What policy priorities should we have for the future? In this month’s commentary, Raymond discusses a number of policy decisions that have hampered the industry’s ability to maintain and expand capacity and considers changes that we should advocate for.

Table of Contents

Specification Committee Meeting

Reminder that the Specification Committee will meet on May 9th in Denver, CO. For more information, please contact Dave.

Next Generation Manufacturing Meeting

Reminder that the NGM group will meet on May 25th in Detroit, MI at the Automate show and in conjunction with SwRI’s ROS-I consortium annual meeting. For more information, please contact Dave.

77th Technical & Operating Conference

The 2023 T&O Conference will be on December 6-9 at the Loews Hotel in Chicago. If you would like to recommend a topic and presenter, please contact Dave.

Research Review

Please save the date for the annual SFSA Research Review which will be held on July 18-21. The meeting is planned to be in-person at Rosemont, IL. This year’s review will cover DID, ICT, and steel casting related SPI projects. Additional details to follow. For any questions, contact Caelan Kennedy

DOE FOA

The U.S. Department of Energy’s (DOE) Advanced Materials and Manufacturing Technologies Office (AMMTO) has a funding opportunity announcement targeting large near net shape components for a clean economy. Successful projects will develop manufacturing technologies to fabricate a full-scale metallic component with a weight over 10 tons (20,000 lbs.) that is relevant to carbon-free power generation or clean energy manufacturing. Manufacturing sectors of interest include those critical to U.S. economy, such as clean energy generation, transportation (freight and passenger), industrial machinery, heavy equipment, and domestic infrastructure.

The full funding opportunity announcement can be found here. Concept papers are due by 5/11/2023.

Students Seeking Foundry Internships

SFSA recently reached out to more than 200 students participating in this year’s Cast In Steel competition to invite them to submit resumes if they are interested in an internship or career opportunity for Spring graduates. Candidates will be posted on the Future Founders portion of the SFSA website at: https://www.sfsa.org/graduates/. SFSA has already received resumes and anticipates several more from the competition this month.

Cast in Steel 2023

YOU’RE INVITED

to the 2023

CAST IN STEEL COMPETITION

Featuring African Spears

Join us, along with teams from

32 universities for the

COMPETITION

Monday, April 24th

1:00 pm – 5:00 pm

Hilton Cleveland Downtown

100 Lakeside Avenue E

Cleveland, OH 44114

Room: Hope Ballroom

and the

AWARDS CEREMONY

Tuesday, April 25th

8:30 am – 9:30 am

Huntington Convention Center of Cleveland

300 Lakeside Ave. E

Cleveland, OH 44113

Room: 26ABC

Stop by the FEF booth at the Metalcasting Congress on Tuesday afternoon to see all the spears on display

Member Interns: Peaslee & Schumo Scholarships

Recruiting students to join our industry and grow into leadership positions remains a critical need in the steel casting industry and a strategic initiative of the Society. The Steel Founders’ Society Foundation aims to attract the next generation workforce by providing scholarships to student interns. To compete for the scholarships, interns are required to work at a member foundry and carry out a specific task or investigation. Selected works are presented at the annual T&O conference. If you currently have or plan to have an intern work at your foundry in 2023, be sure to encourage them to submit a paper and presentation to Renee Mueller (rmueller@sfsa.org), by August 18. Find out more about the scholarships at https://www.sfsa.org/scholarships/.

