Table of Contents

Members’ Lunch and Roundtable Discussion at Metalcasting Congress in April

SFSA is pleased to invite members and special guests to join us for lunch on Tuesday, April 14th from 11:30 a.m. to 1:30 p.m. at Bistro Bella Vita, 44 Cesar E. Chavez Ave SW, Grand Rapids, Michigan, just a short walk from the DeVos Convention Center.

For $55, you’ll enjoy a delicious meal while connecting with fellow SFSA members. Following lunch, we’ll begin the roundtable discussion, providing an excellent opportunity to share insights and ideas with peers.

Registration and payment are required to reserve your spot, so please be sure to register soon. Registration closes on March 23rd.

Hope you will join us for this great opportunity to network, collaborate, and connect.

If you have any questions, please contact Renee at rmueller@sfsa.org.

Save the Dates – SFSA EHS/HR Meeting – April 29-30

Please save the dates – the next SFSA EHS/HR meeting will be held April 29-30 in Milwaukee area. Meeting agenda and hotel details will be emailed to members later this month.

NGM and FL Meeting

Next Gen Mfg (NGM) and Future Leaders (FL) will meet in Pittsburgh, PA March 10th. This meeting will focus on automation and AI, and will include talks from industry experts, a demonstration at Instinct Robotics and a tour of Duraloy Technologies. Additionally, the ARM Institute is holding a Robotic Casting and Forging Forum on March 11th. Registration details for both meetings were emailed to members.

Steel Casting Technology Classes

SFSA will be planning US locations for classes with Tom Stevens. The format could be 2-day classes over three months to cover the fundamentals of Steel Casting Technology (book 1), or like recent T&O topics Tom has covered, we could do subject-focused two-day classes (topics from book 2). Please contact Dave with any questions or requests.

Research Review, July 7-9

Please make your plans to participate in the annual SFSA Research Review on July 7-9. This year’s meeting will be held in-person in Rosemont, IL. The Review covers the latest in both Carbon & Low Alloy and High Alloy steel casting research under the AMC and STAR programs. The meeting is also your opportunity to interact with the researchers and provide industry steering. The event vets our research portfolio to select the R&D projects to be featured at the National T&O. More details regarding registration and the Design Day are to come. For any questions, contact Caelan Kennedy (ckennedy@sfsa.org).

Additional Keel Bars Needed

To support the development of the SFSA carbon & low alloy atlas, we are looking for additional standard keel block legs:

- 1010, 1035, 1045

- 4330

- 4120, 4130, 4140

- Any carbon level for the 13XX, 46XX, or 51XX alloy families

SFSA is developing a carbon & low alloy atlas to show the effect of alloying elements and heat treating on the mechanical properties and microstructure of low alloy steels. As-cast and bars from same heat would be preferred, and if you can pour at least 10 from the same heat that is even better. Heat chemistry or mechanicals would be appreciated, but not required. Please contact Caelan (ckennedy@sfsa.org) or Tory (tory@sfsa.org) for shipping details.

Mold Wash and Riser Sleeve Working Groups

TEvaluation of mold wash and riser sleeve performance will be ramping up in the early portion of the year. Utilizing both university partners and commercial labs, the makeup of mold washes will be determined beyond the carrier and refractory type, as well as the amount of gas released by each component during casting. New materials for washes will also be explored, such as those used in investment casting, to improve strength and surface finish while reducing quality details.

Testing is beginning at University of Alabama at Birmingham (UAB) to measure the heat retained and/or generated by sleeves with calorimeters, and compare these values to computer simulations, showing the accuracy of these simulations to reality. As insulating riser sleeves have shown to perform as well or better than simulation, this testing campaign aims to gather data on exothermic sleeves.

