Table of Contents

Casteel Commentary

This month, Raymond reviews his predictions for 2021, and tries his hand at predicting the future of the North American steel casting industry for 2022.

Funding Needs for Army and Navy Steel

As discussed in the commentary of the November Casteel Reporter, globalization has created a reduced US steel foundry supply chain to support the DOD. SFSA is working with the DoD to identify funding opportunities to help improve steel casting production for Army and Navy weapon systems; likely targeting improvements for efficiency/throughput and the qualification of new suppliers. Please contact Dave with your thoughts on how Army or Navy funding could help improve your foundry or could assist with funding certification to Navy Technical Publications.

75th Technical & Operating Conference

The diamond jubilee was truly a special event with a return to being in-person, art contest, special seminar, diamond papers, hands-on workshop and the most papers. Thanks to the authors, workshop presenters and T&O Committee for their investment in enabling the success of the event. We all benefit from foundry members, academic partners, and government personnel who come together to make our industry better. Planning is already underway for this year’s conference; tentatively scheduled for December 7-10 in Chicago. If you would like to recommend a topic and presenter for the 76th T&O, pleasecontact Dave.

Awards

Safety award for achievement of a Perfect Safety Record with 2020 zero DART rate: Bahr Brothers.

Safety awards for achievement of safety records of accident frequencies equal to or less than the national average for manufacturing: Acerlan, Corporaçion POK, Eagle Alloy, Fimex, Magotteaux-Pulaski, ME Global-Tempe, and MetalTek-Carondelet.

Steel Founders’ Society Foundation scholarships awarded to member interns selected to present at the T&O: Matthew Day – Howell Foundry, Margot Henke – Stainless Foundry, Kiersten James – Stainless Foundry, John Paul McCarten – Andritz, and Max Selbach – Stainless Foundry.

Service citations recognize the completion of terms for board members and chairs of the society’s committees and groups that have invested time and energy to make these functions beneficial for members: Shawn Cefalu, MetalTek-Wisconsin Centrifugal (National T&O Chair), Al Kinnard – Ashland Foundry (Board Director), Steve Gear – Bradken-Tacoma (Board Director), and Phil Harper – American Foundry Group (Past President).

Research Highlight

Missouri S&T has been investigating new applications of fiber optic cables in the steel industry. Fiber optics enables continuous real time data collection over a large area with a relatively easy and cost-effective system. Missouri S&T has previously utilized fiber optics to measure strain and temperature on large pieces of equipment like furnaces for process optimization. They have recently begun a new project under SPI to use fiber optics to study the gap formation during solidification in a steel mill. Observing and measuring the gap formation in a continuous casting machine has historically been difficult to achieve due to the high temperatures, corrosive environment, and oscillating copper mold. If successful, this technology could likely be applied to other molding systems to develop a better understanding of solidification.