Market News

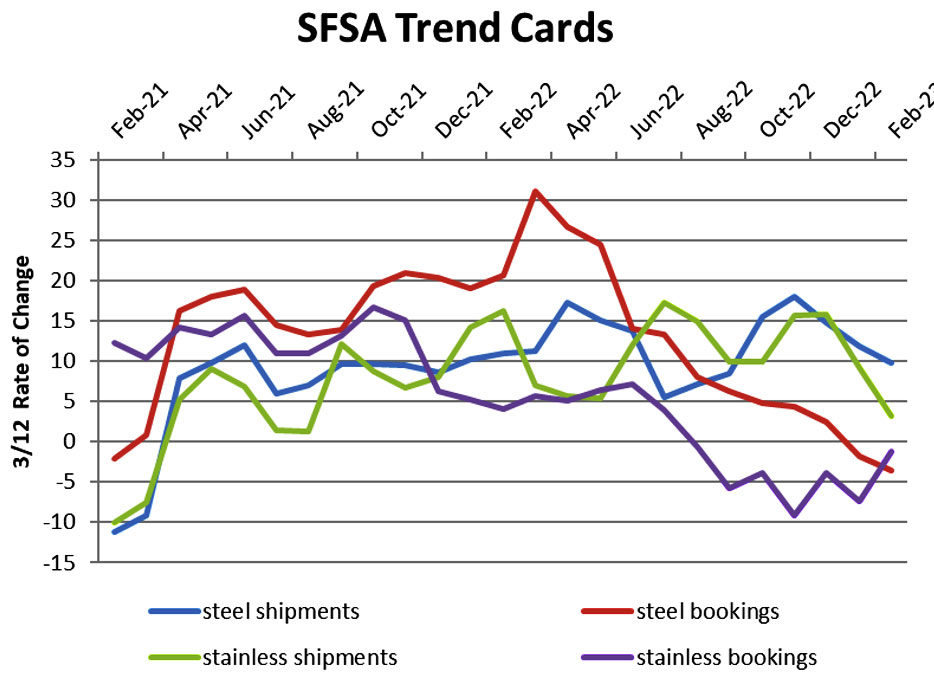

The February SFSA trends report shows stainless and steel bookings remaining below year ago levels, with stainless trending towards positive territory while steel continues its downward trend. Similarly, steel and stainless casting shipments continue to trend downward. Nearly 85% of members surveyed anticipate that bookings will either be flat or decrease in the next three months. In terms of workforce, nearly 60% of respondents reported that they do not anticipate expanding their workforce in the next three months, the highest percentage since December 2020.

ITR Economics lowered their outlook for the US Mining Production (excluding oil and gas) 12MMA by 3.5%, 4.8%, and 4.1% for year-ends 2023, 2024, and 2025, respectively based on Federal Reserve Board revised data. In addition, the forecast for US Heavy-Duty Truck Production was downgraded by 15.0%, 12.0%, and 17.5% for year-ends 2023, 2024, and 2025, respectively. This downgrade is attributed to high interest rates and economic uncertainty are overshadowing pent up demand. They are predicting that production will peak mid-2023 and then decline into early 2025.

Two manufacturing sectors tracked through ITR Trends remain in accelerated growth of the business cycle, US Defense Capital Goods New Orders and North American Light Vehicle Production. Most of the other manufacturing sectors are forecasted to end 2023 on the back side of the business cycle, either in slowing growth or recession.

Casteel Commentary

For more than 4 decades, since 1982, our steel casting industry along with other capital-intensive manufacturing has suffered. Markets have been volatile, globalization has substituted imports for domestic production, increasing regulatory costs and liabilities, cultural opinions, etc. have limited our ability to operate profitably enough to modernize. While we remain competitively efficient and capable of high-performance valuable products, market conditions that have been the result of policy choices have resulted in the decline of our capability. We have sufficient capacity to meet the current volume, but have not had the resources, the capital, to modernize, automate and innovate for the needed future production.

This challenge is now beginning to be recognized by policy makers, financial experts and national security leaders. As discussed last month, China took advantage of gaining free trade access to subsidize and prioritize their economic status to dominate the industrial materials and components necessary for economic and national security. Rebuilding a dominant national security and pursuing other policy objectives like climate impact will require domestic capability. Because of SFSA’s unique role in defense and industrial communities, we have and may have more influence in changing the policies to make our industry profitable and sustainable. Germany has done this in a high cost and limited resource environment and in North America we are better situated to succeed.

