Inflation or recession? How bad will it be and how long will it last? Read Raymond’s take in this month’s Casteel Commentary.

Table of Contents

Research Review

Please save the date for the annual SFSA Research Review which will be held on July 18-22. The meeting is planned to be in-person at Rosemont, IL. This year’s review will cover DID, ICT, and steel casting related SPI projects. Additional details to follow. For any questions, contact Diana David.

Member Interns: Peaslee & Schumo Scholarships

Recruiting students to join our industry and grow into leadership positions remains a critical need in the steel casting industry and a strategic initiative of the Society. The Steel Founders’ Society Foundation aims to attract the next generation workforce by providing scholarships to student interns. To compete for the scholarships, interns are required to work at a member foundry and carry out a specific task or investigation. Selected works are presented at the annual T&O conference. If you currently have or plan to have an intern work at your foundry in 2022, be sure to encourage them to submit a paper and presentation to Diana David (ddavid@sfsa.org)by August 19. Find out more about the scholarships at https://www.sfsa.org/scholarships/.

Research Highlight

Smart job shop manufacturing technologies are being developed by Phil Deierling, a professor from University of Iowa. First is a new quality mapping tool, Defect Automated Recording and Tracking (DART). The goal is to develop a low-cost open-source code that can easily be integrated to existing foundry systems to track quality of steel castings. The tool will process pictures of castings with indications marked by inspectors and will record the indications for this casting. This will enable keeping an electronic record of quality for a range of castings. Foundries can use this electronic data to compare indications for several castings that are the same part. Future improvement can be the capability to integrate casting process information for each casting with these quality data to enable analysis for any trends or correlations. Second project is robotic part recognition. The goal is to develop a framework for a low-cost software and hardware system that enables part recognition and grasp detection of steel castings. If a robot can identify the part and, from its geometry, determine how to grab it and bring it to the next workstation without crushing or damaging it, this will be key in establishing smart automation technologies in job shop foundries.

Next Generation Manufacturing

In 2022, SFSA will revisit collaboration with AFRL’s Digital Manufacturing Research Team and continue collaboration with SwRI’s ROS-Industrial robotic blending collaboration project and PushCorp. There have been some developments in grinding media with improved capability for processing steel, which will help to unlock automated grinding of steel castings. Additional integrators interested in job shop (high-mix, low-volume), Small & Medium-sized Enterprises in hot & heavy manufacturing are coming into the market. This is important for successful implementation of automation unless a foundry is willing to directly invest in in-house capability. That said, challenges beyond job shop automation exist for our industry. Similar to robot torch cutting, the key is automating a process that requires live feedback to control the operation. SFSA recently kicked-off a project with Phil Deierling from UI to overcome mapping quality data issues. Defect Automated Recording and Tracking (DART) will work to provide a low-cost solution that is adaptable to the foundry’s needs including IS requirements. Phil is also working on keystone automation technology projects for part identification and part holding. New start projects include UAB and Arctos pursuing next steps in Automated Image Analysis. Alabama has been working with image capture technology that enables building a solid model including the actual surface of the casting. This technology provides both a means to capture 3D part data similar to other scanning equipment but also a means to capture the part surface for potential opportunities such as quality. SFSA is working with a new partner to develop ARtisan (Augmented Reality) technology. AR can enable the next generation artisan by providing virtual process instructions and “on job” training. A recent development for steel building construction showed how the technology could be used to match an assembly to a virtual model of the assembly including part and spatial recognition. For a foundry, this could unlock a “quick check” of the mold before closing or wax assembly before dipping. Please mark your calendar for the NGM meeting tentatively on June 9th in Muskegon, MI. To learn more about NGM or join this group, please contact Dave.

