundry will be selecting which customers to supply rather than what business to chase.

This market shift will be similar to the challenge we face in workforce. Instead of young people anxious to find a job and we get to select the best candidates, the shortage of workers means that they will be recruited by more than one company and get to choose who they want to work for.

- 2024/2025 Our gross profit level for decades as an industry has been inadequate to reinvest including modernization, automation and innovation. This is a huge problem of public policy and I have been increasingly drawn into discussions at DoE and DoD about this challenge. The lack of capacity will likely give us an opportunity to increase our level of profitability. We need to recognize like the machine shops that our profitability must be adequate to maintain and reinvest to be capable of future success.

Our biggest challenge in 2024/2025 will be to achieve a profitability that allows us to re-capitalize the business and modernize and automate to meet the challenge of national and economic security. We are needed if we are to have stability and future growth.

The graph compares for publicly traded companies their price to book and price to sales. Traded companies have a market capitalization that is the current price to buy the company. This is often too low as can be seen when a takeover like Nippon’s effort to buy USS offers a substantial higher price than the current market stock price. Integrated steel mills throughout the world are prices below their book value. Specialty steel producers are more valued. Systemic profitability is the key factor in company value. Steel foundries are typically more profitable than steel mills but less than specialty producers. But due to a lack of profitability in North America, we continue to lose plants to closure in all these categories. On the graph I pit the steel foundries at PB of 2 and PS as 1. This has been a good first cut at plant value where the investor want the ROI to be twice the ROS.

Raymond

| STEEL FOUNDERS' SOCIETY OF AMERICA BUSINESS REPORT | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| SFSA Trend Cards (%-12 mos. Ago) | 12 Mo Avg | 3 Mo Avg | August | July | June | |||||

| Carbon & Low Alloy | ||||||||||

| Shipments | -3.6 | -6.1 | -3.1 | -5 | -10.3 | |||||

| Bookings | -6.7 | -10.8 | -15 | -10.4 | -7 | |||||

| Backlog (wks) | 9.9 | 9.3 | 9 | 10 | 9 | |||||

| High Alloy | ||||||||||

| Shipments | -1.6 | 2.7 | 5 | 3 | 0 | |||||

| Bookings | -1.7 | 0.7 | 2 | 0 | 0 | |||||

| Backlog (wks) | 9.5 | 9.3 | 9 | 10 | 9 | |||||

| Department of Commerce Census Data | ||||||||||

| Iron & Steel Foundries (million $) | ||||||||||

| Shipments | 1,648.50 | 1,639.30 | 1,609 | 1,650 | 1,659 | |||||

| New Orders | 1,680.80 | 1,616.70 | 1,606 | 1,637 | 1,607 | |||||

| Inventories | 3,213.00 | 3,231.70 | 3,263 | 3,223 | 3,209 | |||||

| Nondefense Capital Goods (billion $) | ||||||||||

| Shipments | 83.2 | 87.8 | 88.1 | 89.7 | 85.6 | |||||

| New Orders | 88.5 | 82.7 | 91 | 92.1 | 64.9 | |||||

| Inventories | 230.2 | 232.5 | 232.9 | 232.4 | 232.2 | |||||

| Nondefense Capital Goods less Aircraft (billion $) | ||||||||||

| Shipments | 74.1 | 73.7 | 73.6 | 73.7 | 73.9 | |||||

| New Orders | 73.7 | 73.6 | 73.7 | 73.5 | 73.7 | |||||

| Inventories | 163 | 163.2 | 163.4 | 163.1 | 163 | |||||

| Inventory/Orders | 2.2 | 2.2 | 2.22 | 2.22 | 2.21 | |||||

| Inventory/Shipments | 0 | 2.2 | 2.22 | 2.21 | 2.21 | |||||

| Orders/Shipments | 0 | 1 | 1 | 1 | 1 | |||||

| American Iron and Steel Institute | ||||||||||

| Raw Steel Shipments (million net tons) | 7.3 | 7.2 | 7.3 | 7.2 | 7.2 | |||||