One aspect of our challenge is that while manufacturing has grown over these decades, the growth rate was less than the economy as a whole and improvements in efficiencies reduced the number of workers needed. This means that we are a smaller part of the economy, manufacturing and trade are around 9% of the U.S. economy and Government is around 35%. The ability to succeed in manufacturing is held captive to public policy. One indication of the challenge we face is the foreign ownership of many of the U.S. capital-intensive industries. The U.S. has a surplus of investment capital and yet North American capital-intensive industries are not attractive for domestic investment.

Given the current concerns about economic and national security, there are questions about what policies have limited our industries, like steel foundries, to be profitable enough to attract capital. I need your help in identifying the policies and proposing some paths forward. What policies and practices have limited our ability to invest?

- Globalization – Allowing multi-national OEMs and even government agencies to exploit the world trade system to distribute their purchase needs globally without an adequate system to enforce market disciplines allowed nations to pursue mercantilist policies to gain market dominant positions not based on economic efficiencies but on policy objectives. Global trade based on free trade agreements were not designed to facilitate market discovery of value with the most capable producer profiting but on economic goals to support favored industries. The U.S. favored service industries as being larger in the economy, more economically important and culturally attractive. Trade laws are intended to limit market distorting unfair trade practices, but the current system is unable to respond to small, advanced manufacturing markets that rapidly change. Even in traditional markets, enforcement is slow, costly, and corrupted by cheating. In domestic markets, legal oversight is necessary to ensure honest markets. No mechanism is in place to oversee trade to ensure that market forces and not trade policies determine the best suppliers.

- The trade remedies of anti-dumping and counter-vailing duties need an expedited affordable process to allow high value, advanced manufacturing access and quick resolution.

- Externalities that are costs carried by domestic suppliers must be considered at the border to ensure that market prices reflect manufacturing capability.

- Nations that abuse the system to gain dominant positions based on policy objectives and not product value and production efficiency must be limited to thwart their effort to eliminate native producers.

- Currency values matter and the U.S. dollar as the world’s currency gives global traders an advantage in importing to the U.S.

- Tax Policy – Traditional tax policies created during the industrial revolution when manufacturing was the engine of economic success and technology evolved slowly need to be changed to respond to modern conditions. Differential treatment of expenditures for capital equipment compared to other costs burden manufacturing and limits interest in investing and owning these facilities. Leasing of capital equipment is a symptom of the economic inefficiency of requiring purchasers to depreciate this equipment rather than allowing the full deduction of the cost at the point of purchase. Purchases are made in years that are profitable and depreciation may not be fully realized until firms have loss years.

- Depreciation should give way to full expensing of any cost and treat equipment purchase like any other legitimate expenditure.

- Other tax policy items

- Regulatory Costs – The current system of regulations for environmental, health and safety are inefficient and cumbersome. They impose a legal liability on manufacturing that is unlike other liabilities making capital investment. The performance of the industry has been remarkable but the regulatory agencies continue to tighten the rules with little evidence that the tighter requirements will improve performance in health, safety or environment. The current methodology creates a creeping continuous increase in cost and liability with no clear way for compliance. The rules are often unworkable and are “implemented” in a way that allows current producers to operate with procedures deemed “practicable”.

- Environmental regulations should provide a tax rebate for the best performing sources that must be used for capital investment in domestic facilities.

- Emission limits should be normalized to epidemiological levels of proven harm. Continuously adding cost to gain marginal performance makes future profitability uncertain and increase liability for producers.

- Liability needs to be manageable for manufacturers through some type of insurance or compliance audit to allow rational investment and management.

- Rules need to be consolidated and rationalized to create a clear set of reports, compliance dates and safe harbor practices.