If interested in joining either group, please email Tory Wendlandt (tory@sfsa.org), and check out the SFSA wiki pages (Riser Sleeve Working Group, and Mold Wash Working Group).SFSA is developing a carbon & low alloy atlas to show the effect of alloying elements and heat treating on the mechanical properties and microstructure of low alloy steels. As-cast and bars from same heat would be preferred, and if you can pour at least 10 from the same heat that is even better. Heat chemistry or mechanicals would be appreciated, but not required. Please contact Caelan (ckennedy@sfsa.org) or Tory (tory@sfsa.org) for shipping details.

NASCC

SFSA will be exhibiting at the North American Steel Construction Conference (NASCC) to promote the use of castings in steel construction.

The building construction conference, NASCC, will be April 22-24 in Atlanta, Georgia. SFSA’s partnership with AISC, has enabled the use of steel castings for North American buildings to no longer be a novelty, but more opportunity for our industry awaits. This year marks several achievements and near-term accomplishments:

Members can receive an exhibit pass for Thursday, April 23. RSVP with Caelan (ckennedy@sfsa.org) by March 6.

Cast in Steel Competition

This year is shaping up to be an exciting one, with 64 teams from 37 universities, mentored by 38 industry partners.

The Horsemen’s Axes will be on display during the MetalCasting Congress at the DeVos Convention Center, 303 Monroe Ave. NW, Grand Rapids, MI. They will be displayed in the Chase Board Room on the second floor on Tuesday, April 14 and Wednesday, April 15, from 9:00 a.m. to 4:00 p.m.

The Cast in Steel TV series competition will take place at Grand Valley State University’s Innovation Design Center, 227 Winter Ave. NW, just a short walk from the convention center.

The competition will take place on Thursday, April 16 and Friday, April 17, with the award ceremony taking place after the competition on Friday, April 17. Exact times will be announced once finalized.

New this year, following the competition, SFSA will auction off the axes. The proceeds from the auction will directly benefit the participating schools.

Again, this year, our presenting sponsor is the Industrial Base Analysis and Sustainment (IBAS) Program, managed by the Innovation Capabilities and Modernization (ICAM) Office in the Office of the Assistant Secretary of Defense for Industrial Policy (ASD IBP).

| UNIVERSITY | FOUNDRY NAME | ||

|---|---|---|---|

| Arizona State University | ME-West Castings | ||

| Arkansas State University | Southern Cast Products | ||

| Baylor University | Delta Centrifugal | ||

| California Polytechnic State University, Pomona (2 teams) | Soundcast Co. | ||

| California State Polytechnic University, Pomona | Aerotec | ||

| California State Polytechnic University, Pomona | Miller Foundry | ||

| Central Michigan University (2 teams) | Bay Cast Inc | ||

| Colorado School of Mines (2 teams) | Western Foundries | ||

| Ecole Nationale Supérieure D'Arts Et Métiers Campus de Cluny | Safe Metal | ||

| ESFF - Ecole Supérieure de Fonderie et de Forge | Ferry-Capitain | ||

| Ferris State University | Eagle Alloy, Inc. | ||

| Georgia Southern University | Georgia Southern University, N/A | ||

| Georgia Southern University (5 teams) | Carolina Metal Casting | ||

| Georgia Southern University | Carolina Metal Casting | ||

| Grand Valley State University | Eagle Alloy | ||

| Grand Valley State University | Eagle Precision Cast Parts Inc | ||

| Herron School of Art and Design, IU Indianapolis | Harrison Steel Castings Company | ||

| Instituto Tecnológico de Morelia | Fundidora Morelia | ||

| Instituto Tecnológico de Morelia | Acerlan Matrix Metals S.A. de C.V. | ||

| Louisiana Tech University | Howell Foundry | ||

| Michigan Technological University | Bay Cast Inc | ||

| Michigan Technological University | Temperform | ||

| Michigan Technological University | Aalberts Surface Technologies | ||

| Minnesota State College Southeast | Midwest Metal Products | ||

| Mississippi State University | Southern Cast Products | ||

| Missouri University of Science and Technology | Missouri University of Science and Technology | ||

