History Doesn’t Repeat Itself, but It Often Rhymes – Mark Twain

Table of Contents

Fall Leadership Meeting

There is still time to register for the Fall Leadership Meeting on September 23-26, 2022, at the Grand Hyatt in Vail, CO. SFSA staff and Board look forward to welcoming everyone to this essential meeting for leaders in the steel casting industry to learn, strategize and network.

This year’s business sessions will include presentations from Edison Welding Institute (EWI) on Foundry Automation Opportunities, Chris Kuehl on Economic Outlook for Manufacturers, Neil Elliott on Energy Supply and Policy Update, John DuPont on Challenges and Suggestions for Educating and Recruiting Metallurgical Engineers, Raymond’s State of the Industry, Martha Guimond will provide an EHS Regulatory Update, SFSA market forecast, and an industry roundtable. The Society has also arranged optional group activities for members and spouses which include an ATV tour and Bike Tour of Vail Pass.

Make your plans now to attend – https://sfsa.site-ym.com/event/FLM2022

Note: The hotel room block is nearly sold out. Additional room nights will be subject to hotel availability and prevailing room rates.

76th T&O Conference

The 2022 T&O will be on December 7-10 at the Loews Hotel in Chicago. The conference is the world’s only event on steel casting technical and operating papers, mostly by fellow SFSA members. Sessions will include topics on Next Gen Manufacturing, molding, melting, foundry engineering, finishing quality, EHS, management, technical and featured research. Please contact Dave with any questions.

DLA Casting R&D Video

The Defense Logistics Agency sponsors several programs that support steel casting research. This support over the past couple of decades has helped advance our industry, which in turn sustains domestic manufacturing to enable the casting supply chain. The value from casting R&D, is highlighted in a new DLA video. Thanks to Stainless Foundry & Engineering, MetalTek International, Badger Alloys and Mercury Marine for their support in creating this video.

Steel Casting Research

The July Casteel Reporter introduced SFSA’s research objectives. It also put forward an opportunity for industry to champion research projects by direct involvement in the steering and deployment; thus, obtaining an early and direct benefit from current R&D. In addition, an opportunity to propose new, non-competitive research ideas to SFSA’s research committees. To sponsor a project or submit a research project, please contact Dave. In this Reporter, we highlight our research thrust for Process-Driven Performance Modeling/Fitness-for-Purpose Design (PDPM/FFP). This thrust will develop process-driven performance modeling methodology supported by robust datasets to enable Fitness for Purpose designs. Modeling and simulation for manufacturing coupled with modeling for design results in more accurate and reliable performance. FFP utilizes a fracture mechanics-based design methodology for a given part and material to establish flaw tolerance and requirements for processing. Manufacturing the part to designed material conditions along with Quantitative NDT inspection for the known critical flaw size, shape and location will provide reliable part performance in even the most demanding environments. Research is needed to develop a lower bound property relationship with casting simulation, which needs to be supported with testing and data for mechanical properties and analysis for microstructure characteristics. Research is also needed to provide guidance for designers to characterize quality related to performance. This work will also enable a code-based design approach along with testing of the design methodology to current codes such as BPVC and SINTAP. The following projects are supporting this thrust:

- Characterization and Analysis – University of Alabama at Birmingham

- Correlate the Structural and Microstructural Effects on the Measured Critical Mechanical Properties of a Material – Texas A&M University

- Quantifying the Mechanical Property Differences between Commercial and Premium Grade Martensitic and Ferritic Steels for Commercial and Defense Applications – Texas A&M University

- Heavy Investment Casting Project – Cal Poly Pomona

- Generalized Fatigue Assessment for Steel Castings – Baylor University

- Modeling to Predict Performance and Reliability Analysis – The University of Iowa

- Cast Steel Components for Building Construction (Weld Interface & Casting Quality and Performance) – The University of Arizona

- Casting Surface Effect on Fatigue Properties Testing – Iowa State University

SFSA utilizes a R&D project dashboard to provide an overview and status on activities. To learn more about the above projects, the dashboards are available here. For any additional information, please contact Dave.

Cast in Steel 2023

Mark your calendars for the 5th Annual SFSA’s Cast in Steel Competition on April 24, 2023, in Cleveland, Ohio. The award ceremony will be held in conjunction with the AFS Metal Casting Congress which runs from April 25 – April 27.

You may be wondering what we’re casting this year. This year’s competition will challenge university students to use modern casting tools to creatively design and produce a functioning version of an African Spear Point. The Spear Point will be attached to a standard handle at the competition site for evaluation.

Similar to previous year’s competition, each team will work with a foundry partner. If your foundry is interested in partnering with a team, contact Raymond at monroe@sfsa.org or Renee at rmueller@sfsa.org.

For more detailed information about the competition visit Cast in Steel.