- Externalities – Government policies are externalities that if used to ensure market competition are required. Most policies are not directed in the manufacturing world at market oversight to ensure competitive transactions based on production prowess and product value but to address other values. Some are ancillary to production like environmental rules for domestic producers while allowing imports from global suppliers that do not have the same constraints. Required contributions for social programs, unpaid time off, minimum wages, etc. all are externalities that may be good policies but make domestic producers challenged when global suppliers not compliant are allowed access with no border adjustment. Government is more than three times the size of manufacturing and policy is a bigger factor in global trade and domestic profitability than manufacturing capability. By any objective measure of efficiency or product value, U.S. producers are competitive with any producers in the world. Their imported products are below the cost of manufacturing in the U.S. market not due to poor management or some efficiency or resource advantage, it is due to national priorities and policies.

- Workforce – The myth that we could exist in a post-industrial world as if we exist in a post-agricultural world was exposed as dangerous by shortages in the COVID pandemic. The breakdown of the global economy based on potential conflicts and geopolitical challenges highlighted the need for capital-intensive manufacturing for national and economic security. Like the need to ensure that public policy sustains a viable farming capacity, manufacturing is necessary as well. The cultural idea that a career in manufacturing is a failure instead of vital is self-defeating. Our current policies encourage and subsidize young people to vocations outside of manufacturing. To have the workforce we will need and to give the next generation the purposeful and meaningful opportunity to be engaged in making the products necessary for our lives, we need to balance our investment in the future by providing starting financial support not only to post-secondary paths but also vocational paths.

I hope these ideas catch many of the policy priorities we need to advocate for the future. I would appreciate your corrections, additions and improvements to this text. We at SFSA are frequently asked about what changes we need to make and I need your help and guidance to provide the best answers!

Raymond

Raymond

| STEEL FOUNDERS' SOCIETY OF AMERICA BUSINESS REPORT | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| SFSA Trend Cards (%-12 mos. Ago) | 12 Mo Avg | 3 Mo Avg | February | January | December | |||||

| Carbon & Low Alloy | ||||||||||

| Shipments | 12.6 | 9.8 | 10 | 13.5 | 6 | |||||

| Bookings | 8.4 | -3.5 | -3.5 | -8 | 1 | |||||

| Backlog (wks) | 14 | 13.9 | 15 | 14 | 12.8 | |||||

| High Alloy | ||||||||||

| Shipments | 9.8 | 3.2 | 2.2 | 2 | 5.5 | |||||

| Bookings | -1.1 | -1.3 | -1.8 | -4.5 | 2.5 | |||||

| Backlog (wks) | 12.1 | 11.1 | 10 | 12 | 11.2 | |||||

| Department of Commerce Census Data | ||||||||||

| Iron & Steel Foundries (million $) | ||||||||||

| Shipments | 1,518.50 | 1,594.00 | 1,668 | 1,617 | 1,497 | |||||

| New Orders | 1,535.90 | 1,569.30 | 1,662 | 1,566 | 1,480 | |||||

| Inventories | 2,726.80 | 2,806.00 | 2,804 | 2,819 | 2,795 | |||||

| Nondefense Capital Goods (billion $) | ||||||||||

| Shipments | 82 | 84 | 83.1 | 83.7 | 85.2 | |||||

| New Orders | 86.4 | 88 | 81.9 | 83.1 | 99.1 | |||||

| Inventories | 214.3 | 218.8 | 219 | 218.4 | 219 | |||||

| Nondefense Capital Goods less Aircraft (billion $) | ||||||||||

| Shipments | 74 | 75.1 | 75.2 | 75.3 | 74.6 | |||||

| New Orders | 74.5 | 75 | 75.1 | 75.1 | 74.8 | |||||

| Inventories | 149.2 | 153.6 | 153.9 | 153.6 | 153.2 | |||||

| Inventory/Orders | 2 | 2 | 2.05 | 2.04 | 2.05 | |||||

| Inventory/Shipments | 0 | 2 | 2.05 | 2.04 | 2.05 | |||||

| Orders/Shipments | 0 | 1 | 1 | 1 | 1 | |||||

| American Iron and Steel Institute | ||||||||||

| Raw Steel Shipments (Million net tons) | 7.4 | 7 | 6.9 | 7.1 | 6.9 | |||||