| Missouri University of Science and Technology | Caterpillar | ||

| Missouri University of Science and Technology | Southern Cast Products | ||

| Penn State Behrend | Ashland Foundry & Machine Works | ||

| Pittsburg State University | Monett Metals | ||

| Purdue University | Kimura Foundry America | ||

| Purdue University WL | Waupaca Foundry, Plant 5 | ||

| Rose-Hulman Institute of Technology | Harrison Steel Casting Company | ||

| Tennessee Tech University | Magotteaux | ||

| Texas State University (3 teams) | Henderson Manufacturing Co. | ||

| The Ohio State University | Fisher Cast Steel | ||

| The University of Alabama | Southern Alloy | ||

| Trine University | Bahr Brothers Manufacturing | ||

| Universidad Autonoma De Nuevo Leon | Fundiciones Lerma S.A de C.V | ||

| University of Alabama at Birmingham | Andritz | ||

| University of Northern Iowa | UNI Metal Casting Center and Factory 4.0 Center | ||

| University of Northern Iowa | Wisconsin Precision Casting Corporation | ||

| University of Tennessee-Knoxville (2 teams) | Magotteaux | ||

| University of Wisconsin - Madison | MetalTek | ||

| University of Wisconsin - Milwaukee (3 teams) | MetalTek | ||

| University of Wisconsin Platteville | MetalTek | ||

| University of Wisconsin - Madison | Signicast | ||

| Virginia Tech | Midwest Metals | ||

| Wentworth Institute of Technology (3 teams) | DW Clark | ||

| Youngstown State University (2 teams) | Trumbull Foundry and Alloy |

Casting Dreams Competition

We’ve already had 14 competitions from Illinois, Iowa, Massachusetts, Michigan, Ohio, Pennsylvania, with another 18 planned for late February and early March in California, Georgia, Indiana, North Carolina, and Wisconsin. This year’s competitions are anticipated to reach more than 700 students.

The casting will be on display during the MetalCasting Congress at the DeVos Convention Center, 303 Monroe Ave. NW, Grand Rapids, MI. Stop by the Chase Board Room on the second floor on Tuesday, April 14 and Wednesday, April 15, from 9:00 a.m. to 4:00 p.m.

The Nationals Award Ceremony will take place on Wednesday, April 15, at 10:00 am at the DeVos Convention Center in the Chase Board Room.

Don’t miss the opportunity to see the incredible castings these talented young students have created.

Market News

ITR reports that core economic indicators continue to signal accelerating growth, though employment remains a lagging metric. Consumer spending remains a key economic driver, providing underlying stability despite uneven conditions across income segments and regions. Current projections anticipate moderate growth in 2026, softer conditions in 2027, and renewed improvement in 2028.

Most manufacturing markets have entered accelerating growth or recovery phases, with heavy-duty trucks remaining a notable exception. Growth rates across many sectors are projected to peak in mid- to late 2026, level off in 2027, and transition into a broader cyclical upswing in 2028.

Defense-related capital goods are expected to outperform in 2027, supported by elevated geopolitical tensions and sustained federal spending.

SFSA Business Trends

To benchmark your facility with other steel foundry members, SFSA encourages you to participate in the monthly SFSA business trends survey – only participants have access to the results. The quarterly data will no longer be included in the Casteel Reporter. Please complete the business trends survey for January 2026: https://www.surveymonkey.com/r/SFSA_BTB_Jan26. Survey results are provided to participants the following month.

SFSA Business Report

December data is is delayed from the Department of Commerce due to funding shortfalls. An updated business report is anticipated to be published in the next Casteel Reporter.

Casteel Commentary

This month’s Casteel Commentary is the first draft of a white paper to explain to customers and others the current state of our capacity and the need for collaborative partnerships to modernize and innovate our capability. Our customers need castings that are integrated better into their designs and products to get higher performance and create greater value. They need us.