Future Leaders

Sustaining the workforce has been a hot topic for over a year now. Since 2008, the Future Leaders group has helped prepare foundry personnel for greater responsibilities and ensure that steel casting generational knowledge is transitioned to the next floor supervisor, foundry manager, COO, engineer or metallurgist. Developing talent from within is key for steel foundries given the steel casting is both unique and complex, but also because there are few outside opportunities to acquire this expertise. Workforce shortages highlight the need to recruit, develop and promote our best talent. Future Leaders is intended for people that are new to the steel foundry industry with potential to aspire to greater responsibilities within the foundry. The group meets twice a year with meetings typically providing four distinct benefits. One, an opportunity to network with peers to develop life-long partnerships and promote the value they bring back to their foundry. Two, a mini-seminar that typically focuses on understanding basic concepts and the history of how we have this understanding today. Three, an opportunity to learn from our industry’s subject matter experts. Four, a tour of a steel foundry, which provides enormous value as many people new to the industry have only seen the four walls of the foundry they work at. Please mark your calendar for the Future Leaders meeting tentatively on June 9-10 in Muskegon, MI with a mini-seminar that will build on the Data & Analysis webinar series with using Design Of Experiments (DOE). Similar to recent past meetings, we will look to couple this meeting with the Next Gen Mfg meeting. Both technical and operating staff can gain a benefit from this activity. To learn more about Future Leaders or join this group, please contact Dave.

Market News

The February SFSA Trends report showed steel bookings and shipments both continue an upward trend over year ago levels. Carbon and low alloy steel backlog remained at the prior month’s high of 16 weeks. Stainless shipments remain strong while bookings and backlog edged lower, signaling slowing growth for the months ahead. Similarly, nondefense capital goods (excluding aircraft) new orders are anticipated to transition to slowing growth in the near term.

ITR Economics revised their outlook for US mining production (excluding oil and gas) downward in part to a revision of the historical production data by the Federal Reserve Board. High commodity prices are anticipated to create a modest increase in 2022 but a decline is forecasted for 2023. Oil and gas production continues to rise, and the market is forecasted for accelerated growth into 2023. Overall, growth is anticipated for nearly all manufacturing markets throughout the year and inflationary pressures are anticipated to ease later in the year.

Casteel Commentary

Inflation or recession is inevitable. Not only is it inevitable, but it will also be persistent and significant. Our efforts to avoid the losses for speculative investments in 2009 through support from the Federal reserve followed by the large expenditures to support the economy while shutting it down for two years during COVID, resulted in an explosion of created money by the Federal Reserve banking system.

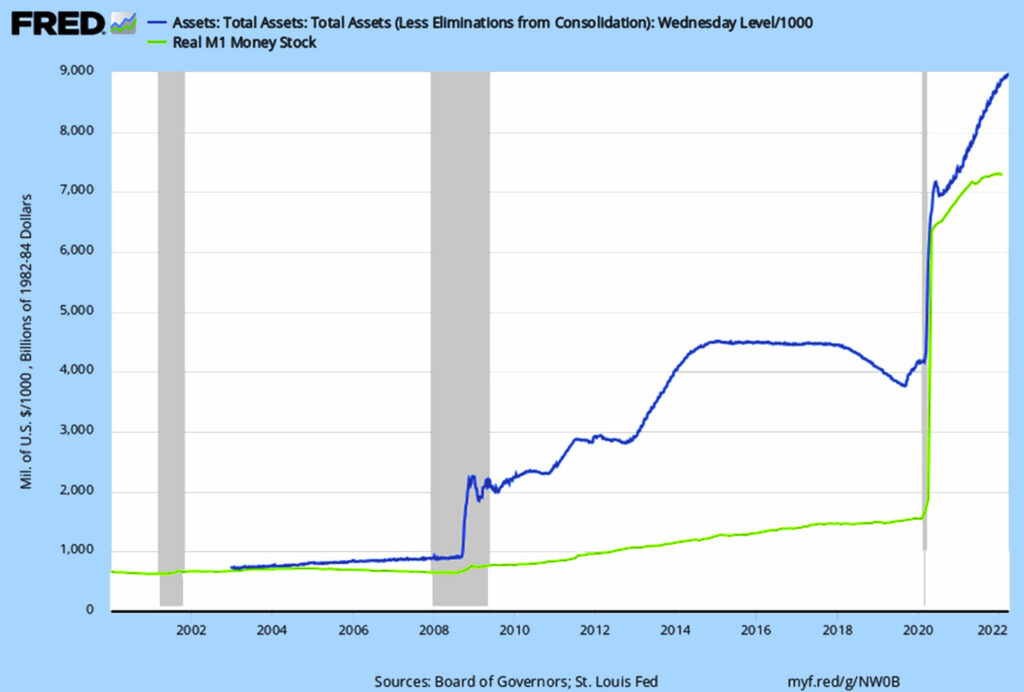

The graph shows the bump that was unprecedented in 2009 to support the unsound investments made by financial institutions and avoid the losses in the system. The Fed put is a belief by financial market participants that the Federal Reserve will step in to boost the markets if the price of the markets falls to a certain level. (https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/fed-put/)