Market News

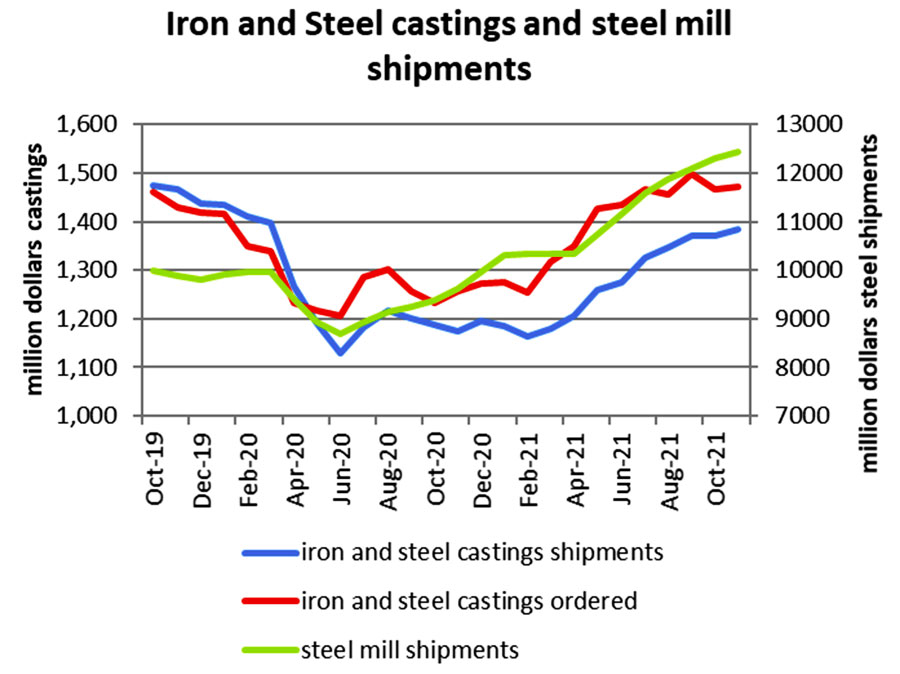

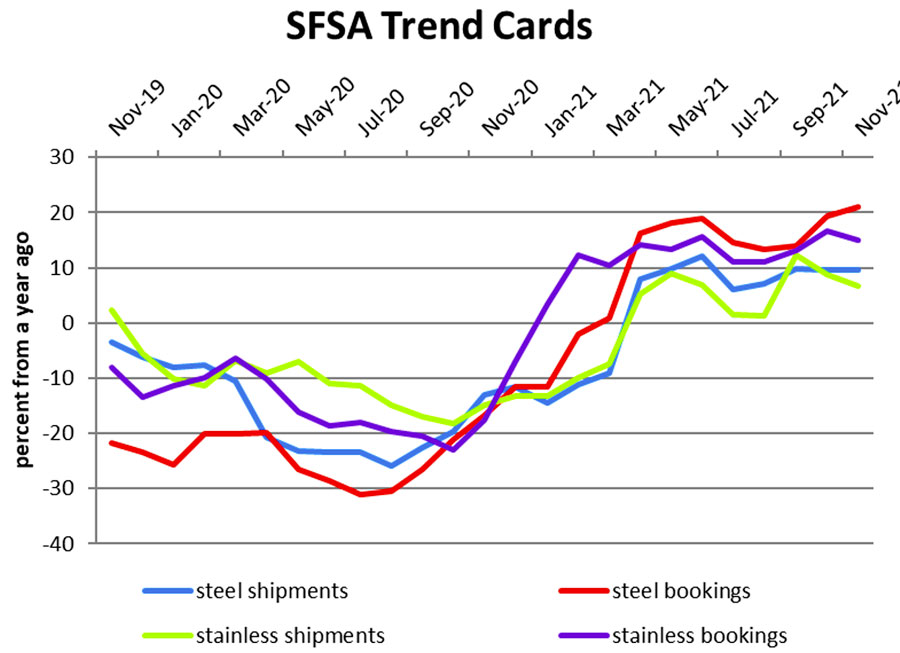

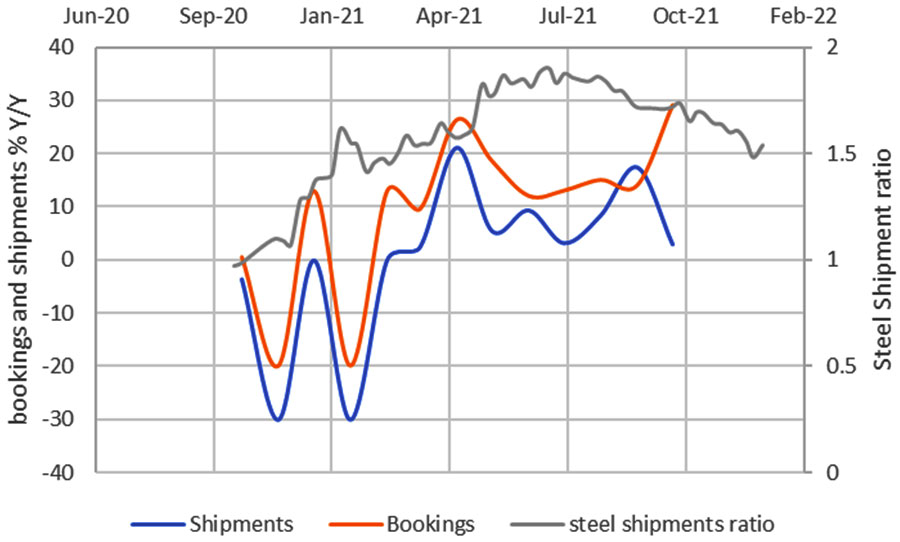

Department of Commerce numbers for iron and steel castings and steel mill shipments continue to trend upwards. Orders are still outpacing shipments due to strong casting demand and supply constraints largely attributed to labor shortages. SFSA Trends reflects the same for steel and stainless castings, with the latest steel casting backlog increasing to 14 weeks and stainless to 12 weeks.