We need them to treat us as critical suppliers and allow us to invest and innovate so that we are reliable and capable of providing them the best value. I welcome your comments and corrections before we post this as a resource on the website.

Thanks

Steel Foundry Capacity and Capability

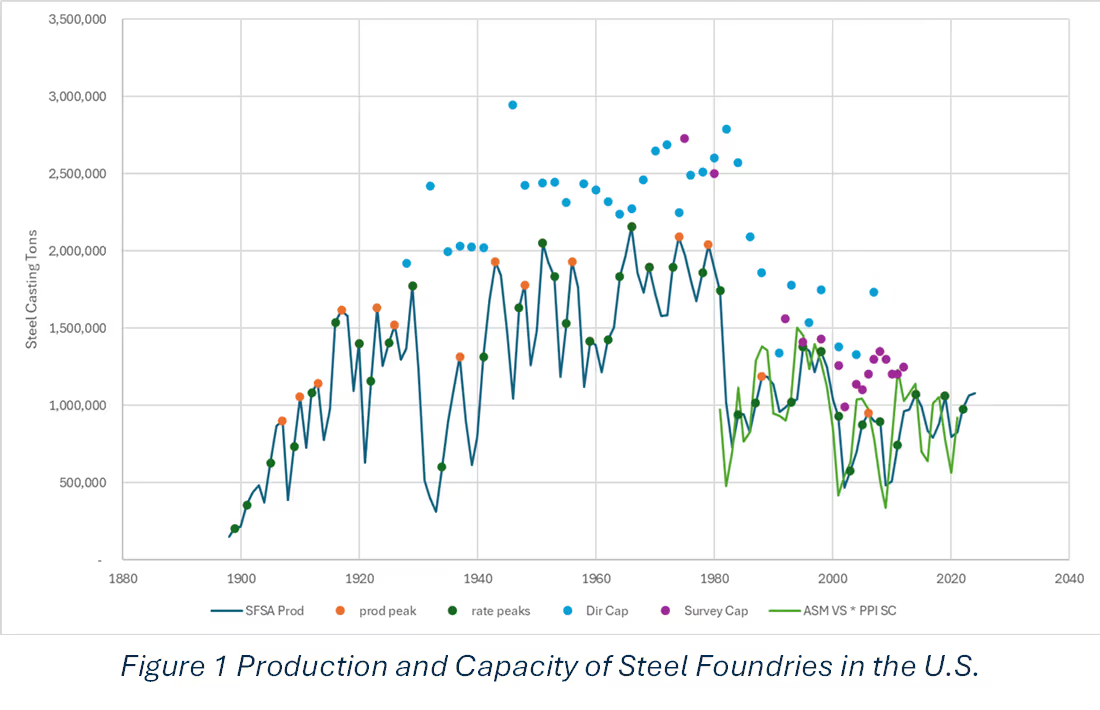

Steel foundries as a capital-intensive industry grew during the capital boom that created much of our critical infrastructure starting in the 1950’s before that demand collapsed after 1982. Like most major capital-intensive industry segments; excess capacity, globalization, continued regulatory and public policy burdens have limited the surviving plants ability to operate profitably enough to invest in modernization and innovation. Since 1980 the industry has lost more than half of the production capability as seen in Figure 1.

Capacity for manufacturing in many industries is defined by the big piece of capital equipment bolted to the floor in the middle of the main plant. The plant capacity is set by that operation and is defined by its production if it operates continuously every day for the year. Early in steel casting production, the melting operation was that capacity limitation and the SFSA Directory Capacity (Dir Cap) was the melt capacity. This was true pre-WWII as seen. Post WWII, the melt capacity was no longer the limit on production. Melt capacity was more than needed to meet the requirements even when the foundries were operating at their capability.

After 1990 to provide a more meaningful measure of steel foundry production capability, SFSA collected data on the maximum single month production for individual plants for the last 4 years of production. Annualized, this was used as the production capability. The idea was that with the current work mix, plant, and workforce, the plant would in at least one month made the largest volume they were capable of with their current structure. These capability surveys both gave a more realistic picture of the industry and also resulted in revisions by plants of their reported capacity as seen after 1990 in Figure 1.

