In this month’s commentary Raymond tries to make the case that where we are is not normal; globally, economically, or culturally. We are on an ahistorical unsustainable path which will cause our world to reshape and we need to plan for a future that is different.

Table of Contents

Future Leaders Meeting March 14-15

The Future Leaders meeting will be held in Tuscaloosa, Al on March 14-15. The meeting will include a discussion of cracking and hot tearing in steel castings with Charlie Monroe, along with lab activities and analysis. We’ll do a roundtable discussion and tour Southern Cast Products. The cost to attend is $30 to cover the cost of a catered lunch for both days – other costs for travel, hotel, meals, etc. are the attendees’ responsibility. Please bring your own safety shoes for the tour. Final details for the meeting will be sent to all registered attendees. Please register here, for more information or questions please email Ruth Berrios at ruth@sfsa.org.

Steel Casting Research

The July Casteel Reporter introduced SFSA’s research objectives. It also put forward an opportunity for industry to champion research projects by direct involvement in the steering and deployment; thus, obtaining an early and direct benefit from current R&D. In addition, an opportunity to propose new, non-competitive research ideas to SFSA’s research committees. To sponsor a project or submit a research project, please contact Dave. In this Reporter, we highlight our research thrust for Steel Database. This work will build a repository for steel data regardless of product form. While machine learning and big data are today’s buzzwords, the application of designed analysis of small data can yield large returns. Similar to the work done by Raymond Monroe presented at the 2020 T&O, member heat data can be used to identify targets or new areas of opportunity. Unfortunately, much effort is spent acquiring data for a specific project or commercial verification. Compiling this data will provide a unique opportunity for informed decisions in the future. SFSA utilizes a R&D project dashboard to provide an overview and status on activities. To learn more, the dashboards are available here. For any additional information, please contact Dave.

Cast in Steel 2023

The 5th annual Cast in Steel competition is in full swing. University students will create an African Spear Point exploiting the casting manufacturing process from design conception to performance. The requirements for the spear point assembled with a handle plus the spear point must be less than 1.5 kg (3.3 lbs.) and must be less than 2 m (78.7in) in overall length.

This year’s competition is shaping up to be the largest yet, with 42 teams from 31 universities mentored by 29 industry partners registered to compete! The competition will be held in conjunction with the AFS MetalCasting Congress in Cleveland Ohio in April. On Monday, April 24 teams will put their spear points through a series of tests. The awards ceremony will be on Tuesday, April 25. Everyone is welcome to attend the competition and awards ceremony.

SFSA is once again collaborating with the Foundry Education Foundation (FEF) for this year’s competition. The team’s spear points will be on display at the FEF booth during the AFS MetalCasting Congress. After the MetalCasting Congress, the spear points will be put up for auction through FEF. All proceeds go toward FEF’s scholarship program. American Foundry Society (AFS) is our presenting sponsor, the Industrial Base Analysis and Sustainment (IBAS) Program run by the Innovation Capabilities and Modernization (ICAM) Office in the Office of the Assistant Secretary of Defense for Industrial policy (ASD IBP), is also a sponsor, and we have three co-sponsors, Investment Casting Institute, MAGMASoft, and Non-Ferrous Founders’ Society.

Remember to join the Cast in Steel LinkedIn group, and follow the Facebook page.

