After watching both party’s conventions and hearing the promises made by their respective nominees, I thought it would be appropriate to review additive manufacturing in this months Casteel Commentary. Like the promise to end wars on the first day in office or to being peace in the Middle East, policy makers and business leaders believe that additive manufacturing (AM) will solve the challenges of manufacturing needed to secure our economic and national security. Like those promises for immediate and complete solutions, AM is not and will never be that capable. Like whoever is elected may make limited progress to improve the issues they care about, this side of heaven, there are no immediate or final solutions. AM will play an important role in future design and manufacturing but will not displace current methods and will increase production of and not replace castings.

Table of Contents

SFSA Safety Awards

It is time to participate in the SFSA Safety Award Program! To be eligible for safety awards, participants must report a safety record DART for 2023 that is equal to or less than 2.0. This is the composite average for all manufacturing industries. We will be awarding “Perfect” and “Outstanding” awards.

If you’re 2023 DART rate is 2.0 or lower, you need to fill out the online application no later than September 9, 2024 to be eligible for a safety award. Member companies achieving a safety record less than or equal to 2 will receive a certificate; companies achieving a perfect record with a DART Rate of 0 will receive a plaque. Safety award recipients will be recognized during the SFSA T&O Conference in December.

Application URL: https://www.surveymonkey.com/r/SFSA_SafeT_24

Research Review

SFSA held its annual Research Review on July 9-11 as an in-person event. There were 78 attendees, including 18 industry members supporting the Carbon & Low Alloy Research Committee and the High Alloy Research Committee. This year’s review covered select research under the DID, AMC ICT, SPI, and STAR programs. Like last year, this year’s review included a Design Day. With the support of the Carbon & Low Alloy Research Committee and the High Alloy Research Committee, research projects to be featured at the T&O have been selected.

The research portfolio is working towards 5 main objectives: Advanced High Strength Steels, Quantitative Nondestructive Testing, Process Driven Performance Modeling/Fitness For Purpose, Hybrid/Advanced Manufacturing Technology, and Industry 4.0. The Research Review covered all 5 main objectives with 38 presentations from 21 different organizations.

Technical & Operating Conference

Mark your calendar – the T&O Conference will be held in Chicago December 12-14, with a member workshop on Wednesday December 11.

SFSA EHS/HR Meeting

Save the date: Please plan to attend the SFSA EHS & HR Group Meeting on October 22-23, 2024 at the Hampton Inn & Suites – Spokane Valley in Spokane, WA. This meeting is a great opportunity to learn from your peers on many topics including Engaging the next generation workforce, recruitment and retention strategies, furnace safety best practices, EHS regulatory and enforcement update, and more. Attendees will also tour two SFSA member foundries – Spokane Industries and WearTek. Additional details and registration information will be available soon.

US EPA Releases Final Formaldehyde IRIS Assessment

On Aug. 19, the EPA posted the final Formaldehyde IRIS Assessment to the EPA’s website: IRIS Toxicological Review of Formaldehyde (Inhalation) (Final Report, 2024) | IRIS | US EPA. Despite all of the comments and criticisms of the underlying assessment, the final assessment largely retains EPA’s original conclusions and the IRIS values are unchanged from the draft. The American Chemistry Council issued the following press release: EPA’s Final Formaldehyde IRIS Assessment Ignores Peer Reviews and Best Available Science – American Chemistry Council. The final formaldehyde TSCA risk evaluation is expected by year end and remains to be seen how EPA will apply the findings from the IRIS assessment. The ACC will continue to reinforce why the formaldehyde IRIS assessment is not appropriate for the ongoing TSCA and FIFRA assessments or any science-based regulatory process.

Cast in Steel 2025 Competition

Excitement is building for the Cast in Steel Competition, coming to Atlanta, Georgia, from April 9-11, 2025!

Has your foundry already partnered with a team in previous years? Fantastic! If you haven’t already joined the fun, now’s the time. Your support can make a difference in helping students excel in this thrilling competition. Let’s team up and make this year’s event the best one yet!

This year’s challenge? University students will use modern casting tools to design and produce a functioning replica of one of George Washington’s actual swords—or create a design based on his known preferences and needs. Here are the specifications for the sword:

- Weight: Must not exceed 2 kg (4.4 lbs.).