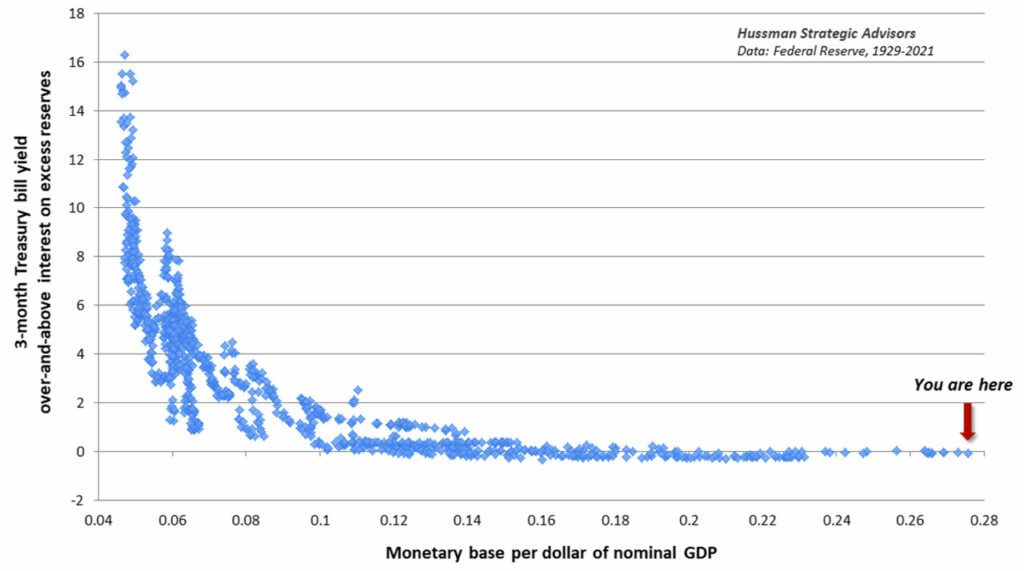

This excess monetizing and the slow economic growth as a result of slow growth in the incoming workforce and lack of capital investment have driven interest rates to near zero levels. In fact the Federal reserve paid back interest in the excess reserves to help them recover from the collapse in 2009. These increases in the monetary base as a percent of the GDP create conditions where this money is a hot potato where currency holder seek to find any investment that give them hope of a positive return. The Federal Reserve having supported financial institutions by supporting equity prices has created a nightmare situation where equity valuation are beyond any historical level compared to the value of assets or future profitability. The graph above shows the level of excess money and the relationship with interest rates. Raising rates to dampen inflation will require dramatic reductions in the money supply. The alternative is to allow this money to chase real assets and commodities creating higher levels of inflation.