Market News

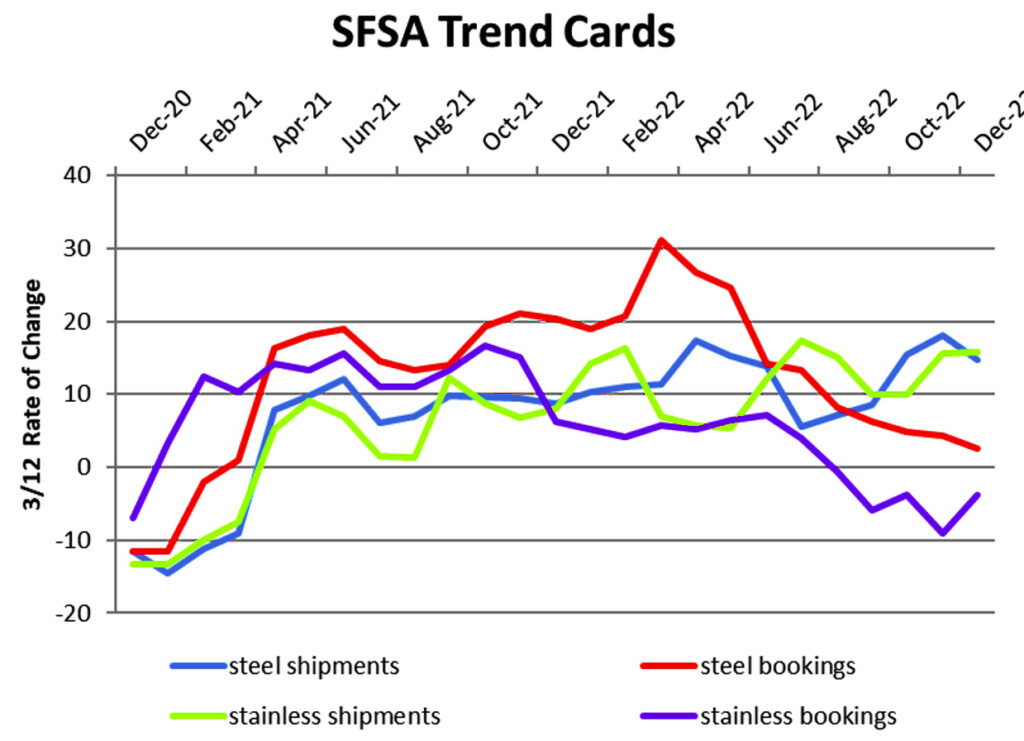

For the December 2022 SFSA trends report, steel casting bookings are near parity to December 2021 and stainless bookings remain below year ago levels since August. Steel and stainless shipments have remained at 15% over year ago levels for the fourth quarter of 2022. The same trend is evident in the Department of Commerce’s numbers for iron and steel casting shipments and orders. Reported backlogs remain constant with the ongoing labor shortage.

ITR recently reported that most of the manufacturing markets will be on the backside of the business cycle, which is slowing growth or recession, for the balance of this year and well into 2024. Current exceptions are US Defense Capital Goods New Orders, which remains in an accelerated growth phase due to an increased defense budget and military assistance to Ukraine. On the other end of the business cycle are US Metalworking Machinery New Orders and US Mining Production (excluding oil and gas), which are now in a recession phase.

Casteel Commentary

Not normal- The Casteel Commentary this month tries to make the case that where we are is not normal; globally, economically, or culturally. We are on an ahistorical unsustainable path which will cause our world to reshape and we need to plan for a future that is different. There is going to be no return to normal. Much of this is documented in Zeihan’s new book, The End of the World is Just the Beginning, https://zeihan.com/end-of-the-world/ I am not endorsing all he says but the fundamental trends identified are only part of the unsustainable path that will change.