ITR is forecasting slowing growth for a majority of the manufacturing markets throughout 2022 and into 2023. Oil and gas is forecasted for accelerated growth this year. The forecast for US Machinery New Orders was revised upwards to account for updated outlooks for the US B2B sector and inflation.

The SFSA 2022 Market Forecast, updated in December by the Marketing Committee, is available online here.

Casteel Commentary

My Ideas for 2021 for the North American Steel Foundry Industry:

- Demand for steel castings in North America should be steady for the beginning of the year and improve through the year. It should be up sharply by years end.

Steel casting demand did increase throughout the year. Bookings and shipments went up dramatically in April and remained positive throughout the balance of the year. November results show bookings up over 20% and shipments up about 10%. Backlogs are over 11 weeks suggesting that the lag in shipments increase is due to lack of workforce or supplies.

- Shortages and capacity constraints even in our industry should become apparent toward the end of the year.

As detailed in last month’s Casteel Reporter, U.S. public policy has limited the ability of our members to operate profitably and make the critical investments needed for success. Globalization with distorted pricing from offshore competitors gaming the system and large customers preferring developing market suppliers to gain bit the cost advantage and access to the rapidly growing regional economy has resulted in the loss of plants and capacity in North America. This challenge is now recognized but no action to resolve or improve the situation has yet been identified.

- Equity and investments should drop as the effect of lockdowns and lost productivity make their way into the profits and performance of the economy.

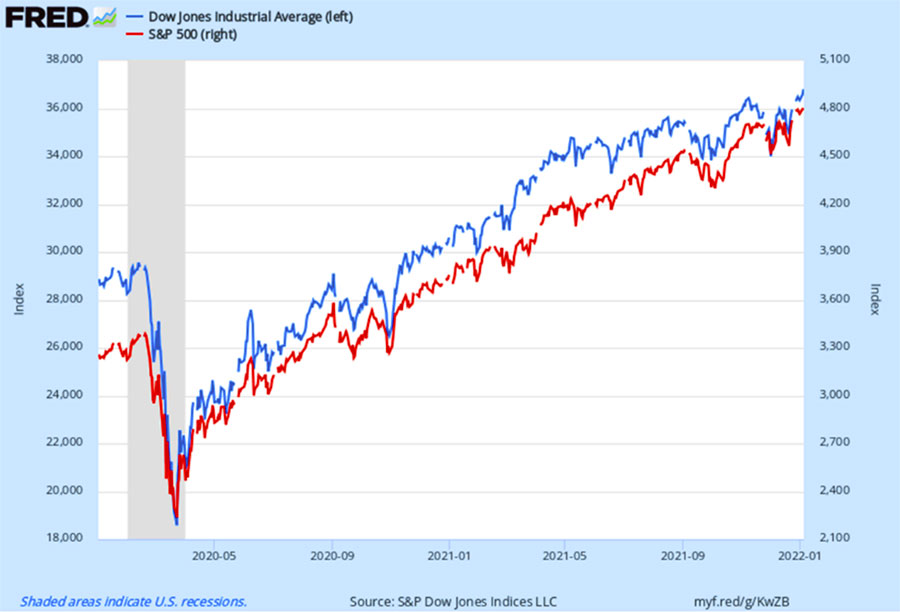

This idea was wrong, for I think at least the past 5 years I have been wrong. Painfully, the market prices remain at historic highs compared to any measure of market value, well in excess of 1929. This will not end well. Inflation will be persistent as excess money from the market chases limited supply for goods in the marketplace.