- Length: Must not exceed 1 m (40 in) in overall length.

If your foundry is interested in partnering with a team for this exciting competition, please contact Raymond Monroe at monroe@sfsa.org or Renee Mueller at rmueller@sfsa.org.

For more detailed information about the competition, click HERE.

Casting Dreams Competition

In addition to the Cast in Steel competition, SFSA has created a metalcasting competition for students ages 14-18. Castings can be made from any metal, and can be any student-made cast metal object that fits in a certain size mailing box and under a weight limit (10lb for the 2024 competition). More information can be found here: https://castingdreams.org. Modern Casting magazine featured an article about one entry that an AFS member felt a special connection with – https://www.qgdigitalpublishing.com/publication/?i=827398&p=58&view=issueViewer

AFS Environmental, Health and Safety (EHS) Conference

The 2024 AFS Environmental, Health and Safety (EHS) Conference will be held at the Amway Grand Plaza in Grand Rapids, Michigan on Oct. 1-3. The conference brings together leading experts and peers to discuss the latest developments, innovations, and best practices in foundry EHS. For more information, visit: https://www.afsinc.org/conferences/36th-environmental-health-and-safety-conference

Market News

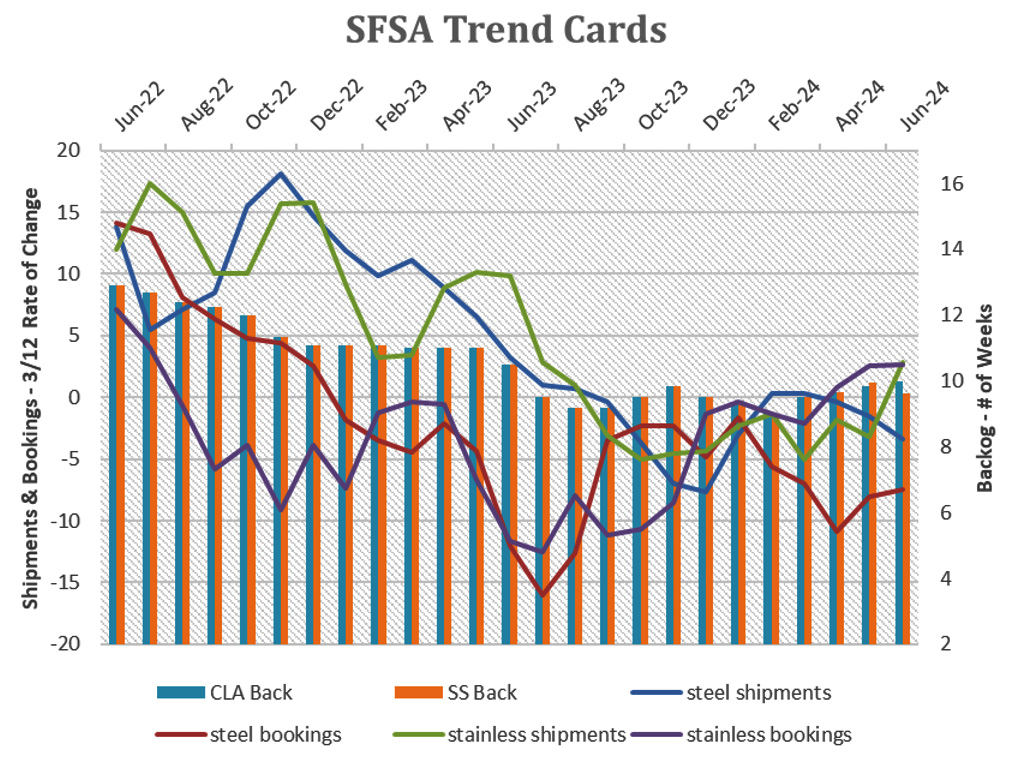

In June, YoY steel casting bookings continue to trend upward while shipments are trending downward with both below year ago levels. YoY stainless bookings and shipments were at parity with June 2023 levels and the 3/12 for both around 3% above year ago levels. Steel and stainless backlogs continue to trend closer to year ago levels. The YoY for carbon and low alloy steel is -4.76% and stainless is -8.75%.