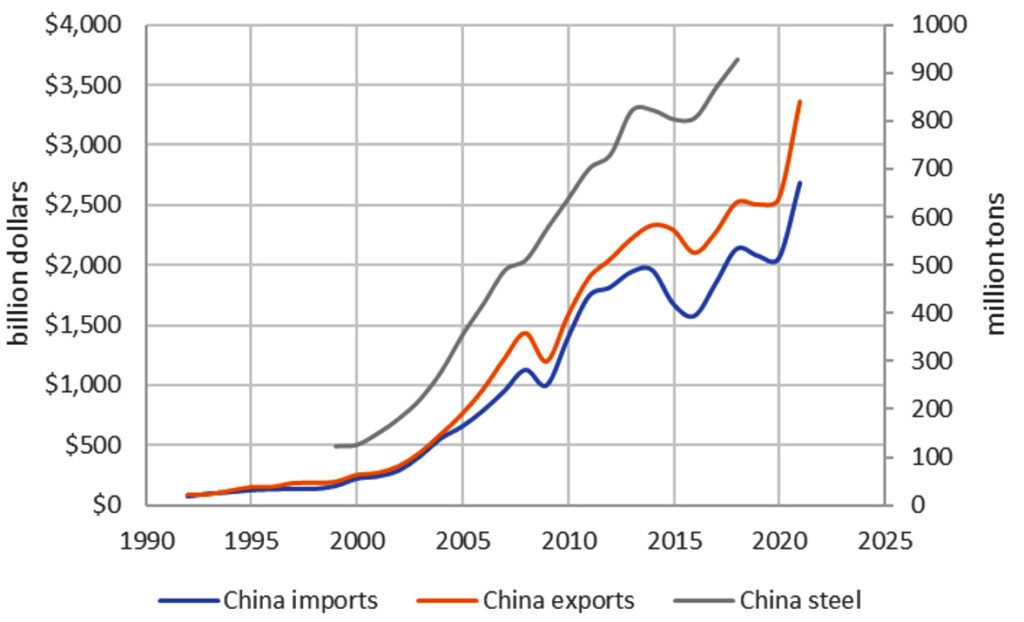

Globalization was an aberration historically and depended on the U.S. as a guarantor of trade, commerce and security. The U.S. did this not as a means for prosperity but as an artifact of the alliance needed to prevail in the Cold War. The world prospered, most regions economically had significant increases in standards of living and many poor regions modernized and urbanized. China was the most aggressive beneficiary aggressively pursuing their economic and national move to become the dominant player not only regionally but globally. This can be seen in their explosion of trade.

China ascended to the World Trade Organization in 2001 and pursued a deliberate strategy to have a dominant position in the ownership and production of the basic industrial materials. This is not based on their raw materials or advantage in low cost energy as can be seen in Figure 1. China imports the raw materials and even their low cost labor was inadequate so their public policy was formulated to enhance trade to prosper and become dominant. The North American public policy thought this was advantageous since it provided lower costs and the hope that China would moderate. This policy was shown to be problematic during the pandemic when North America was unable to get the basic material and equipment needed to respond.

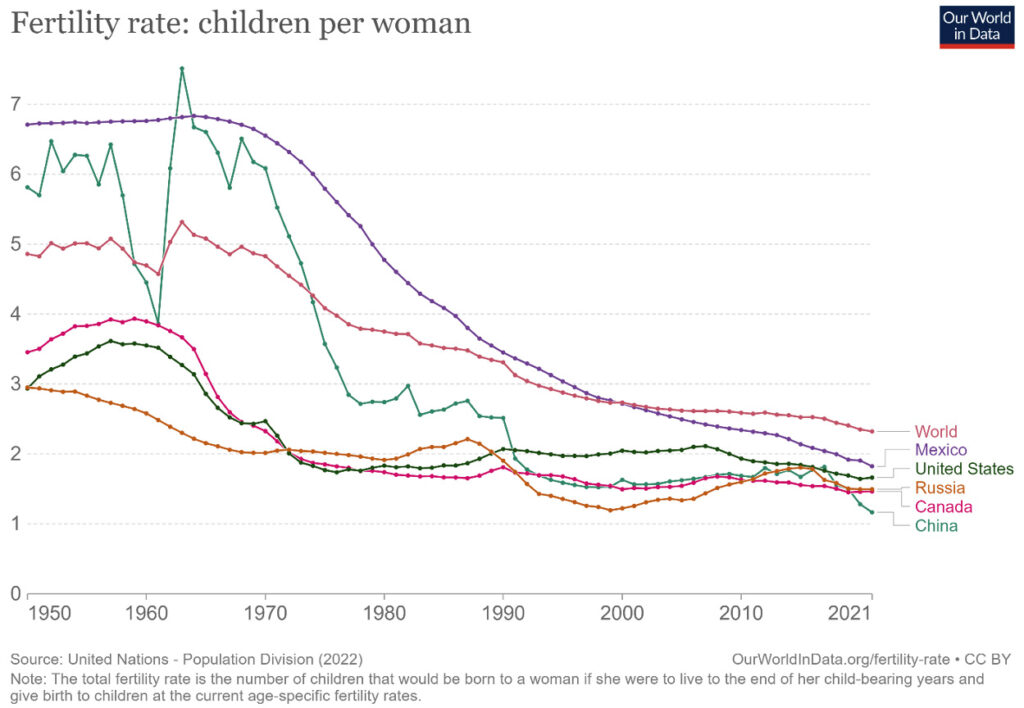

The situation now is even more problematic with Russia’s invasion and war with Ukraine and the return to a more authoritarian state in China. China in particular is investing to become a military peer to North America but faces formidable challenges. Both China and Russia are in the most severe demographic collapse in history seen in Figure 2. (https://zeihan.com/demographics-part-5-the-chinese-collapse/) This year deaths in China outpaced births by 800,000 according to China’s own numbers.