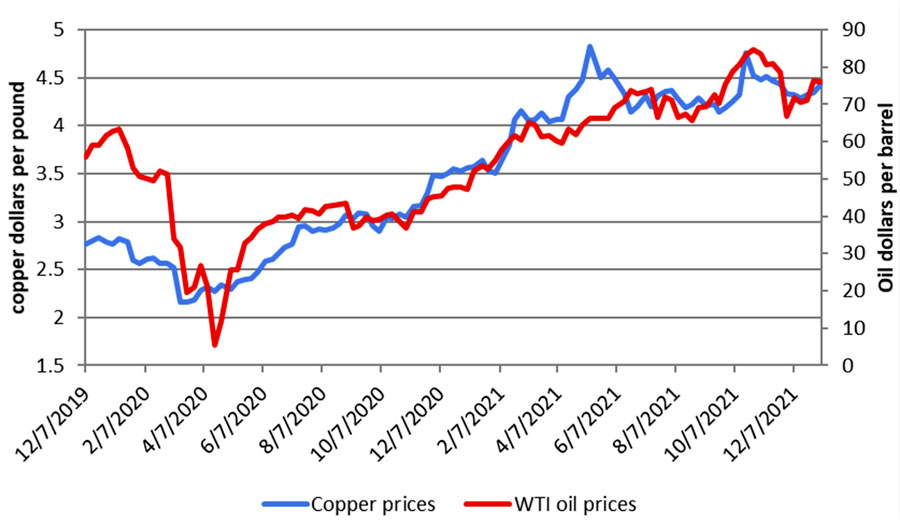

- Oil and copper prices should remain stable or increasing.

Oil and copper prices are high. They would justify added investments in mining and signal industrial activity that is strong. These higher prices will stimulate the need for steel casting production.

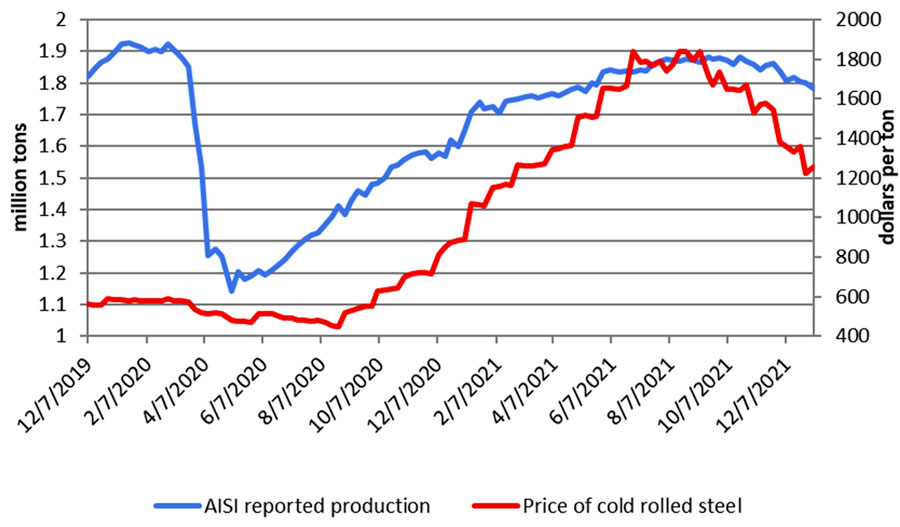

- Steel demand should remain strong for the whole range of steel products.

As expected, the production and pricing of steel at the beginning of 2021 was unsustainable. As the economy began to open despite the ongoing and shifting restrictions, demand for steel grew. Tariffs and logistical challenges in shipping has led to strong demand for steel in North America.

- The move away from globalization to a more nationalistic policy will continue reflecting the underlying economic and political realities of our world.