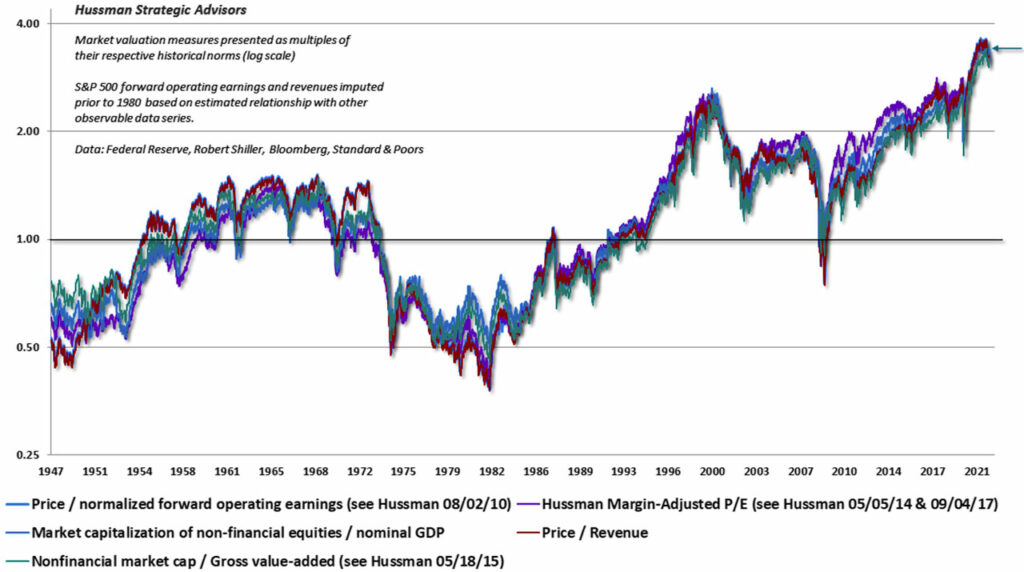

By any reasonable measure, equity prices are three times their historic norms. This is not due to the prospect of extraordinary growth or profitability but is accepting the same meager returns offered by the low interest rate bonds.

Traditional investments tried to balance the portfolio in equities, companies that were capable of future profits, and bonds, guaranteed returns of interest dependent on the survival of the enterprise. The federal debt was seen as risk free in terms of default but could see an erosion of the value due to both inflation eating the value or rising interest rates making bond’s value fall. Low interest rates in an era where the federal reserve has supported equity prices and inflation has lagged the monetizing has led to the belief that equity prices should be discounted to the growth rate implied by the interest rate of federal debt.

As inflation causes liquidation of equities at these unsustainable levels, the values will drop dramatically and the money will chase the real assets creating more inflation. Aggressive action by the Federal reserve would require removing vast sums of money from the system.

This will make operating a capital-intensive business a daily challenge as we have already seen. It may also make capital-intensive plants valuable and increase both our profitability and ability to invest and modernize.

Raymond

| STEEL FOUNDERS' SOCIETY OF AMERICA | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| STEEL FOUNDERS' SOCIETY OF AMERICA | ||||||||||

| BUSINESS REPORT | ||||||||||

| SFSA Trend Cards (%-12 mos. Ago) | 12 Mo Avg | 3 Mo Avg | February | January | December | |||||

| Carbon & Low Alloy | ||||||||||

| Shipments | 9.3 | 11 | 10 | 8 | 14.9 | |||||

| Bookings | 18.3 | 20.7 | 25 | 25 | 12 | |||||

| Backlog (wks) | 11.2 | 15.5 | 16 | 16.5 | 14 | |||||

| High Alloy | ||||||||||

| Shipments | 8.3 | 16.3 | 11 | 10 | 27.8 | |||||

| Bookings | 10.9 | 4.1 | 6 | 11 | -4.9 | |||||

| Backlog (wks) | 11.4 | 13.7 | 13 | 16 | 12.2 | |||||

| Department of Commerce Census Data | ||||||||||

| Iron & Steel Foundries (million $) | ||||||||||

| Shipments | 1,346.80 | 1,398.70 | 1,344 | 1,420 | 1,432 | |||||

| New Orders | 1,480.70 | 1,554.70 | 1,473 | 1,482 | 1,709 | |||||

| Inventories | 2,401.20 | 2,504.00 | 2,501 | 2,494 | 2,517 | |||||

| Nondefense Capital Goods (billion $) | ||||||||||

| Shipments | 80.3 | 83.7 | 84.4 | 84.3 | 82.3 | |||||

| New Orders | 86.9 | 93.1 | 89.9 | 96.4 | 93.1 | |||||

| Inventories | 202.7 | 208.8 | 210.1 | 208.6 | 207.7 | |||||

| Nondefense Capital Goods less Aircraft (billion $) | ||||||||||

| Shipments | 75.5 | 78.9 | 79.6 | 79.3 | 77.6 | |||||

| New Orders | 77.5 | 79.9 | 80.1 | 80.3 | 79.3 | |||||

| Inventories | 136.9 | 143.4 | 144.8 | 143.5 | 142 | |||||

| Inventory/Orders | 1.8 | 1.8 | 1.81 | 1.79 | 1.79 | |||||

| Inventory/Shipments | 0 | 1.8 | 1.82 | 1.81 | 1.83 | |||||

| Orders/Shipments | 0 | 1 | 1.01 | 1.01 | 1.02 | |||||

| American Iron and Steel Institute | ||||||||||

| Raw Steel Shipments (million net tons) | 8 | 7.6 | 7.2 | 7.8 | 7.9 | |||||