The withdrawal of the U.S. from providing security to global shipping and trade, the integrated trading system ideal sought by policy makers becomes untenable. ( https://zeihan.com/deglobalization-theres-no-stopping-it-now/)

North America is not immune to the demographic challenges, as also seen in Figure 2. Mexico is likely to become the most vibrant manufacturing sector in North America with a younger population and higher fertility rate giving them more workers than the U.S. and Canada. The U.S. as the dominant economy in North America is on its own collision path with destiny. Our economic trajectory is unsustainable.

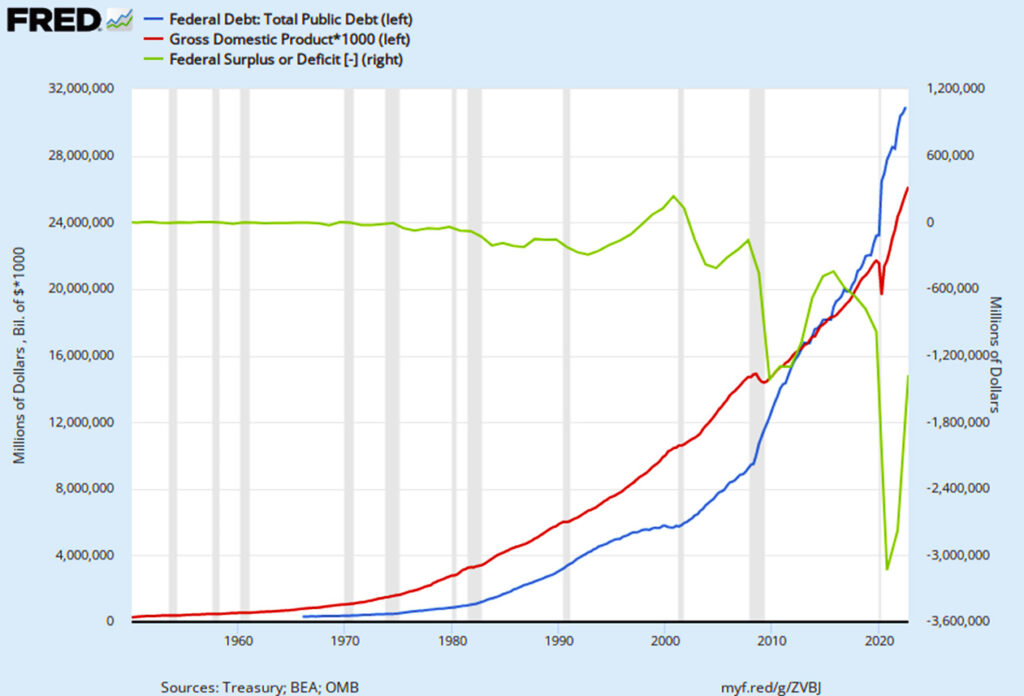

Historically, especially after the great Depression, the U.S. had a disciplined economic policy to maintain a stable dollar and strive for a balanced budget. After 1971, the U.S. went off the gold standard for currency and the Federal Reserve tried to manage the business cycle resulting in the stagflation of the late 1970s. The combination of excess investment in goods and capital infrastructure because of this distortion, our industry was challenged with price stability while inflation reduced the value of our products relative to the bulk of the economy. Regulatory burdens, globalization and other costs imposed by public policy decisions made it difficult to succeed in our industry and led to an ongoing reduction in the number of plants and our capabilities.

While policy makers assume that capital intensive industries like our are not thriving because we are not efficient or capable, the reality is that the framework of public policy and the cultural naivety of our educated decision makers have placed a burden on us. This is exacerbated by the neglect of the rise of China as a peer competitor and the irresponsible buplic policy abandoning the disciplines of ordinary financial management.

