This month’s commentary reviews Raymond’s predictions for 2022, and includes new ones for this year.

Table of Contents

76th Technical & Operating Conference

The T&O this past December was another success thanks to the authors, workshop presenters and T&O Committee. With most of the 58 papers presented by industry and the majority of member foundries represented at the conference, it was a tremendous opportunity to work together in advancing our industry. We all benefit from foundry members, academic partners, and government personnel who come together to make our industry better. Planning is already underway for this year’s conference; tentatively scheduled for December 6-9 in Chicago. If you would like to recommend a topic and presenter for the 77th T&O, please contact Dave.

Awards

Service citations recognize the completion of terms for board members and chairs of the society’s committees and groups that have invested time and energy to make these functions beneficial for members: Jeff Cook – Eagle Alloy.

Steel Casting Research

Each month, the Casteel Reporter highlights some of SFSA’s research. SFSA members have an opportunity to help direct our research projects and can obtain an early benefit from current R&D. Members can also propose new, non-competitive research ideas to SFSA’s research committees. To sponsor a project or submit a research project, please contact Dave.

This month, we highlight our research on Advanced High Strength Steels (AHSS). This work will improve quality and decrease the production time of high-performance steels, which in turn improves manufacturability and enables a responsive supply chain to produce these alloys. Historically, composition and heat treatment were broad and made manufacturing and reliable performance achievable. Microalloying, specialized heat treatment cycles and even grain boundary engineering offer new opportunities for steel. Achieving properties in heavy sections, resolving hydrogen issues, and developing practices for welding and machining are also considerations in advanced steels development. High performance steels provide weldable, tough, and affordable alternatives to aerospace aluminum or titanium. The following projects support this thrust:

- Fe-Containing Multi-Principal Element Alloys for Protective Structures – Colorado School of Mines

- Advancing Low Alloy High Performance Steels – Colorado School of Mines

- Weldability of Fe-10Ni as a Robust Replacement for Filler Metals Used in Naval Structures – Lehigh University

- Optimization of Current HY Steels – QuesTek

- HSLA 150 Development – QuesTek

- Effects of Microalloying Additions on the Microstructure and Performance of HY Steels – University of Maryland

SFSA utilizes a R&D project dashboard to provide an overview and status on activities. To learn more about the above projects, the dashboards are available here. For any additional information, please contact Dave.

5th Steel Casting Design Video Now Available

Mike Gwyn completed the 5th video of the Steel Casting Design Series and SFSA has posted it to the Steel wiki along with a shareable link for customers. Episode 5 in the SFSA Casting Design & Manufacturing Engineering webinar series addresses the problems and solutions for thickness differences in the mold cavity interior regions. Interior thickness differences result from junctions of shapes. An example would be a wall from the casting’s exterior joining a cylindrical boss in the middle of the mold cavity. Sometimes the thicker section is functional, like a boss for a fastener or bearing. Often it is increased thickness for resisting stress structurally. If a junction with more thickness occurs along the perimeter of a steel casting design, there is no problem. A riser can easily be attached to the perimeter to feed the additional thickness. However, in the mold’s interior, feeding that thickness is not so easy. How to resolve that difficulty in both the OEM’s design geometry and the producer’s tooling design is the subject, and it is necessary for successful Castability Geometry.

The next design video titled ‘Process Dominated Castability Geometry’ will be released in February 2023.

Cast in Steel 2023

Last chance to sign up your team for the 2023 SFSA Cast In Steel (CIS) competition. Get your team together today!

Teams will create an African Spear Point exploiting the casting manufacturing process from design conception to performance. The performance competition and awards ceremony will be held during the AFS Metalcasting Congress in Cleveland, Ohio on April 24-25, 2023.

If your foundry is interest in partnering with a team, contact Raymond at monroe@sfsa.org or Renee at rmueller@sfsa.org.