The SFSA Marketing Committee is working on the 2025 SFSA Market Forecast. The committee would appreciate receiving your input on the markets that you serve in support of the forecast. Please take a moment to complete the market forecast survey: https://www.surveymonkey.com/r/4cast2025. Responses are kept confidential and will be aggregated with other member responses.

Casteel Commentary

Within the DOE, NIST and DoD, AM is seen as an essential new technology to reduce the challenges of acquiring castings necessary for the infrastructure and equipment we will need to maintain and modernize our world. The reality is that AM is a great benefit for specific needs and is a great innovation that will increase the performance and use of castings but will not make a meaningful impact for decades in ordinary manufacturing production.

The desire to identify how AM can help address the current concerns about steel casting supply and capability, there have been a number of strategy/road mapping sessions:

- NIST sponsored EWI to develop a roadmap, https://ewi.org/introducing-a-u-s-roadmap-to-accelerate-production-of-large-structures-and-systems/

- America Makes developed a roadmap, https://www.americamakes.us/wp-content/uploads/2023/11/AM-Technology-Roadmap-for-Casting-Forging-Roadmap-OCT23.pdf

- OSD IBAS in their ICAM office is supporting the forging and casting industry to address current concerns about supply chain robustness. Castings and Forgings have been identified in the DoD response to EO 14017 in https://media.defense.gov/2022/Feb/24/2002944158/-1/-1/1/DOD-EO-14017-REPORT-SECURING-DEFENSE-CRITICAL-SUPPLY-CHAINS.PDF

All of these efforts include significant efforts to use AM to supplement castings to ensure manufacturing readiness, but….

Ironically, castings in many ways are the original information technology. The current rapid development of artificial intelligence depends on new hardware replacing the traditional central processing unit (CPU) with a graphics processing unit (GPU). This is a recognition that one way to understand information is to see that it is a data set in n-dimensional space, a shape. Castings have been making shapes since the beginning for over 5,000 years so we are likely the oldest metal making information technology. The oldest casting found is a bronze frog from before 3000 BC. Today a cheap pound of steel is about 30 to 50 cents compared to steel castings which are 3 to 5 times as expensive. When you buy a casting, you are buying the value of the shape, the information. Patterns are an information tool, a program, that can be used to create that geometry and provide that value repeatedly.

Steel was also the critical material for the early information tools. The steel needle for a compass was introduced for navigation over 1000 years ago. Modern steel melting was advanced by Huntsman over 250 year ago in the crucible steel process so that springs for clocks could be higher quality and keep more accurate time.

One method of AM is direct energy deposit (DED) which arc melts a wire or a powder to provide the metal, a welding process. Steel foundries have been using AM DED (welding) for over 100 years and the first ASTM specifications on welding steel castings A27-39 included in 13(b) provisions for welding to replace non-compliant material and additively replace it to create the features required. ASTM 216 was adopted in 1939 and is still active and the title includes the phrase, “suitable for fusion welding”.

The foundry industry was an early adopter of AM for patterns and tooling. A paper in 1991 in Modern Castings highlighted the use of STL for creating patterns for investment castings. Early approaches included making patterns from glued layers of paper with the shape printed out cutting the paper with a laser. Sand printing has become an ordinary commercial technology widely adopted and used.

Steel foundries will gain a significant market opportunity as a result of the popularity of AM for the next generation of engineers. Traditional engineering with 2D drawings and limited ways to analyze performance resulted in engineers that were comfortable designing structures and equipment out of standard shapes machined and welded together. As kids, they would have learned to build things like assembling a puzzle out of pieces using Tinkertoys or Erector sets. 3D printing will enable the current designers to use topography optimization to create unique geometries. These geometries will be printable, but the economics and performance needed will drive these new geometries to be made as castings. An example of the is the development of Giga-castings by TESLA to increase performance and reduce cost.

Printed molds also enable steel casting producers to manufacture more than one alternative design without the time or cost of tooling that allows designers the ability to meet schedule and evaluate alternative including radical ideas. The traditional casting development cycle was crippled by the time and cost of tooling during the design and development of new systems.