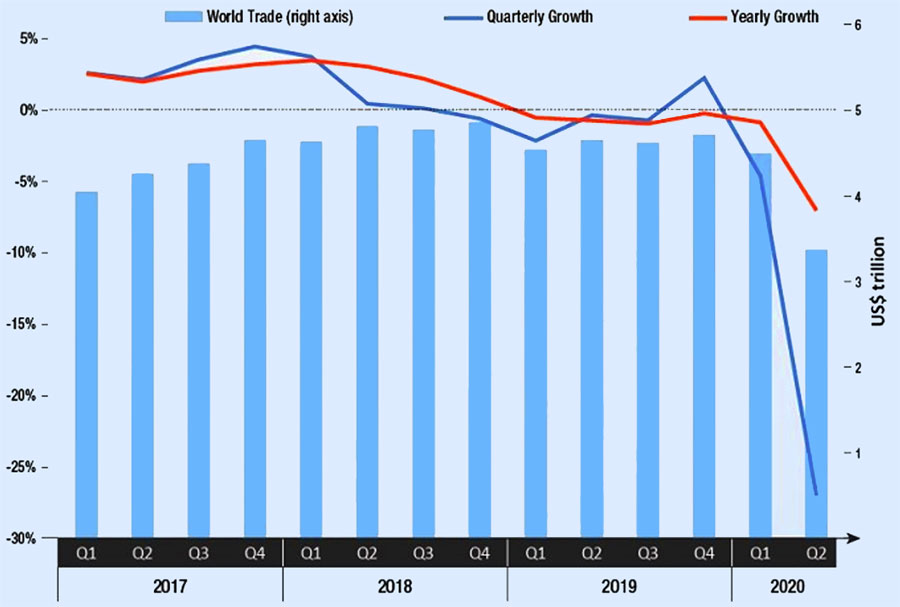

The challenge of logistics, concerns about reliable supply and the need to find alternative suppliers as the political and economic global picture become uncertain has led to some movement to re-sourcing into North America. During 2020 with the sharp drop in demand, world trade levels dropped dramatically.

https://unctad.org/news/global-trade-continues-nosedive-unctad-forecasts-20-drop-2020

- In products and market essential for domestic security, there will be efforts to disengage from China, but these will not have a big effect.

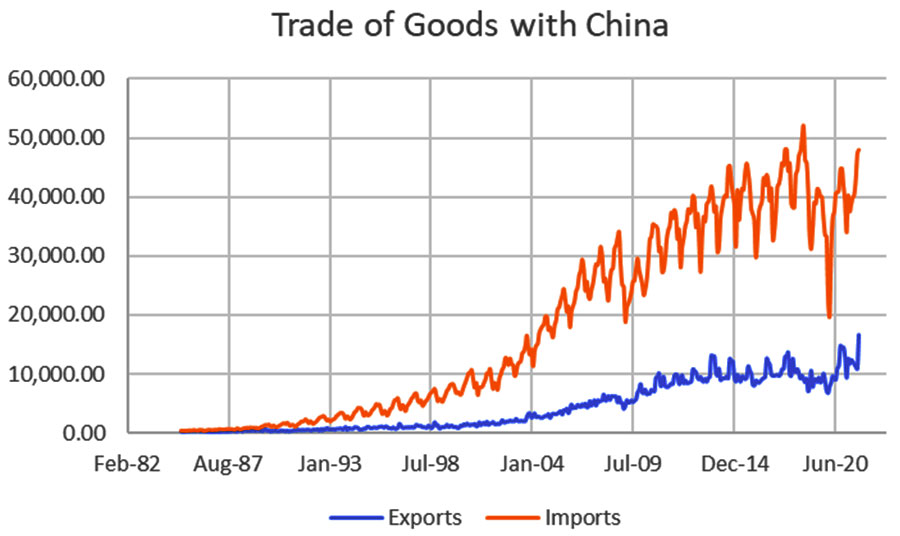

Even with this significant drop in world trade, our balance of trade in goods with China remains largely unchanged. There was a sharp drop in imports in 2020 but the most recent data from 2021 shows a rebound in imports to pre-pandemic levels.

My Ideas for 2022 for the North American Steel Foundry Industry:

- Demand for steel castings will be volatile reflecting the instability in our economic and political situation. However, the lack of capacity, concerns about reliable supply, the need for parts in our regional economy, wariness of dependence on overseas supply will likely keep us fully booked through 2022.