Recruiting the Next Generation

Victor Okhuysen and Dika Handayani of Cal Poly Pomona have written a great article on training and recruiting high-quality engineering candidates through industry-partnered competitions like Cast in Steel. It’s published in the December edition of INCAST magazine and you can read it here.

Student Apprentices Seeing US Internship Opportunities

Two students attending Ecole Supérieure de Fonderie et de Forge in Sèvres, France are seeking summer internship opportunities at a US foundry to fulfill a TOIEC (Test of English for International communication) requirement for graduation. These students have both done apprenticeships at Ferry Capitain. The students’ CVs are available here. Please contact them directly if you are interested in supporting.

Market News

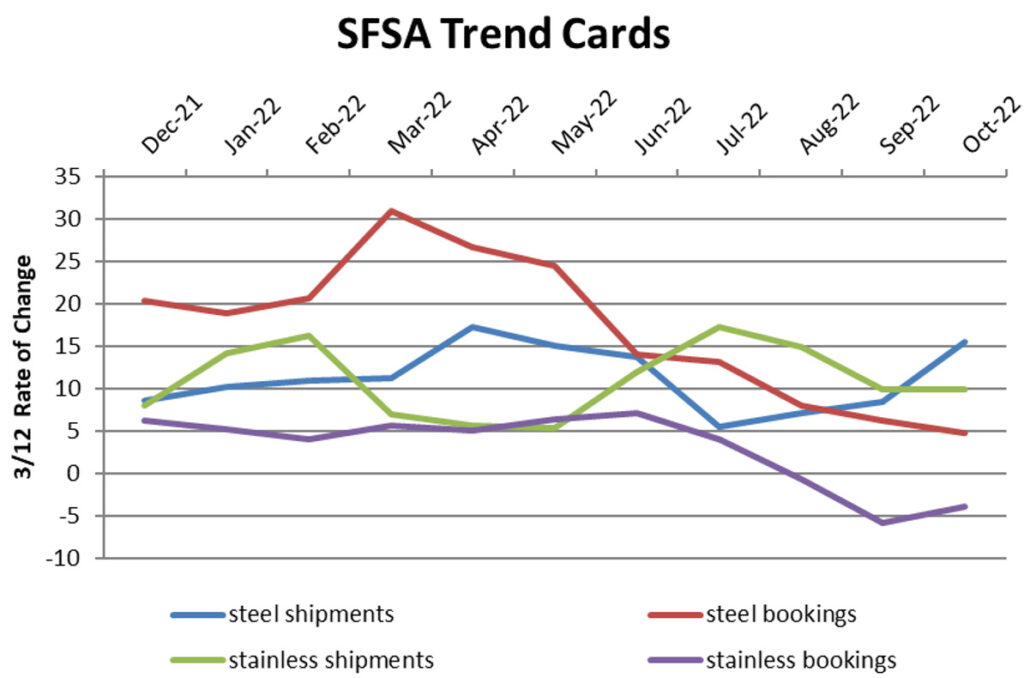

According to the SFSA trends report, steel and stainless casting bookings have been in a year over year decline since August 2022 while shipments have continued to trend upward. In November, 80% of members anticipated that bookings in the next three months will be flat or decline. The median backlog for steel and stainless castings remains relatively constant at 13 weeks for steel and 12 weeks for stainless.

ITR is forecasting that business activity will be modestly positive in the first half of 2023 in those areas that maintained a positive trend through the end of 2022. Business cycle conditions will generally deteriorate going through the second half of the year. A mild recession is forecasted for 2024. Furthermore, all the manufacturing sector forecasts were revised to a varying degree based on the industries susceptibility to interest rate changes, yield curve inversion, and macroeconomic variations. US metalworking machinery and construction machinery new orders as well as US mining production have been revised lower while US defense capital goods new orders was revised upward. The SFSA 2023 Market Forecast, updated in December by the Marketing Committee, is available online here.