AM metal parts have a real role in the future in prototype production, small parts in isolated settings where the supply chain or storage of spares is impractical or costly, or for unique materials and composite structures that are only obtainable by advanced additive methods. To understand AM it is necessary to understand the two dominant methods of manufacturing. Laser powder bed fusion (LPBF) prints a layer of metal dust at a time and is slow and the powder is expensive and limited in materials that are available. But this technique allows constitutionally graded materials and fabrication of expensive elements. Refractory metals for high temperature applications is an example. The alternative method for larger shapes is DED which is basically making the component from weld metal. It results in a rougher surface and would require finishing and post processing not unlike castings. Both processes can make capable parts but verifying the properties and part quality remains under development.

This is another benefit for steel castings because the verification of material properties and part quality face many of the same challenges that are present in castings. New ways of justifying and qualifying AM parts should be transferable to castings and allow more meaningful processes and tests to use castings. This should allow higher performance by reducing the excessive factors of safety traditionally required by casting designers and users.

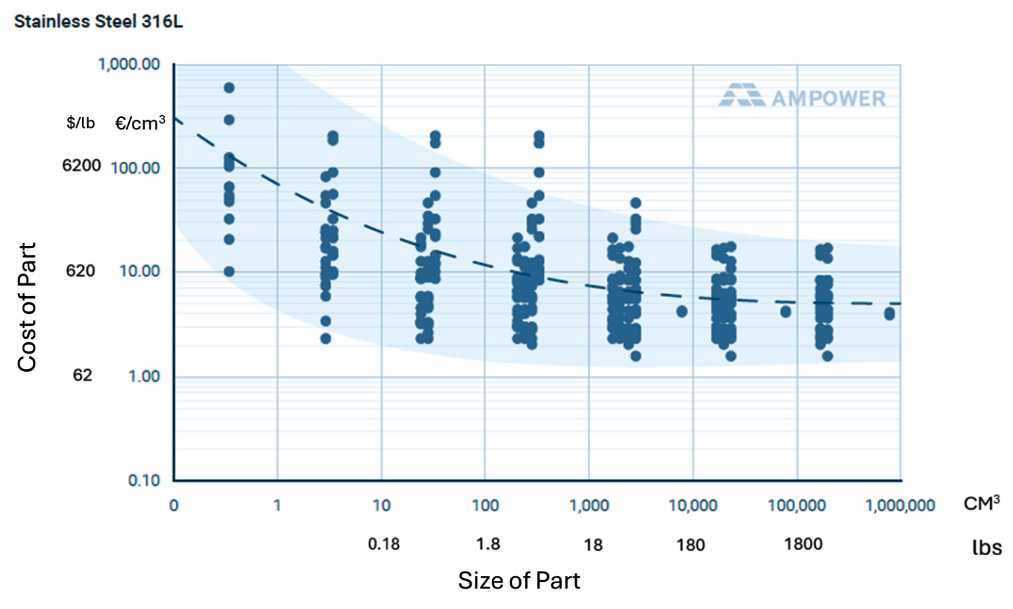

A fundamental challenge of AM is the cost and efficiency of making the powder or wire required for the process. Many of the benefits of time, flexibility or energy efficiency are artifacts of ignoring the process of making the powder or wire. LPBF components today are an order of magnitude more expensive than investment casting. The cost for 316L, the most common and low-cost powder used for LPBF, is shown in Figure 1.

The lower end cost per pound based on this graph is over $100. The largest LPBF platform listed had a size capability of less than 30 in.

The alternative and only current method for larger parts at scale is DED or some variation of welding technology to produce the part. The reported cost for large components is $50 a pound for production. As casting suppliers for large components know, the direct cost of material in the part is less than half the total cost which needs finishing and inspection. Large scale parts require costly infrastructure to lift, move and process the part. Finishing requires the same type of operations in DED that castings need, heat treatment and machining. DED surface finishes require that same type of finishing as castings to meet dimensional and surface quality requirements.

Most weld procedures result in the deposited material have different properties than the base material. One rule of thumb that steel foundries used was that the casting might not achieve all of the same properties as the mill products, as long as the performance exceeded the welds, the casting was qualified. A fundamental challenge for large structural DED AM components is how do you qualify the properties of the material? Where and how many samples must be tested? What orientation? How to handle the variation in wire or powders used for production?