Market News

Second quarter US GDP was slightly below first quarter by 0.23%. Similarly, first quarter GDP was 0.36% below the fourth quarter of 2021. With two consecutive declines, this meets the technical definition of a recession. However, both 2022 quarters were year over year higher than the first two quarters of 2021 at 3.6% and 1.6% respectively. The declines in 2022 GDP are primarily due to the reduction in government spending. ITR is forecasting that GDP will be relatively flat in the coming quarters as rising interest rates and the withdrawal of stimulus are counterbalanced by the financial stability of consumers and businesses. Furthermore, most of the steel casting markets are anticipated to remain in the slowing growth phase well into 2023.

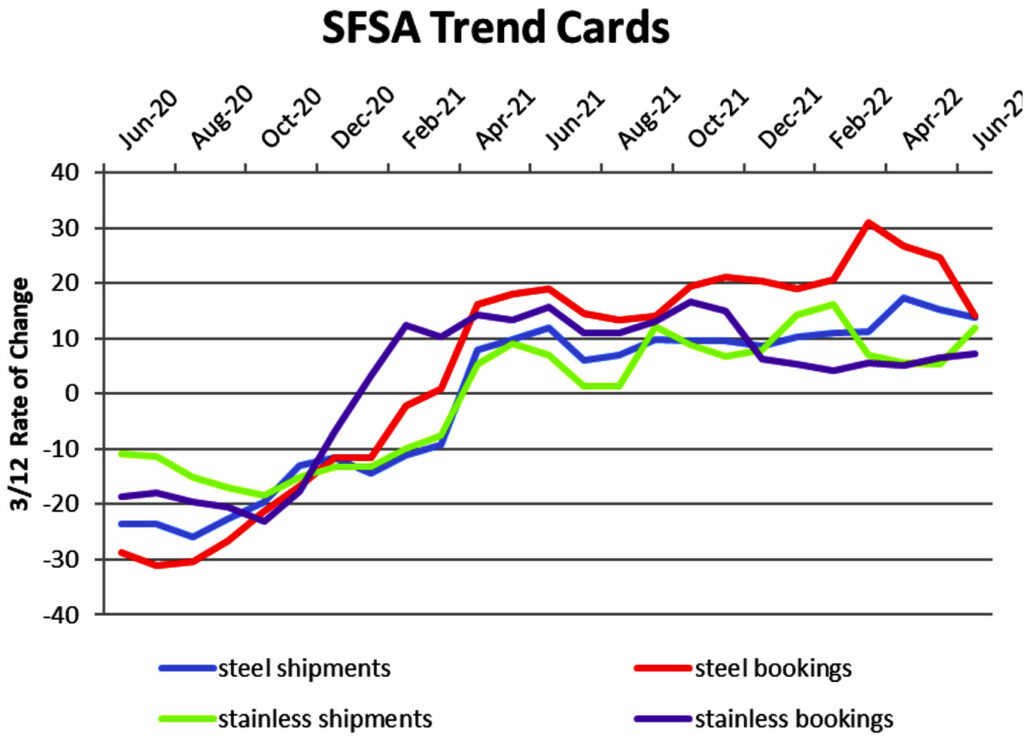

The June SFSA trends posted a further decline in year over year bookings for both steel and stainless castings while shipments were up. Booking and shipments are near parity as evident with the decline in backlog of steel castings at 14 weeks and stainless around 13 weeks. A similar trend can be seen with Department of Commerce numbers shipment and new order numbers for iron and steel foundries and nondefense capital goods less aircraft. AISI reports that steel shipments were down 4% from the prior month but YTD steel shipments are at the same level as 2021 (no change).

The SFSA Marketing Committee will be meeting this month to work on the 2023 Market Forecast which will be presented at the Fall Leadership Meeting next month. An important component to the survey is input from members on their customer markets. A survey is open through next week to collect responses from members. Please be sure that your company participates, the survey is online. Your answers are kept confidential and will be aggregated with other member responses.

Casteel Commentary

History Doesn’t Repeat Itself, but It Often Rhymes – Mark Twain.

For thirty years, since the market collapse of 1982 for steel castings, our industry suffered from excess capacity. Public policy, as cited in prior newsletters, distorted the marketplace, and avoided the liquidation of excess investment through market failures and avoided new investment through globalization and trade policy. The result has been that our North American economy has starved capital-intensive industries like steel foundries from the profits and investments needed to maintain our capability and grow our markets. Little thought has been given to the critical need for our type plants.

Farmers were seen as essential to the economic and national security of the region and public policy was developed to allow farmers to remain profitable. This has allowed us to remain a major producer in global food products.

In contrast, manufacturing was seen as a market driven industrial marketplace and regional producers were expected to compete with global suppliers. North American producers were capable to competing on product value, quality, and efficiency; but we have not been able to offset the costs of trade policy, financial and regulatory structures that penalize us relative to the rest of the world. The liquidation of the excess capacity installed in North America in the 1970s in 1999 through 2003 was followed by a global re-capitalization in 2004 to 2014 like the one in 1965 to 1982. Unlike that re-capitalization, the investment went into the largest growing economic region dominated by China. Global enterprises pushed new investment in that region to gain market position to benefit from the growth as those economies modernized and prospered.

North American producers suffered from excess costs from tax policies, regulatory pressures and cultural bias. Externalities like climate policy and financialization burdened capital-intensive industries and made investments in our industry unattractive to our wealthy investing class.