Our current policy and budget will not continue, there is not enough money in the world. As seen in Figure 3, deficits in the budget became constant after 1980 and with the pandemic became unbelievable. This cannot end well.

Medicare taxes were put in a trust fund since the program collected more in taxes than it spent but the expectation for 2023 is that the taxes are $412.6 billion and the cost is $415.6 billion for a deficit of $3 billion. The same story is rapidly approaching for Social Security that will exhaust its reserves in 2034. The number of workers per beneficiary is rapidly approaching 2 to 1.

On the other hand, we are in a unique position to reset our industry. The supply chain concerns about our capability to support the requirements for national security, adequate energy and infrastructure is driving policy makers to begin addressing both the financial and workforce challenges we face. There are likely to be policies more corporatism type collaboration which will make our nosiness challenges different. Developing and maintaining connections with policy makers and government entities will be essential. The Government spending in North America exceeds 35% of the economy. They are an un-ignorable player.

In addition, given the arbitrary complexity and rapidly changing cultural whims, success will, I believe, depend on making and honoring personal relationships. The North American economy was blessed to have a structure where assuming honest suppliers and customers was taken for granted. Legal policy was intended to enforce the expectation of honest and fair dealing. Unfortunately that is rapidly fading and our future will depend on having friends across the enterprise that we can trust and who trust us.

Things will change rapidly, and we must be sensitive and clever to take advantage of changes and work to ensure our plant, team and place in the economy is robust, diversified and profitable.

Raymond

| STEEL FOUNDERS' SOCIETY OF AMERICA BUSINESS REPORT | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| SFSA Trend Cards (%-12 mos. Ago) | 12 Mo Avg | 3 Mo Avg | December | November | October | |||||

| Carbon & Low Alloy | ||||||||||

| Shipments | 12.1 | 14.7 | 6 | 16.3 | 22 | |||||

| Bookings | 13.5 | 2.5 | 1 | 1.6 | 5 | |||||

| Backlog (wks) | 14.3 | 13.7 | 12.8 | 15 | 13.3 | |||||

| High Alloy | ||||||||||

| Shipments | 11.2 | 15.8 | 5.5 | 20 | 22 | |||||

| Bookings | 0.8 | -3.8 | 2.5 | -20 | 6 | |||||

| Backlog (wks) | 12.7 | 11.1 | 11.2 | 10 | 12 | |||||

| Department of Commerce Census Data | ||||||||||

| Iron & Steel Foundries (million $) | ||||||||||

| Shipments | 1,482.30 | 1,495.00 | 1,492 | 1,485 | 1,508 | |||||

| New Orders | 1,518.80 | 1,514.70 | 1,495 | 1,530 | 1,519 | |||||

| Inventories | 2,682.50 | 2,775.30 | 2,790 | 2,780 | 2,756 | |||||

| Nondefense Capital Goods (billion $) | ||||||||||

| Shipments | 81.6 | 84.8 | 85.1 | 85.1 | 84.2 | |||||

| New Orders | 87.7 | 91.7 | 100.6 | 84.3 | 90.2 | |||||

| Inventories | 212.4 | 216.8 | 218.9 | 216 | 215.5 | |||||

| Nondefense Capital Goods less Aircraft (billion $) | ||||||||||

| Shipments | 74 | 75 | 74.6 | 75.1 | 75.2 | |||||

| New Orders | 74.6 | 74.9 | 74.9 | 74.9 | 75.1 | |||||

| Inventories | 147.3 | 152.1 | 153.1 | 152 | 151.3 | |||||

| Inventory/Orders | 2 | 2 | 2.05 | 2.03 | 2.02 | |||||

| Inventory/Shipments | 0 | 2 | 2.05 | 2.02 | 2.01 | |||||

| Orders/Shipments | 0 | 1 | 1 | 1 | 1 | |||||

| American Iron and Steel Institute | ||||||||||

| Raw Steel Shipments (million net tons) | 7.5 | 7 | 6.9 | 6.9 | 7.2 | |||||