Much of the challenge of large-scale additive has not grappled with the bigger commercial and acquisition challenges for these type components. Here is a submission to OSD outlining the challenges of using AM for casting applications. As a part of the NIST roadmap sessions, I provided the following input to make the case that large, fixed location steel structures with complex geometries will be cast.

When a large steel structure has shape, casting quickly becomes the only economic and structurally capable method of production. There are a number of critical components that are made in forgings for safety and reliability when smaller but must be made as castings when larger, frames for mining trucks, hooks for large cranes, etc.

When making components of more than 10 tons, castings quickly become the only realistic option. Additive would require melting more than the 10 tons on steel, forming wire and then re-melting to DED produce the part. All steel components start by casting, we make them all from liquid steel heats. When we use steel as a material in a standard product form, most of our cost is making the shape including welding to assemble components. Castings cost about 2 to 5 times the cost of the material but that is often less than machining or fabricating the shape needed. Castings are an information technology, providing the complex geometry needed for performance. Fabricated large sections often put the welds in the location with the highest load demands for the structure.

Large steel components are mostly in a fixed location, so the weight is not the main driver for performance or cost. Steel castings can be made of an easily weldable grade that has predictable properties and well-developed design and inspection methods. Large active components like large ship drive shafts are made from forgings to gain fatigue performance and weight targets but structural components in fixed locations can use an overdesigned casting and get enhanced performance at lower costs. It is unlikely to be able to make that much wire, remelt it in DED, make and inspect the part, and resolve the schedule, cost and performance issues.

AM is a great step forward that provides significant opportunities for steel castings. The ability to design and evaluate complex shaped parts, the ability to produce alternative design concept parts in a timely and cost-effective way, and the excitement of the new technology that we can use all makes this an asset more than a threat.

Raymond

| STEEL FOUNDERS' SOCIETY OF AMERICA BUSINESS REPORT | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| SFSA Trend Cards (%-12 mos. Ago) | 12 Mo Avg | 3 Mo Avg | June | May | April | |||||

| Carbon & Low Alloy | ||||||||||

| Shipments | -2.8 | -3.4 | -10.3 | -1.5 | 1.8 | |||||

| Bookings | -5.7 | -7.4 | -7 | -3.8 | -11.5 | |||||

| Backlog (wks) | 10 | 10 | 9 | 10 | 11 | |||||

| High Alloy | ||||||||||

| Shipments | -2.4 | 2.8 | 0 | 1 | 7.5 | |||||

| Bookings | -3 | 2.7 | 0 | 2.1 | 6 | |||||

| Backlog (wks) | 9.4 | 9.6 | 9 | 9.8 | 10 | |||||

| Department of Commerce Census Data | ||||||||||

| Iron & Steel Foundries (million $) | ||||||||||

| Shipments | 1,644.00 | 1,688.00 | 1,662 | 1,704 | 1,698 | |||||

| New Orders | 1,672.80 | 1,678.30 | 1,601 | 1,685 | 1,749 | |||||

| Inventories | 3,197.50 | 3,197.30 | 3,219 | 3,187 | 3,186 | |||||

| Nondefense Capital Goods (billion $) | ||||||||||

| Shipments | 82.1 | 82.4 | 84.9 | 80.6 | 81.8 | |||||

| New Orders | 87.8 | 77.9 | 65.1 | 84.1 | 84.4 | |||||

| Inventories | 229.1 | 232.2 | 232.5 | 232.7 | 231.6 | |||||

| Nondefense Capital Goods less Aircraft (billion $) | ||||||||||

| Shipments | 74.2 | 74.1 | 74 | 73.9 | 74.4 | |||||

| New Orders | 73.7 | 73.7 | 73.9 | 73.3 | 73.9 | |||||

| Inventories | 162.8 | 163 | 163.2 | 162.9 | 162.9 | |||||

| Inventory/Orders | 2.2 | 2.2 | 2.21 | 2.22 | 2.2 | |||||

| Inventory/Shipments | 0 | 2.2 | 2.21 | 2.21 | 2.19 | |||||

| Orders/Shipments | 0 | 1 | 1 | 0.99 | 0.99 | |||||

| American Iron and Steel Institute | ||||||||||

| Raw Steel Shipments (million net tons) | 7.3 | 7.3 | 7.2 | 7.4 | 7.4 | |||||