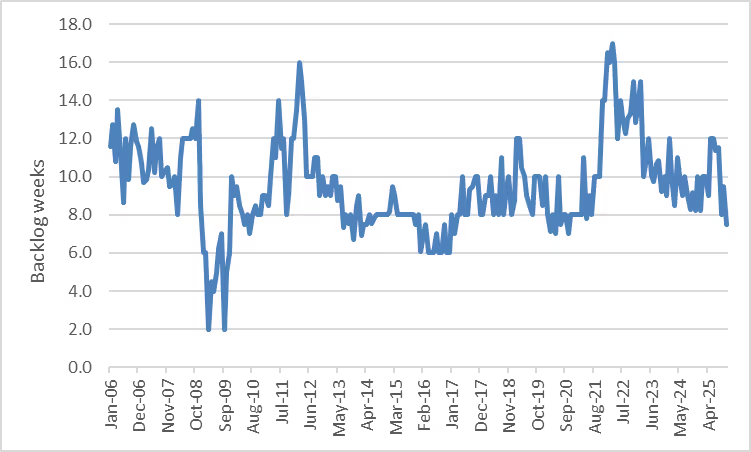

When demand for castings increases rapidly, the plants are limited by their current capability of production. The peaks in Figure 1 show the production capability of the current industry at around 1 million tons. When demand exceeds capability, new customers and orders are scheduled for future production and this shows up in reported backlog shown in Figure 2.

In the capital boom that occurred post 2001, the industry in 2006 and 2007 as seen in Figure 2 had a reported backlog of 8 to 14 weeks. The backlog was dropping slowly as plants were able to hire more workers and make incremental equipment purchases. The backlog then varied from 6 to 16 weeks depending on demand. Backlogs of 8 weeks seems to be “normal” what ever that means. There is also no clear definition of backlog.

For purchasers who need steel castings, this historical backdrop suggests the need to develop a working partnership with their casting supplier that goes beyond an occasional purchase order. Steel foundries are not hardware stores but like specialty machine shops, are custom job shop suppliers with artisans making proprietary engineered castings.

With the changes in globalization and the decline of the industry, domestic steel foundries are likely to be limited in capacity. The situation will become critical enough to require purchasers to pay premiums for existing production capability.

Casting purchasers without stable, healthy, and collaborative suppliers are likely to suffer. Collaborative purchasers can partner with the casting producers to create innovative designs that maximize casting value and create a competitive advantage in the marketplace. Legacy purchasing practices designed to minimize the cost, not maximize the value, limit profitability of the suppliers, making it impossible for them to invest in innovation and modernization.

Longer term collaborative relationships will allow purchasers to be included in the regular production schedule in advance and have the capacity already designated for their casting requirements. Long lead times and extended backlogs will be required for the occasional purchaser who is shopping around for the optimal current price and delivery.

In the past decades with excess capacity, shopping globally for the best price was a reasonable practice. It was not optimal because as the legacy components became dated, the purchasers lacked the internal expertise to use the casting to create the most value. They believed that casting supplier’s interest in redesign and casting changes were not driven by customer value but by manufacturing cost. Casting producers were treated like commodity producers and custom product partners. Casting prices reflected only the cost of production, not the value of the product.

In the expected future with a shortfall of capacity, purchasers will struggle to find the castings they need to maintain their production. They will be bidding against other purchasers for limited production to meet their production schedules. The price of the castings will rise across the board to reflect more of the product value and less of the cost of manufacturing.

Collaborative partnerships between casting producers and manufacturing purchasers can share increase the value and optimize the total cost in manufacturing and assembly to gain a significant competitive advantage. The casting supplier should be an essential team partner that invests the higher prices to become a more capable supplier providing the best casting value and performance.

Raymond