Casteel Commentary

My Ideas for 2022 for the North American Steel Foundry Industry:

- Demand for steel castings will be volatile reflecting the instability in our economic and political situation. However, the lack of capacity, concerns about reliable supply, the need for parts in our regional economy, wariness of dependence on overseas supply will likely keep us fully booked through 2022.

Steel casting bookings went from 20% up to a 30% increase and fell to 5% up but production for steel and stainless castings held between up 5 to 15%.

- Parts and supplies will continue to be difficult to find and logistics will be problematic. China has a plurality or majority of production capacity for many of the basic industrial materials for a developed economy. Our NIMBY society has limited and closed much of our North American production and we will be hostage for many items to overseas supply.

These challenges were also present and made worse with the invasion of Ukraine. The energy markets with the sanctions against Russia and the restrictions on Russian pig iron both exacerbated the supply de-coupling of globalization.

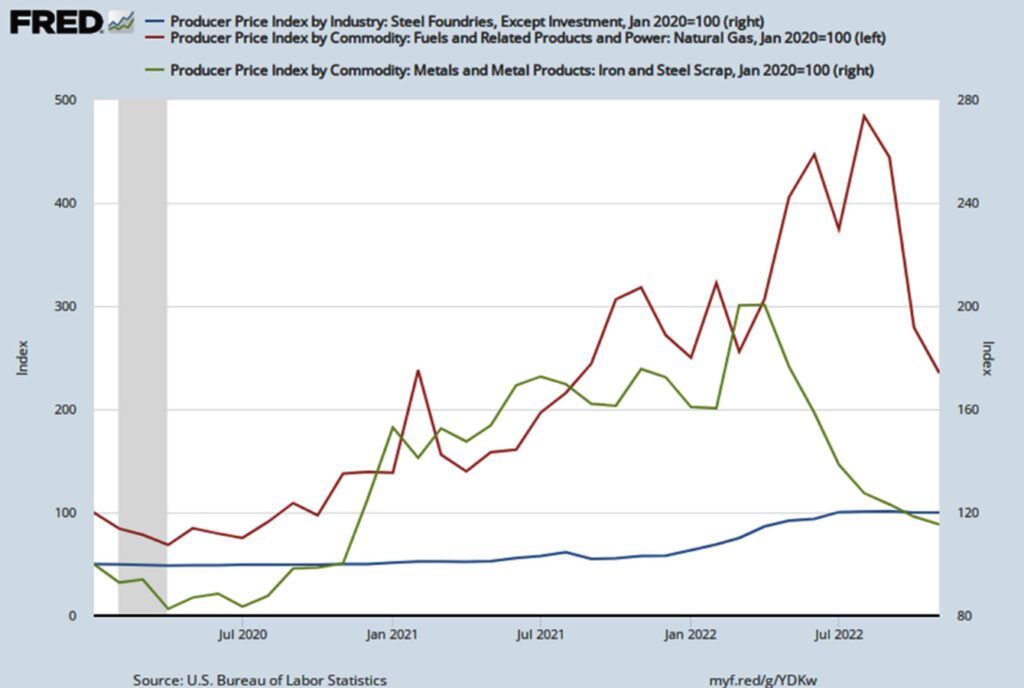

All of the issues with the steel industry’s supply chain have resulted in a significant increase in steel prices, and they have skyrocketed by 300 percent above pre-pandemic levels. Over the past year, the cost of producing steel materials increased by 141.6 percent, and the cost of producing iron and steel increased by 105 percent. Steel became more expensive to maintain as a result of the unreasonably high demand for the material, which led to shortages of raw materials and, in turn, factory inability to meet demand.