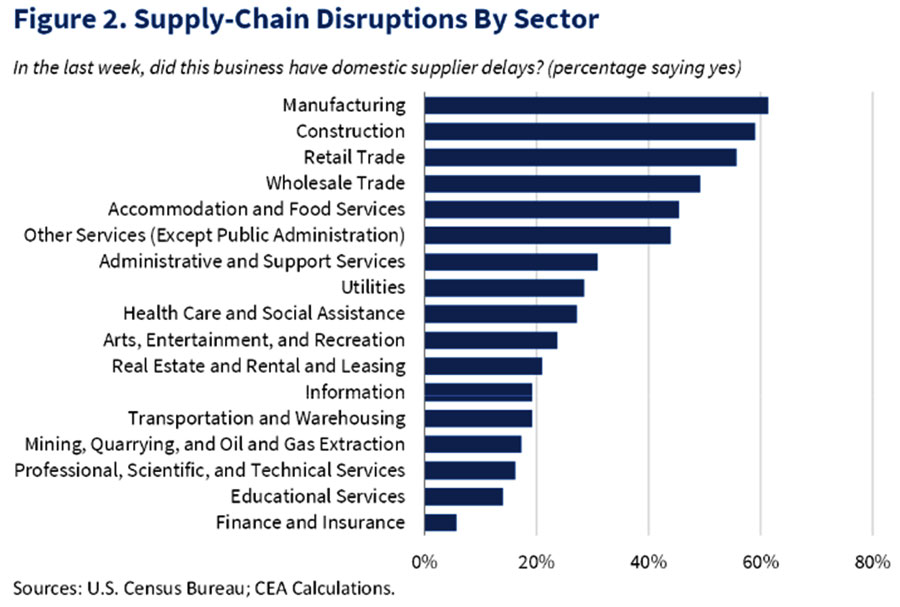

- Parts and supplies will continue to be difficult to find and logistics will be problematic. China has a plurality or majority of production capacity for many of the basic industrial materials for a developed economy. Our NIMBY society has limited and closed much of our North American production, and we will be hostage for many items to overseas supply.

- Workforce will limit of production capability. We have record job openings at historically low levels of unemployment. Our incoming workforce is smaller than our retiring workforce. Automation will become a question of not whether but how.

- Inflation will force careful commercial arrangements as limited supplies result in pricing that is unexpectedly higher.

- China’s economic activity and our equity markets valuations are unsustainable and we will see a significant adjustment this year.

- By the middle of the year, most COVID restrictions will be gone and we will adjust to the endemic as a fact of life.

- Improved market conditions and financial performance should allow steel foundries in North America to plan and begin significant capital modernization and automation.

Business Report

| STEEL FOUNDERS’ SOCIETY OF AMERICA | |||||

| BUSINESS REPORT | |||||

| SFSA Trend Cards (%-12 mos. Ago) | 12 Mo Avg | 3 Mo Avg | November | October | September |

| Carbon & Low Alloy | |||||

| Shipments | 3.8 | 9.5 | 8.0 | 3.0 | 17.5 |

| Bookings | 12.6 | 21.0 | 20.0 | 29.0 | 14.0 |

| Backlog (wks) | 9.3 | 11.3 | 14.0 | 10.0 | 10.0 |

| High Alloy | |||||

| Shipments | 1.8 | 6.8 | 5.0 | -8.7 | 24.0 |

| Bookings | 12.9 | 15.1 | 9.7 | 14.0 | 21.6 |

| Backlog (wks) | 10.7 | 11.4 | 12.0 | 11.0 | 11.3 |

| Department of Commerce Census Data | |||||

| Iron & Steel Foundries (million $) | |||||

| Shipments | 1,288.7 | 1,384.7 | 1,403 | 1,400 | 1,351 |

| New Orders | 1,401.7 | 1,472.7 | 1,459 | 1,401 | 1,558 |

| Inventories | 2,304.8 | 2,437.3 | 2,464 | 2,443 | 2,405 |

| Nondefense Capital Goods (billion $) | |||||

| Shipments | 78.2 | 80.9 | 81.0 | 80.8 | 80.9 |

| New Orders | 82.3 | 86.2 | 88.6 | 85.1 | 84.8 |

| Inventories | 199.0 | 204.5 | 206.0 | 204.4 | 203.1 |

| Nondefense Capital Goods less Aircraft (billion $) | |||||

| Shipments | 73.5 | 76.0 | 76.3 | 76.0 | 75.8 |

| New Orders | 75.7 | 78.6 | 78.8 | 78.8 | 78.2 |

| Inventories | 133.4 | 138.5 | 140.0 | 138.5 | 137.0 |

| Inventory/Orders | 1.8 | 1.8 | 1.78 | 1.76 | 1.75 |

| Inventory/Shipments | 0.0 | 1.8 | 1.83 | 1.82 | 1.81 |

| Orders/Shipments | 0.0 | 1.0 | 1.03 | 1.04 | 1.03 |

| American Iron and Steel Institute | |||||

| Raw Steel Shipments (million net tons) | 7.8 | 8.1 | 7.9 | 8.2 | 8.1 |