The need for regional production for both economic and national security was made obvious during the pandemic. China’s investments and market distorting subsidies allowed them to fulfil their national strategy to dominate all the materials needed for a modern economy. Their market distorting policy favored capital-intensive industries while our market distorting policies burdened our plants. The pandemic highlighted this vulnerability when the materials for vaccines and medicines, PPE and ventilators were not available from overseas suppliers or were produced in our regional economy.

Our policies will need to change if we expect to restore our needed industrial capabilities.

We may be forced soon to grapple with these challenges. The geopolitical/military environment is exposing our weakness in manufacturing that is a great concern. The excessive valuations of securities and debt seen by the low rates of return will spill over into inflationary price increases in real goods. As the future becomes less certain, the re-evaluation of the value of future profitability of service industries will likely result in a liquidation of these type assets and an effort to find assets with intrinsic value, like in capital intensive industrial plants. This move will be supported by market conditions, like we have today, where our customers are concerned about our capability to meet their requirements and need to allow pricing that creates the profitability we will need for current and future investments.

While we will be different from the boom of the 1970’s, we will see many similarities. Our production throughput will be the key to growing profitably. More WIP and automation will be normal. Purchasers will be more concerned with our technical capability, production capacity and financial stability than our relative pricing. They will not be indifferent to price but will be compelled to support fully loaded pricing that their suppliers need to remain capable.

One of the fundamental challenges we will face will be to identify the best customers. Like the purchasers looking for capable suppliers, we will need to identify successful customers. We need to find customers that have realistic expectations and collaborate on profitable and sustained co-production.

Many of our customers who have for 30 years had excess suppliers and global strategies will find it difficult to adjust to this more even-handed business environment. Instead of shopping for new suppliers, they will need to find ways to work with capable suppliers to add value and share in success.

While we need to identify the automation and modernization capital investments and have a business framework to realize these investments, we must find customers that support and encourage us to be successful. Our customers purchasing function will need a complete turn around from the Lopez method of bankrupting suppliers to gain market pricing advantages.

We will probably have more than ten years of business that taxes our production capability. Hopefully, public policy makers will change the investment incentives to ensure that our industry along with all the other key manufacturing plants, are able to prosper, invest and innovate for the future.

Prediction is very difficult, especially if it’s about the future. Niels Bohr

Raymond

| STEEL FOUNDERS' SOCIETY OF AMERICA | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| STEEL FOUNDERS' SOCIETY OF AMERICA BUSINESS REPORT | ||||||||||

| SFSA Trend Cards (%-12 mos. Ago) | 12 Mo Avg | 3 Mo Avg | June | May | April | |||||

| (%-12 mos. Ago) | ||||||||||

| Carbon & Low Alloy | ||||||||||

| Shipments | 10.9 | 13.8 | 12 | 3.5 | 26 | |||||

| Bookings | 19.9 | 14.1 | 11.8 | 18.5 | 12 | |||||

| Backlog (wks) | 13.1 | 14 | 14 | 12 | 16 | |||||

| High Alloy | ||||||||||

| Shipments | 9.8 | 12 | 20 | 10 | 6 | |||||

| Bookings | 8.1 | 7.2 | 2 | 10 | 9.5 | |||||

| Backlog (wks) | 12.5 | 12.9 | 12.4 | 12.9 | 13.4 | |||||

| Department of Commerce Census Data | ||||||||||

| Iron & Steel Foundries (million $) | ||||||||||

| Shipments | 1,437.70 | 1,532.00 | 1,535 | 1,533 | 1,528 | |||||

| New Orders | 1,528.60 | 1,542.00 | 1,458 | 1,526 | 1,642 | |||||

| Inventories | 2,524.80 | 2,674.70 | 2,669 | 2,694 | 2,661 | |||||

| Nondefense Capital Goods (billion $) | ||||||||||

| Shipments | 80.1 | 79.4 | 79.7 | 79.9 | 78.6 | |||||

| New Orders | 86.5 | 83.9 | 84.3 | 84.1 | 83.3 | |||||

| Inventories | 206.7 | 211 | 211.9 | 210.8 | 210.1 | |||||

| Nondefense Capital Goods less Aircraft (billion $) | ||||||||||

| Shipments | 74.6 | 72.8 | 73.4 | 72.9 | 72.1 | |||||

| New Orders | 76.2 | 73.5 | 74 | 73.5 | 73.1 | |||||

| Inventories | 141 | 145.4 | 146.5 | 145.4 | 144.4 | |||||

| Inventory/Orders | 1.9 | 2 | 1.98 | 1.98 | 1.97 | |||||

| Inventory/Shipments | 0 | 2 | 2 | 1.99 | 2 | |||||

| Orders/Shipments | 0 | 1 | 1.01 | 1.01 | 1.01 | |||||

| American Iron and Steel Institute | ||||||||||

| Raw Steel Shipments (million net tons) | 7.9 | 7.7 | 7.6 | 7.9 | 7.6 | |||||