https://blog.fleetx.io/supply-chain-issues-faced-in-the-steel-industry/

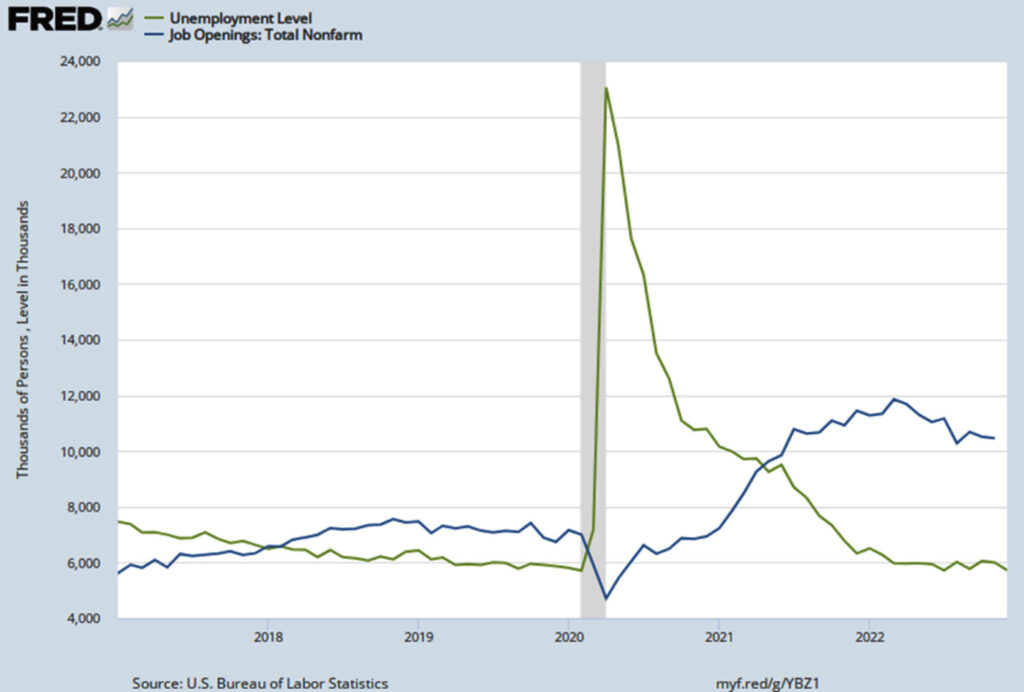

- Workforce will limit of production capability. We have record job openings at historically low levels of unemployment. Our incoming workforce is smaller than our retiring workforce. Automation will become a question of not whether but how.

In 2018 the demographic reality began to catch up with us where the number of unemployed was less than the number of jobs openings. The pandemic caused a huge jump in unemployment and drop in job openings which disappeared halfway through 2020 and became the worker shortage we have lived with since. The current level of job openings is twice the unemployment level.

- Inflation will force careful commercial arrangements as limited supplies result in pricing that is unexpectedly higher.

Scrap and natural gas prices dramatically increased and poised a challenge to realize those costs.

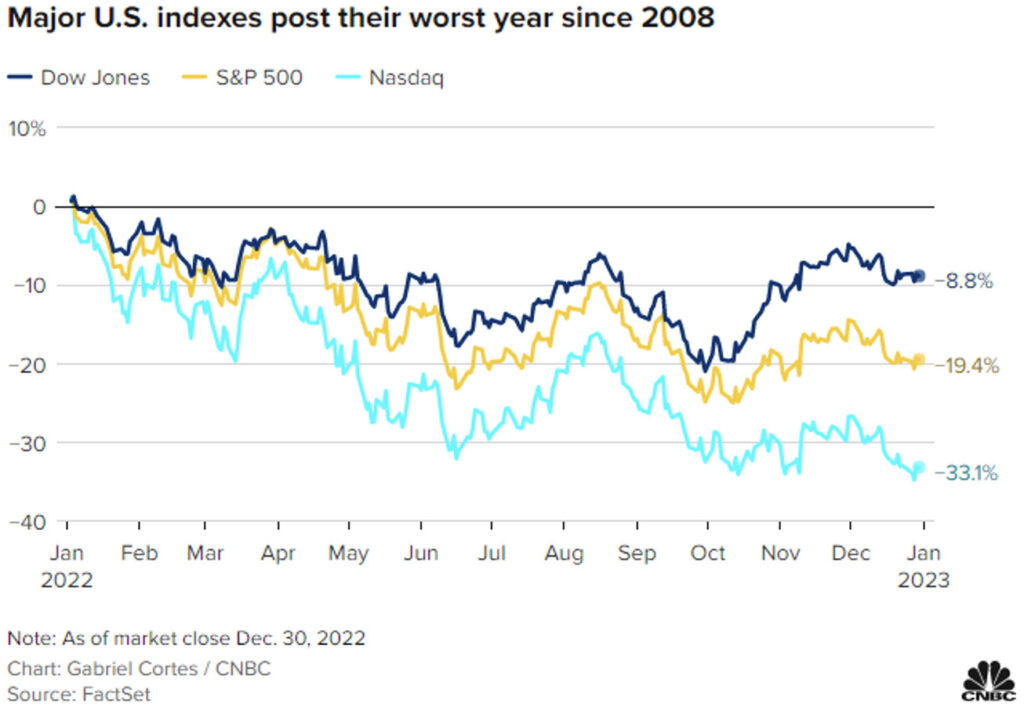

- China’s economic activity and our equity markets valuations are unsustainable and we will see a significant adjustment this year.

Stock fell in 2022 and China is in an increasingly unstable position.

- By the middle of the year, most COVID restrictions will be gone and we will adjust to the endemic as a fact of life.

- Improved market conditions and financial performance should allow steel foundries in North America to plan and begin significant capital modernization and automation.

I think I count this one as a miss, but I am hopeful for 2023!!

My Ideas for 2023 for the North American Steel Foundry Industry:

- The global reduction in capacity for steel castings that was most severe in North America will make the demand in 2023 for steel castings firm, continuing the trend of full production based on available supplies, logistics and workforce. A recession this year will temper the demand but the systemic requirements for steel castings to maintain the infrastructure and material production will support the requirement for steel casting production.

- The public policy requirements for carbon emission reduction and electrification will increase the investment in mining and infrastructure, supporting the need for steel castings. These requirements will be postponed as it becomes increasingly apparent that the technology and resources available cannot meet the aggressive targets. This will also require conventional investments in fossil fuel production and peak demand natural gas generation.

- Economic and national security will require more capital investment in our industry as globalization recedes and regional sourcing become needed to reduce risk. These capital funds will come either from longer term supplier agreements with OEMs, national security funds to ensure domestic supply or from elevated profitability from pricing that reflects inadequate capacity.

- Workforce challenges will remain systemic for future years including 2023. Steel casting producers will be automating to reduce the labor required for production. Plants will develop longer term plans to automate limited by the availability of funding, capable equipment and useful technology. This will result in up-skilling and up-grading workforce requirements and allow plants to offer more compelling career paths for new employees.

- Suppliers of materials and equipment will face many of the same challenges and will need to prioritize their markets. Establishing a strong and collaborative relationship with our suppliers will be key to ensuring our ability to produce.

- Customers will be both more demanding and more flexible to support their products. Steel foundries will need to become more engaged in understanding the requirements and developing a market structure so customers can support our investment and costs of meeting their needs.

- China will increasingly face huge challenges beyond COVID and geopolitical trade problems. Their demographic challenge of elderly and lack of incoming workforce may be the most significant for any country globally. Their internal debts, focus on construction and infrastructure, dependence on export markets and developed economies’ knowhow remains unsustainable. For critical supplies like steel castings, they will become a difficult source.

- Steel casting producers will need to have a clear view of the drivers for their business and become particular and collaborative with the suppliers and customers who can work together with us in an uncertain political, economic and cultural world.

Raymond